Investing Whiplash: Looking For Closure With Apple And Amazon!

Aswath Damodaran | Dec 04, 2018 02:07AM ET

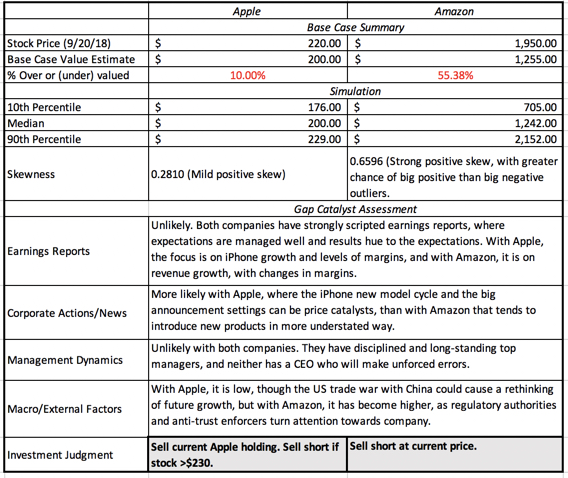

In September, I took a look, in a series of posts, at two companies that had crested the trillion dollar market cap mark, Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), and concluded that series estimated value distributions for both companies and noted that not only did I face more uncertainty in my Amazon valuation, but also that there was a significant probability in both companies that my assessment (that the stocks were over valued) was wrong. I summarized my results in a table that I reproduce below:

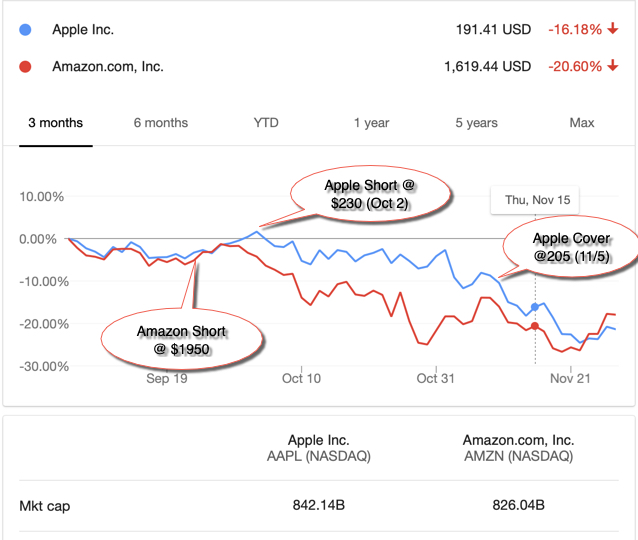

I did follow through on my judgements, albeit with some trepidation, selling short on Amazon at the prevailing market price (about $195) and putting in a limit short sell at $230, which was fulfilled on October 3, as the stock opened above $230. With both stocks, I also put in open orders to cover my short sales at the 60th percentile of my value distributions, i.e., $205 at Apple and $1412 at Amazon, not expecting either to happen in the near term. (Why 60%? Read on...) Over the years, I have learned that investment stories and theses, no matter how well thought out and reasoned, don't always have happy endings, but this one did, and at a speed which I did not expect:

My Apple short sale which was initiated on October 3 was closed out on November 5 at $205, while Amazon got tantalizingly close to my trigger price for covering of $1412 (with a low of $1420 on November 20), before rebounding.

Intrinsic Value Lessons

Every investment, whether it is a winner or a loser, carries investment lessons, and here are mine from my AAPL/AMZN experiences, at least so far:

- Auto pilot rules to fight behavioral minefields: If you are wondering why I put in limit orders on both my Apple short sale and my covering trades on both stocks, it is because I know my weaknesses and left to my own biases, the havoc that they can wreak on my investment actions. I have never hidden the fact that I love Apple as a company and I was worried that if I did not put in my limit short sell order at $230, and the stock rose to that level, I would find a way to justify not doing it. For the limit buys to cover my short sales, I used the 60th percentile of the value distribution, because my trigger for buying a stock is that it be at least at the 40th percentile of its value distribution and to be consistent, my trigger for selling is set at the 60th percentile. It is my version of margin of safety, with the caveat being that for stocks like Amazon, where uncertainty abounds, this rule can translate into a much bigger percentage price difference than for a stock like Apple, where there is less uncertainty. (The price difference between the 60th and 90th percentile for Apple was just over 10%, whereas the price difference between those same percentiles was 35% for Amazon, in September 2018.)

