Investing in Emerging Markets: Will They Continue To Outperform?

Zacks Investment Research | May 16, 2014 05:05AM ET

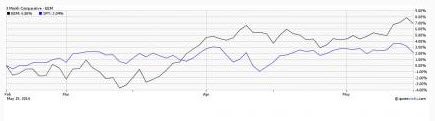

Emerging Markets are hot again! Since the beginning of April, investors have poured in $4.2 billion in iShares MSCI Emerging Markets ETF (ARCA:EEM), making it the top asset gainer for the period.

Among single country ETFs, India ETFs have seen huge investor interest this year, while Indonesia, the Philippines and South Africa also saw asset inflows. On the other hand, China funds have remained out of favor.

So, what happened? Most emerging markets were battered last year as foreign investors rushed for the exits with the start of taper talk.

The trend reversed this year with investors returning to emerging markets as they realized that interest rates in the developed world were not going up as many feared.

But that’s not the only reason; there have been a number of other positive developments that resulted in investors’ recent enthusiasm. In many cases, politics/election hopes have been a major factor.

Indian stocks and the currency have been euphoric on hopes of a new pro-business, reform-friendly government led by Narendra Modi. Small-cap India ETF (NYSE:SCIN) has soared more than 30% in the past 3 months.

Indonesian voters are expecting a win for the opposition party--led by Joko Widodo--who has a reputation for effective governance. Brazilian stocks have risen as voter support for Dilma Rousseff has been declining.

Macroeconomic fundamentals also appear to be improving as some of the measures taken to combat inflation and narrow the current account deficit have been successful.

Do you think emerging markets can continue to surge? Are you investing in emerging markets this year; and in broader or single country funds or in EM stocks?

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.