Index-Linked Report Sweden: Tap Auction In SGBi3108

Danske Markets | Nov 24, 2011 04:07AM ET

- Tap of SGBi3108 at the auction on Thursday, SEK750m.

- Just as we argued in the last edition of our Index-linked Report (on 26 October) the Swedish real rate curve has flattened relative to the German curve. In fact, the Swedish curve is now close to its flattest, relative to the German, ever recorded – currently at minus 35 basis points.

- We have made a thorough overhaul of our inflation forecast. Despite a hefty downward revision of the inflation forecast the BEI 3105 rate is still trading below the corresponding average inflation rate, according to our estimate.

- We expect the real rate curve to steepen as the Riksbank starts to cut the repo rate. The real repo rate is expected to continue to be very low (negative) in the years ahead.

- We estimate the net cash flow in linkers to be SEK27.7bn over the next nine months. Coupon payments together with the maturity of SGBi3106 in April will mean money to investors, whereas only five auctions are planned over the time period. Supply will likely be biased toward longer linkers (SGBi3108). So the supply situation would likely support real rate curve steepeners (together with rate cuts).

- Long-term inflation concerns – in the case of monetising of debt – will be a European issue, if it happens, and should affect longer nominal rates rather than linkers.

Auction in the 10y linker amid a flattening of the real rate curve

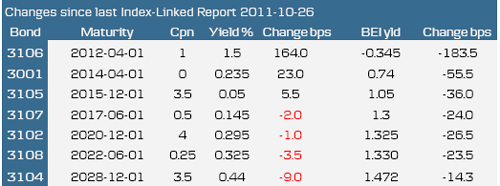

In this year’s last linkers auction the recently introduced SGBi3108 (maturity 1 June 2022) will be offered to the market. The amount is, as normal, SEK750m. The next planned auction is not until 9 February. Since the last auction, on 26 October, BEI rates have declined along the entire curve but most in shorter maturities. The real rate curve has flattened with the 4y bond (SGBi3105) real rate up some 5bp, whereas the 10y bond (SGBi3108) rate has declined near 4bp. The flattening is more distinct relative to the German curve, which is in line with what we argued in the last edition of this report.

The first cut is the deepest - but more rate cuts will save shorter linkers from harm

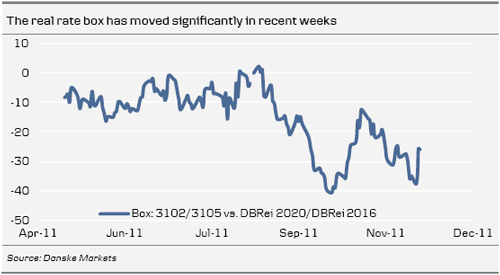

In the last edition of this report we argued for that the Swedish real rate curve was too

steep relative the German curve. We expressed the view that the relative steepness of the real rate curve was not in line with how the Swedish nominal bond curve traded in

relation to the German – a too flat BEI curve with especially longer BEIs too low on a

relatively basis. This was a month ago, but that is an ocean of time in these markets. The real rate box has moved from -15bp to nearly-40bp (recorded a couple of days ago).

Moreover, the European debt crisis is deteriorating further, pushing the first rate cut from the Riksbank earlier in time. We now expect the first cut to be delivered at the next meeting in December. A lowering of the repo rate will affect mortgage costs in the CPI immediately. Posing a risk for shorter linkers initially, but a lower expected inflation rate should move nominal rates most. Thus shorter linkers will suffer in BEI rate terms.

Eventually, as the Riksbank continues to cut rates, shorter linkers will perform along the real rate curve as the real repo rate will be exceptionally low (negative) for a protracted period of time (perhaps for years). This, at least, portrays how the market moved in the wake of the first cut in late-2008 (see following chart). This time, we reckon, the market is prepared for a long period of loose monetary policy in order to tackle effects from the entire western world in deleveraging mode.

Despite a thoroughly revised inflation rate forecast the average inflation rate up to 2015 (when the SGBi3105 matures) is 1.3% in our projections. A likely repo rate path up to 2015 (gradually reducing to 0.5% next autumn, the first hike in late-2013 and ending at 1.5-2% in late-summer 2015), if priced by the market, would result in equivalent average repo rate close to 1.1%. Thus the real rate in SGBi3105 should in such a scenario be priced at minus 0.2% (currently 0.06%). It is not unlikely that the market will price quicker cuts when the first ones that have been delivered – resulting in an even lower average real repo rate.