- Intrinsic value changes over time: Among some value investors, there is a misplaced belief that intrinsic value is a timeless constant, and that it is the market that is subject to wild swings, driven by changes in mood and momentum. That is not true, since not only do the determinants of value (cash flows, growth and risk) change over time, but so does the price of risk (default spreads, equity risk premiums) in the market. The former occurs every time a company has a financial disclosure, which is one reason that I revalue companies just after earnings reports, or a major news story (acquisition, divestiture, new CEO), and the latter is driven by macro forces. That sounds abstract, but I can use Apple and Amazon to illustrate my point. Since my September valuations for both companies occurred after their most recent earnings reports, there have been no new financial disclosures from either company. There have been a few news stories and we can argue about their consequentiality for future cash flows and growth, but the big change has been in the market. Since September 21, the date of my valuation, equity markets have been in turmoil, with the S&P 500 dropping about 5.5% (through November 30) and the US 10-year treasury bond rate have dropped slightly from 3.07% to 3.01%, over the same period. If you are wondering why this should affect terminal value, it is worth remembering that the price of risk (risk premium) is set by the market, and the mechanism it has for adjusting this price is the level of stock prices, with a higher equity risk premium leading to lower stock prices. In my post at the end of a turbulent October, I traced the change in equity risk premiums, by day, through October and noted that equity risk premiums at the end of the month were up about 0.38% from the start of the month and almost 0.72% higher than they were at the start of September 2018. In contrast, November saw less change in the ERP, with the ERP adjusting to 5.68% at the end of the month.

Plugging in the higher equity risk premium and the slightly lower risk free rate into my Apple valuation, leaving the rest of my inputs unchanged, yields a value of $197 for the company, about 1.5% less than my $200 estimate on September 21. With Amazon, the effect is slightly larger, with the value per share dropping from $1255 per share to $1212, about 3.5%. Those changes may seem trivial but if the market correction had been larger and the treasury rate had changed more, the value effect would have been larger.

3 But price changes even more: If the fact that value changes over time, even in the absence of company-specific information, makes you uncomfortable, keep in mind that the market price usually changes even more. In the case of Apple and Amazon, this is illustrated in the graph below, where I compare value to price on September 21 and November 30 for both companies:

In just over two months, Apple's value has declined from $201 to $196, but the stock price has dropped from $220 to $179, shifting it from being overvalued by 9.54% to undervalued by 9.14%. Amazon has become less over valued over time, with the percentage over valuation dropping from 55.38% to 39.44%. I have watched Apple's value dance with its price for much of this decade and the graph below provides the highlights:

- From my perspective, the story for Apple has remained largely the same for the last eight years, a slow-growth, cash machine that gets the bulk of its profits from one product: the iPhone. However, at regular intervals, usually around a new iPhone model, the market becomes either giddily optimistic about it becoming a growth company (and pushes up the price) or overly pessimistic about the end of the iPhone cash franchise (and pushes the price down too much). In the face of this market bipolarity, this is my fourth round of holding Apple in the last seven years, and I have a feeling that it will not be the last one.

- Act with no regrets: I did cover my short sale, by buying back Apple at $205, but the stock continued to slide, dropping below $175 early last week. I almost covered my Amazon position at $1412, but since the price dropped only as low as $1420, my limit buy was not triggered, and the stock price is back up to almost $1700. Am I regretful that I closed too early with Apple and did not close out early enough with Amazon? I am not, because if there is one thing I have learned in my years as an investor, it is that you have stay true to your investment philosophy, even if it means that you leave profits on the table sometimes, and lose money at other times. I have faith in value, and that faith requires me to act consistently. I will continue to value Amazon at regular intervals, and it is entirely possible that I missed my moment to sell, but if so, it is a price that I am willing to pay.

- And flexible time horizons: A contrast that is often drawn between investors and traders is that to be an investor, you need to have a long time horizon, whereas traders operate with windows measured in months, weeks, days or even hours. In fact, one widely quoted precept in value investing is that you should buy good companies and hold them forever. Buy and hold is not a bad strategy, since it minimizes transactions costs, taxes and impulsive actions, but I hope that my Apple analysis leads you to at least question its wisdom. My short sale on Apple was predicated on value, but it lasted only a month and four days, before being unwound. In fact, early last week, I bought Apple at $175, because I believe that it under valued today, giving me a serious case of investing whiplash. I am willing to wait a long time for Apple's price to adjust to value, but I am not required to do so. If the price adjusts quickly to value and then moves upwards, I have to be willing to sell, even if that is only a few weeks from today. In my version of value investing, investors have to be ready to hold for long periods, but also be willing to close out positions sooner, either because their theses have been vindicated (by the market price moving towards value) or because their theses have broken down (in which case they need to revisit their valuations).

Bottom Line

As investors, we are often quick to claim credit for our successes and equally quick to blame others for our failures, and I am no exception. While I am sorely tempted to view what has happened at Apple and Amazon as vindication of my value judgments, I know better. I got lucky in terms of timing, catching a market correction and one targeted at tech stocks, and I am inclined to believe that is the main reason why my Apple and Amazon positions have made me money in the last two months. With Amazon, in particular, there is little that has happened in the last two months that would represent the catalysts that I saw in my initial analysis, since it was government actions and regulatory pushback that I saw as the likely triggers for a correction. With Apple, I do have a longer history and a better basis for believing that this is market bipolarity at play, with the stock price over shooting its value, after good news, and over correcting after bad news, but nothing that has happened to the company in the last two month would explain the correction. Needless to say, I will bank my profits, even if they are entirely fortuitous, but I will not delude myself into chalking this up to my investing skills. It is better to be lucky than good!

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.