Inflation And The Fed. A New Dance Partner With Which To Contend

Michael Lebowitz | Apr 13, 2022 06:18AM ET

The Federal Reserve, bond markets, and economic cycles have been dancing in a well-choreographed fashion for the last 30 years.

This age-old dancing trio, the Fed, yield curve, and economy have a new dance partner. After patiently watching from the sidelines, inflation is flashing her moves. The once predictable partners are falling out of rhythm.

With inflation running at four times the Fed’s 2% objective, the Fed is anxious to reign it in. However, the bond market and economy warn the Fed to be careful. Will inflation lure the Fed to ignore the economy and markets in its quest to tame inflation?

In this piece, we explore the dance trio and inflation. The goal is to appreciate better how the Fed may conduct monetary policy in the months ahead. Will they aggressively hike interest rates while the yield curve flashes recession warnings?

How will inflation and the economy react if they do raise rates? Lastly, what should we expect from stocks if the Fed opts to fight inflation instead of protecting the market?

Traditional cycles

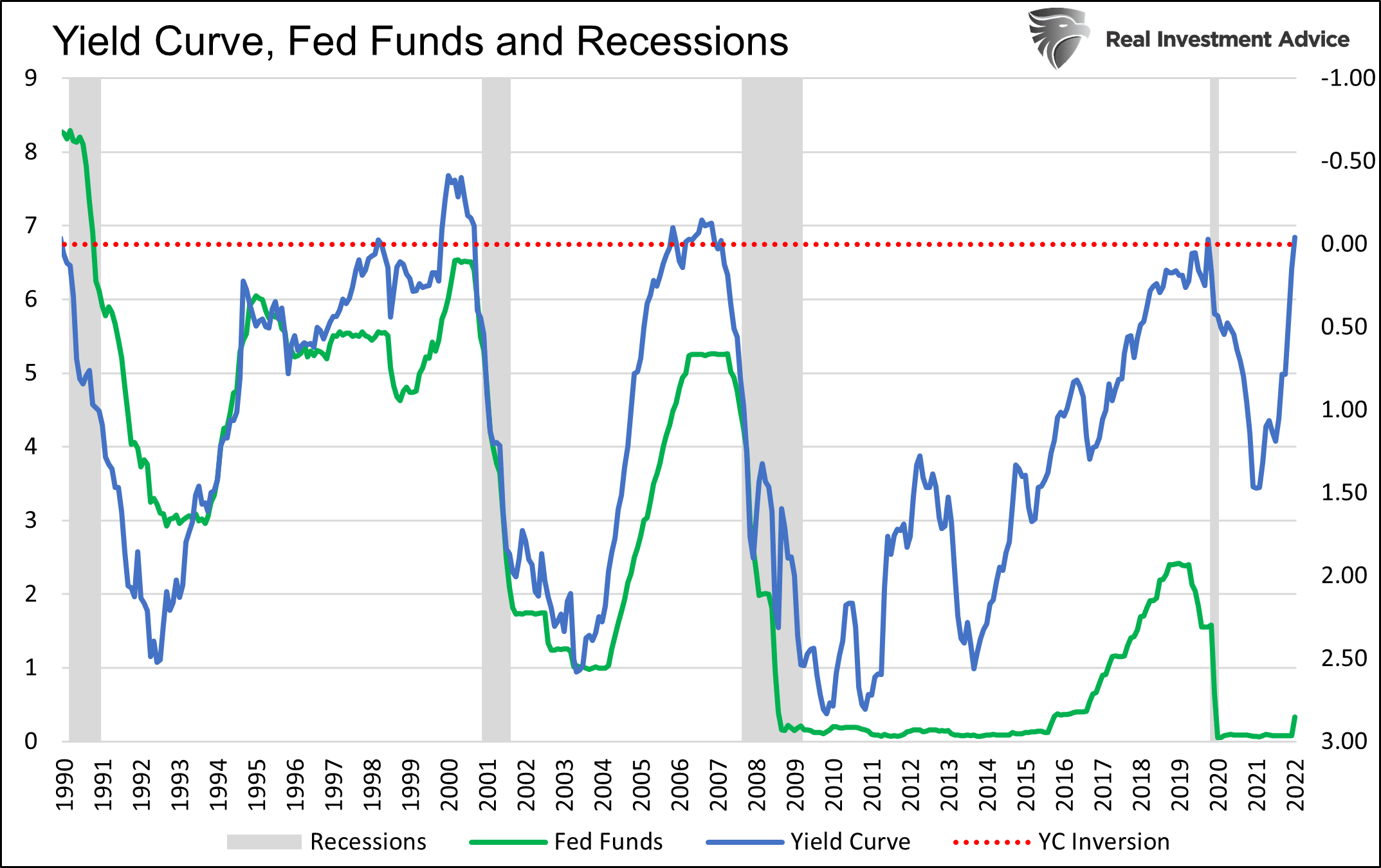

Since at least 1990, the economy, Fed, and yield curve have repeatedly followed the same predictable cycle. As economic activity heats up following a recession, the Fed slowly raises rates.

The yield curve flattens as economic growth wanes. The flattening yield curve ultimately inverts, and the Fed stops raising rates in a year or two. A recession hits, the Fed lowers rates, the yield curve steepens, and the cycle starts anew.

The graph below shows the cycle. We inverted the right y-axis pertaining to the yield curve to highlight the alignment of their movements.