So, there is a clear difference about how to play linkers, whether it is in BEI terms or

whether it is in real rates. Short BEI rates would probably decline, as even more rate cuts are priced into the market (even though our inflation forecast suggests something else). Long-term inflation is priced relatively low at 1.3% some 40-50bp above where BEIs hit bottom in 2008. Shorter BEI rates are considerably higher relative to the situation in 2008 – BEI3105 is now trading at 100bp, which is nearly 140bp above where BEI3106 traded at its lowest in 2008 (-0.36). In 2008 the magnitude of rate cuts took the market by surprise (for instance 175bp at one meeting) and real rates had difficulties keeping up with the pace.

In terms of real rate we expect shorter rates to follow nominal peers and decline when

more cuts (lower real repo rate) are price into the market. This will result in a steeper real rate curve.

Cash flows should support a steepening of the real rate curve

We estimate the net cash flow in linkers to be SEK27.7bn over the next nine months.

There is one auction left this year and that is followed by four in spring 2012. On 1

December three bonds have coupon redemptions and 1 April the bond SGBi3106

matures, which is the reason for the positive cash flow.

However the net cash flow effect should not be exaggerated as the majority of linkers are in the hands of investors, which have the option to decide how to reinvest redemption payments. Nominal bonds might be regarded as a better bet despite the fact that BEIs are flirting with lows in this cycle. The real rate funds are minor players in the market. For instance, of the SEK5.6bn of coupon payments in December we estimate that only some SEK650m will go to real rate funds (which would likely be reinvested in the real rate market).

When we move closer to the maturity of the SGBi3105 it cannot be ruled out that some

investors will desire short-term inflation protection and shift from SGBi3106 to SGBi3105. Supply of short-term inflation protection will diminish in large size and the small issuance that will take place will probably be in longer maturities. Together with

rate cuts this will support steepeners of the real rate curve.

Inflation risk distant - monetising of debt will not be domestic matter

Long-term inflation concerns – in the case of monetising of debt – will be a European

issue, if it happens (we doubt it will), and should affect longer nominal rates rather than linkers. Longer European BEI rates risk rise, spurred by higher nominal rates. However given how closely Swedish long-term nominal yields trade with German yields there should be some influence from higher German rates, if that should happen. Having said that, perhaps we have seen some first indications of debt fears fuelling into German bonds as well over the past days? The benchmark for intraday moves in Swedish bond yields going forward could be Gilts or other Government bonds with own currency.

Updated inflation forecast and notorious January CPI

The outlook for Swedish inflation over the next couple of years is changing rapidly. We

now foresee CPI inflation getting to just below zero by the end of 2012, before turning

gradually higher. We now see a much steeper inflation path than we did previously, with average annualised inflation by end-2015 at 1.3%. The reasons for the steep decline in inflation in 2012 are several: First, inflation pressures appear to evaporating quickly, as 11 out of 15 price components turned out lower than we had forecast in October. Hence, this suggests there is a widespread disinflationary pressure starting to come through now as retail sales have been weakening for a year. Consumer confidence has collapsed as the risk for getting unemployed is rising and house prices are being hit. Second, mediators wage bid was for the Swedish manufacturing industry’s rather modest, 2.9% over 22 months (dismissed by both parts though). For the overall economy (i.e. other sectors this would transform to about 3% a year) including wage drift, it turns out to be quite low. Actually, our model suggests underlying CPIF is likely to fall to record lows below 0.5% in 2012 against this background. Hence, this is well in line with our base forecast. Third, the January mortgage re-weighting effect is likely to be slightly negative and the VAT on restaurants (cut from 25% to 12%) is definitely a downside risk to our call. Finally, as we sense something of 2008 and a recession developing in 2012, we expect the Riksbank to cut the repo rate by 150bp to 0.5% – i.e. close to the 2008 low. We expect this to happen in 25bp steps starting in December 2011 and gradually feeding into lower mortgage costs. Hence, CPI is pulled down by both a declining core CPIF and the Riksbank’s rate.

Conclusion/recommendation

In BEI rate terms we foresee a steeper curve where short linkers will suffer from rate cuts and limited inflation pressure. In real rate terms we expect shorter real rate to eventually decline on the back of nominal rates as the real repo rate in the coming years will be negative or close to zero. So for an investor engaged in BEIs we favour longer linkers, whereas in real rate terms shorter maturities should be preferred.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.