Investors, Prepare For A Bounce

Wall Street Daily | Feb 06, 2014 06:43AM ET

You can bet that the father of value investing, Benjamin Graham, is haunting the stock market at this very moment.

For one simple reason…

The market that made him so rich is seriously out of whack right now.

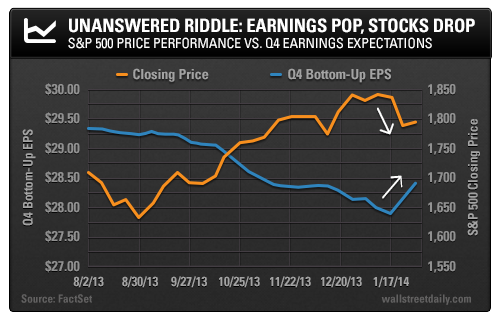

You see, stock prices ultimately follow earnings. But even though the latest earnings data points to strength, the S&P 500 Index is nursing a year-to-date loss of nearly 4%.

Let’s dig into the data for answers – and, more importantly, to find out what it means for our investments over the coming weeks and months. I’ll also reveal Graham’s warning that he continues to shout from the grave…

A Weekly Addiction

Every Friday during earnings season, I devour the Earnings Insight report from FactSet. I recommend you do the same, as it contains invaluable information about the latest earnings trends.

While reading the latest report, one anomaly jumped out at me right away…

In one week’s time, the expected earnings growth rate for the S&P 500 rose to 7.9% from 6.4%.

Let me assure you, after monitoring these reports for years, this qualifies as a significant increase in such a short period of time.

The catalyst? Way better-than-expected earnings reports, particularly from companies in the financial sector. (Believe it or not, banks are finally on the mend.)

All told, 74% of companies in the S&P 500 have topped earnings expectations so far.

While it’s common knowledge that companies underpromise so they can overdeliver, this much overdelivering is uncharacteristic.

Or as FactSet’s John Butters says, “The percentage of companies reporting [earnings per share (EPS)] above the mean EPS estimate is above the one-year (71%) average and the four-year (73%) average.”

Usually, such a strong surprise to the upside would lead to a similar trend in the market, too. But that’s not happening.

Sure, individual stocks are up an average of 0.39% on their earnings report day, according to Bespoke Investment Group. However, the overall market is trending lower.

In fact, after a horrible January, the S&P 500 kicked off February with its second-worst opening-day decline – ever!

What gives?

It’s simple, really. Market conditions are anything but normal right now…

An Emerging Contagion?

Investors can’t seem to shake off the fears of a spillover effect from the taper-inspired rout going on in emerging markets.

In an upcoming issue, I’ll dig into the data to reveal whether or not such fears are misplaced. Right now, I want to focus on the fact that the S&P 500 is acting oblivious to the strong earnings data.

For today, here’s the important takeaway: It won’t last!

As Benjamin Graham famously observed, “In the short term, the stock market behaves like a voting machine, but in the long term it acts like a weighing machine.”

Think his wisdom is outdated? Then chew on a sound bite tweeted this week by a modern-day guru, Chuck Royce of The Royce Funds: “Macro noise can at times be a distraction, but our attention never strays from our long-term view.”

Amen!

Bottom line: The stock market can act quite irrational in the short term. However, it’s only a matter of time before it regains its senses and starts trading based on the merits of the only long-term determinant of prices – earnings.

So should we just sit and wait for the transition to materialize? Not a chance!

Given the erratic behavior in relation to earnings and the precipitous drop in bullish sentiment, we should be on the hunt for attractive buying opportunities to prepare for a bounce.

If I were you, I’d start by scouring the consumer discretionary, consumer staples and energy sectors. They’re the most oversold right now – trading more than three standard deviations below their 50-day moving averages, according to Bespoke.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.