Yield Curve Warns Of Recession

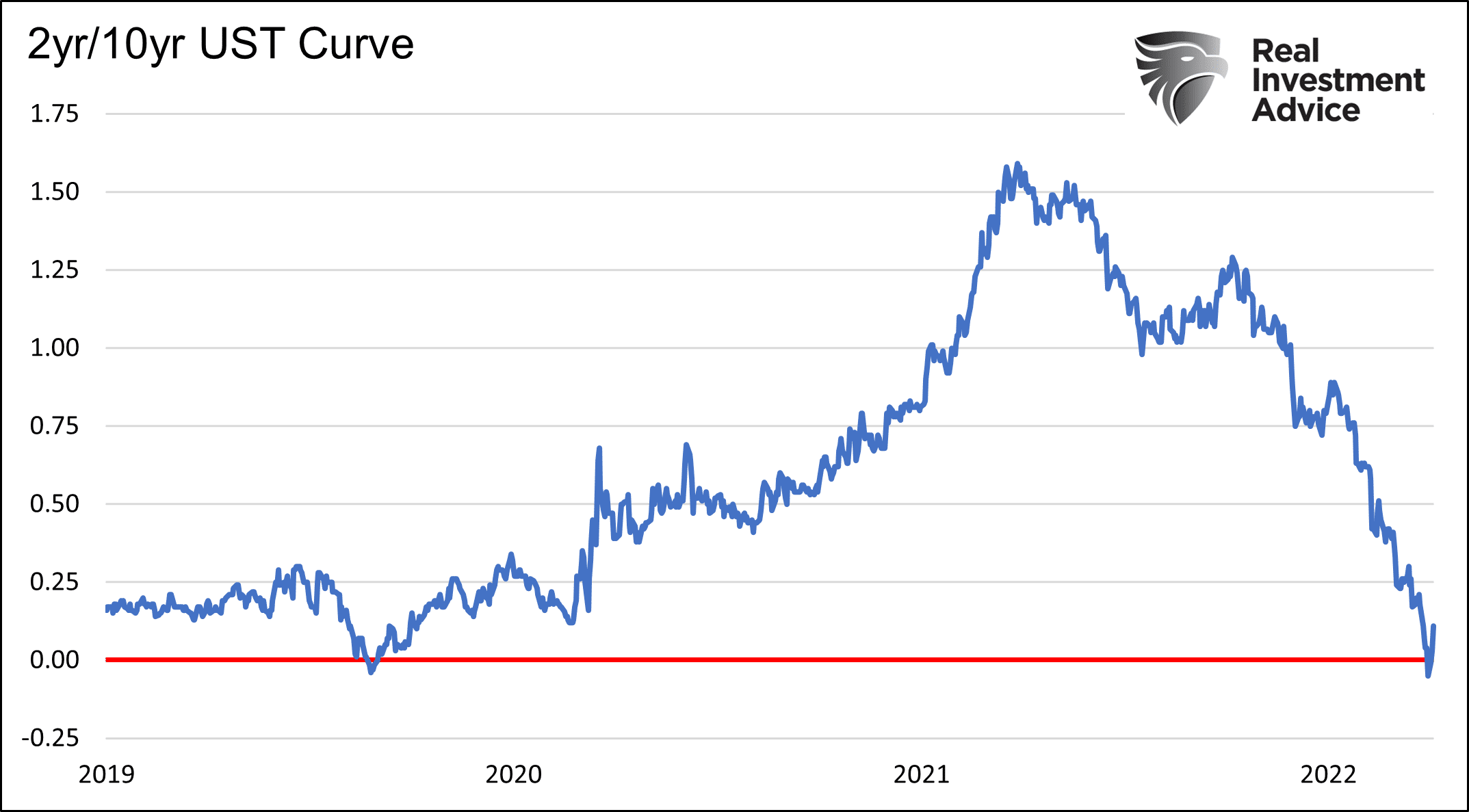

Over the last 12 months, the 2yr/10yr yield curve, as shown below, has flattened by 150 basis points and is flirting with inversion. Typically, a recession occurs from six months to 18 months after it inverts.

More interestingly, some forward yield curves are moderately inverted. Forward yields are a calculation that captures the yield investors expect in the future. For example, the two-year forward yield solves for the two-year yield that needs to occur two years from now, making an investor indifferent between holding a two-year bond today and buying another two-year bond in two years versus buying a four-year bond today.

For instance, if the current 2-yr yield is 1% and the 4-yr yield is 2%, an investor expects the 2-yr forward yield to be approximately 3%.

The graph below, from late February, charts a shorter maturity yield curve. It shows the forward 5yr/1yr curve is inverted. More importantly, the Fed stopped raising rates quickly the last three times this forward curve inverted.

What Will The Fed Do?

At the March 2022 FOMC meeting, the Fed raised rates 25bps from zero. Investors expect the Fed to increase rates by 50bps at the following three meetings.

CPI inflation is running at 8.5%, and the Fed’s preferred inflation measure, PCE Price Index, sits at 6.4%. Both figures are well above the Fed’s 2% target.

The Fed will likely continue to hike rates while the yield curve warns of recession and slowing economic growth. The Atlanta Fed GDP Now forecast forecasts a meager 0.9% growth rate for Q2.

The Wall Street consensus forecast has eroded from nearly 4% to 2% over the last few months. Both estimates pale compared to +12.2%, +4.9%, and +5.6%, the annualized rates from the prior three quarters.

The Fed’s newfound desire to squash inflation is forcing them to ignore the warnings of their old dance partners, the economy, and the yield curve.

Fighting Inflation Versus Stimulating The Economy

Higher interest rates will create a further drag on the economy. This comes as yields have already risen significantly for mortgages, corporate loans, and most other forms of debt.

