Indicators Point To Market At A Short Term Inflection Point

Tiho Brkan | Oct 20, 2014 02:58AM ET

Chart 1: Volume spikes during major bottoms, as retail investors panic

- Volume has spiked on various ETFs, including one of the most traded: iShares SPDR S&P 500 (ARCA:SPY). Usually, a spike in volume is a signal of retail investor (dumb money) liquidation and tends to signal some sort of an intermediate bottom.

Chart 2: Volatility has tripled over the last few weeks… too far too fast!

- The same is true for the volatility index, which has tripled since the middle of September. During mid week, the VIX index was almost 100% above both the 50 day and 200 day moving average. Historically, this has signalled some sort of capitulation (however, sometimes only for a brief rebound).

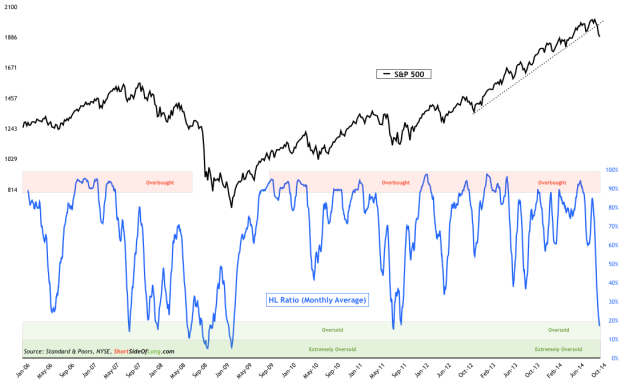

Chart 3: High low ratio has become oversold and should signal a bounce

- Bears have been in control of the current price trend, with some foreign markets under pressure since June. All of this has pushed breadth into oversold territory and the HL Ratio has now officially turned oversold for the first time since August 2011. Even during downtrends such as the one in 2008, this indicator does a great job of signalling a potential relief rally.

Chart 4: Percentage of stocks above 50 MA is also quite oversold now

- Same can be said about the other breadth indicator I frequently use – percentage of stocks above a certain moving average. In this case, we look at the percentage of S&P 500 stocks trading above the 50 day moving average and come to a conclusion that we are most oversold since May of 2012 (last time we saw a 10% correction).

Chart 5: Stocks are deeply oversold relative to bonds over the short term

- The Stock vs Bond Ratio indicator is very interesting (and comes to us from SentimenTrader website). While US stocks have fallen only a little bit in recent weeks, US bonds have rallied all year long and recently gone vertical. This makes stocks very attractive on relative basis. SentimenTrader reported that the intraday movement last Wednesday between stocks and bonds got to almost 5 standard deviations oversold. The chart above shows what happens when the stock/bond ratio got to minus 3 standard deviations.

Chart 6: Some surveys have now entered fear levels and signal a rebound!

- There is no real capitulation or panic yet, that is obvious. Various sentiment indicators are still either complacent or neutral. Investor Intelligence bears remain stubbornly low. However, a few indicators have entered fear levels and one of those is NAAIM. Currently, managers hold under 10% net long exposure to US equities. The last time we saw this was around August to October 2011.

That was a quick indicator recap. We discussed the short term inflection point last Wednesday, so I am not lagging here. I was very quick to point this out in real time. In the short term, bears have been squeezed a bit, with S&P 500 futures rebounding close to 1900. Still, I do not think the volatility is over and by no means has the US stock market seen a major capitulation like we went through in early 2009 and late 2011.

Of course, there is no rule book to say that we have to go through something as dramatic as the repeat of those two recent crashes. On the other hand, it might even be worse this time around. The key question here is connected to underlying conditions and fundamental developments. How well can you read them?

Has the market just overreacted to Fed ending the QE program or is there a real slowdown occurring that could drag the global economy into another recession?

If you believe that the economy is starting to slow properly and earnings to be impacted on the downside, you are probably betting on the start of a new bear market and the indicators above won’t concern you much. On the other hand, if you believe this is just a short term panic, some of the indicators here are signalling oversold conditions right now. Maybe the correction could get a bit worse (10 percent plus), but you might be willing to be a contrarian soon enough.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.