Institutional Investors Are Rotating Out Of Bitcoin And Into Gold

Frank Holmes | May 24, 2021 02:37PM ET

One of the biggest reasons why people invest in assets like gold, Bitcoin and altcoins is because they act as hedges against bad government policy.

Look at Venezuela. The beleaguered country’s currency, the bolivar, isn’t worth

Bitcoin came under pressure from more than just Musk’s distorted comments on its energy usage. The Chinese government has also cracked down on the crypto ecosystem, banning financial institutions from providing services related to digital assets. A hotline has even been set up in one Chinese province that people can use to snitch on neighbors they suspect of mining cryptos.

Of course, this is only the 10,000th time China has come out against crypto. More FUD.

Last week’s selloff was dramatic. By Wednesday, Bitcoin was down more than 40% from its all-time high of $64,000, set in mid-April. The token’s market dominance fell to a three-year low of 40%.

I believe the pullback is healthy. It’s important for investors to remember that this kind of volatility is normal for such a still-emerging, speculative asset class. It’s also important to keep things in perspective: Bitcoin is still up more than 30% so far this year, 315% for the 12-month period.

Institutional Investors Rediscovering Gold

So where have all the millions that have flowed out of crypto funds gone to? Would you be surprised to hear gold?

According to an analysis of CME futures contract, large institutional investors could be shifting away from Bitcoin in favor of gold. “Over the past month, Bitcoin futures markets experienced their steepest and more sustained liquidation since the Bitcoin ascent started last October,” JPMorgan wrote in a recent note to investors. These liquidations have corresponded with inflows into gold ETFs.

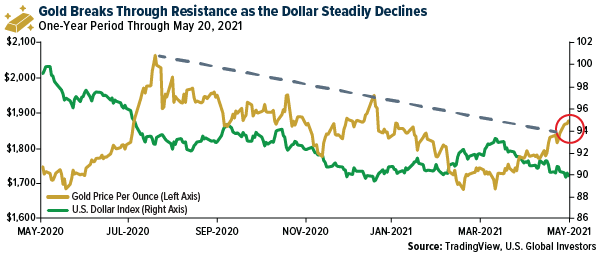

The price of the yellow metal broke through key resistance last week, touching $1,890 an ounce for the first time since January on a declining U.S. dollar. The next test is $1,900, and after that, its all-time high of $2,067.

Whereas Bitcoin is a speculative asset, gold is a well-established, highly liquid asset with a centuries-long track record.

Besides responding to a weaker dollar, gold is finding traction from ongoing unprecedented money-printing and monetary stimulus. The amount of M2 money circulating the U.S. economy is up about 21% from a year ago. Meanwhile, the Federal Reserve maintains its bond-buying program. As of last week, the size of the central bank’s balance sheet was just under a staggering $8 trillion.

More Inflation Warnings

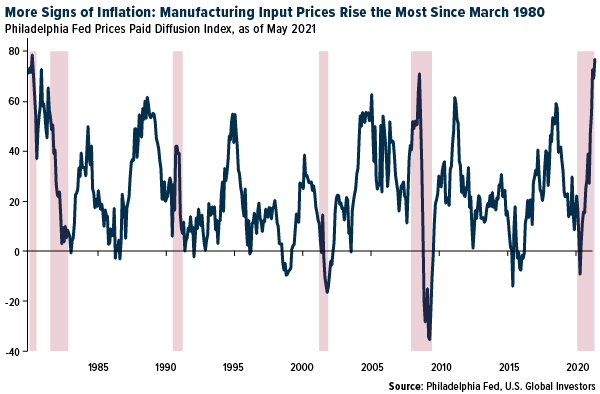

Inflation also continues to weigh on investors’ minds, improving the investment case for gold. Last week we saw even more data emerge warning markets that prices could be headed higher in the near term.

For one, input prices for manufacturers in the Philadelphia region accelerated at their fastest pace in over 40 years. The Philly Fed’s prices paid diffusion index rose to 76.8 this month, the highest reading since March 1980. Three quarters of manufacturers reported price increases while none reported decreases. Expect these higher costs to be passed on to consumers.

Much of the price increases could be related to record and near-record shipping costs. The rate to ship a 40-foot container continues to climb as demand far outpaces supply. The Drewry World Container Index rose 7% during the week ended last Thursday to touch $5,193, a nearly fourfold increase from a year earlier. Freight rates from Shanghai to Rotterdam reached a new all-time high of $9,865 per 40-foot container.

Freight rates from Shanghai to Rotterdam reached a new all-time high of $9,865 per 40-foot container.

Fuel costs have also been rising in the wake of the cyberattack on the Colonial Pipeline, which delivers 45% of gas supply to the Southeast. Last week, GasBuddy predicted that gas prices would be at their most expensive this Memorial Day weekend in seven years.

Gas will average before flying. This gives customers travel access to the Bahamas, El Salvador and Guatemala.

Wheels up!

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.