In fact, some of the reasons recent economic data has been weakening are in part because of higher interest rates. The effect of higher interest rates often lags by six to nine months, so more weakness is expected.

This occurs as fiscal stimulus is quickly becoming an economic drag. The graph below from the Wall Street Journal article Fiscal Stimulus is Turning Into a Fiscal Drag shows the negative contribution to economic growth resulting from the normalization of government spending.

Unlike anything we have seen in the last 30+ years, the Fed will embark on a tightening campaign at the point they typically halted such actions.

What Does A New Dance Imply For Stocks?

Stocks valuations are amplified by fiscal largesse and the massive doses of Fed liquidity via QE and low-interest rates. Both are coming to an end. Not surprisingly, risky assets have taken notice.

The question we face is how far the Fed will go to reduce inflation? Will they hike rates in a recession? Will continued weakness in the stock market change their mind? Some, including former New York Fed President Bill Dudley, argue the Fed should purposely try to reduce stock prices.

Per our Daily Commentary 4/11/2022

“Financial conditions need to tighten. If this doesn’t happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower.”

Investors haven’t had to confront a highly inflationary environment in over 40 years. There are very few professional investors that have managed money in such a situation.

As a rule of thumb, the more the Fed decides to dance with inflation and ignore the bond market and economy, the more we should expect stock prices to fall. Such is an unfamiliar dance and one in which investors are woefully unprepared.

Summary

The Fed is dancing with a new partner, and with it comes unknown risks for investors. No one, including Fed members, know how far they will have to go to fight inflation. They are flying by the seat of their pants.

Today’s dance is different. As such, watch the action on the dance floor closely and react prudently. We are likely entering a period where investors should pay more attention to risk versus reward.

As they say, don’t fight the Fed. That is a bullish mantra when the Fed is running an easy policy. It becomes a bearish mantra in times when they remove liquidity, like today.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.