Indepth Look At The E-Commerce Landscape

Zacks Investment Research | Nov 08, 2013 07:13AM ET

The Electronic Commerce, or e-commerce industry is one of the most progressive sectors of the economy. The industry is evolving very rapidly, so data collection and evaluation are particularly difficult. Consequently, one has to rely largely on surveys by both government and private agencies.

According to the U.S. Census Bureau, the manufacturing sector is the largest contributor to e-commerce sales (49.3% of their total shipments), followed by merchant wholesalers (24.3% of their total sales). These two segments make up the business-to-business category.

Retailers and service providers generated just 4.7% and 3.0%, respectively of their revenues online, a slightly higher percentage than they were in the prior year. The Bureau categorizes these two segments as business-to-consumer.

This places the business-to-business category at 89% of total ecommerce sales, with the balance coming from the business-to-consumer category. The latest numbers from the Bureau suggest that the fastest-growing segments were retail and wholesale. [All the above data from the U.S. Census Bureau relate to 2011, as published in May 2013].

The U.S. Commerce Department estimates that ecommerce sales in the country grew 15.8% in 2012 to reach $225.5 billion.

Retail

Total retail e-commerce was 5.8% of total retail sales in the second quarter of 2013, up slightly from 5.5% in the first quarter, according to the quarterly retail trade survey by the Census Bureau. Forrester Research estimates that this share will go up to 10% by 2017.

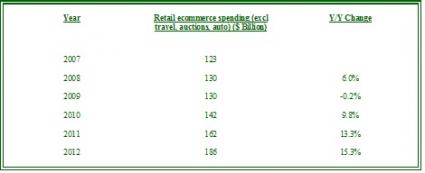

comScore data (as compiled in the table below) indicates that this segment recovered very quickly from the economic downturn and continued to grow at an accelerated rate over the last few years.

Key Drivers

Since the industry is in evolution, the drivers are changing. For instance, the initial push came from the time savings and convenience of online transactions. To this were added the benefits of comparison shopping and personal recommendations. As technology required for personalized recommendations developed, became more available and its benefits more evident, most e-tailers started adding the feature until it is now considered a must-have.

Today, the biggest driver of growth in the industry is the adoption of smartphones, tablets and other mobile Internet devices. In fact, trends indicate that consumers prefer mobile browsers when shopping, searching and entertaining themselves, while preferring apps for navigation and acquiring information. Call this "m-commerce."

comScore sees global mobile Internet users increasing very rapidly, with mobile as a percentage of total ecommerce sales (excluding travel) going from 11% in 2012 to 15% by the end of this year. The firm estimates that mobile represented 10% of total ecommerce sales for the first half of 2013.

eMarketer expects m-commerce to increase as a percentage of total ecommerce, with strong holiday sales this year taking its share of total ecommerce sales to 16%, or $41.7 billion (previous forecast was 15%, or $38.8 billion). This share is expected to go up to 26% in 2017 ($113.6 billion).

Smartphones and tablets accounted for 6.0% and 3.5% of total ecommerce sales in the first half of the year, according to comScore, with event tickets and apparel and accessories being the most popular items on mobile devices. eMarketer estimates that tablets will generate 65% of m-commerce sales this year, with smartphones accounting for the rest.

While smartphones are extremely convenient when on the move, tablets have several advantages of their own. In fact they are a boon to the ecommerce industry, since the larger screens offer better visibility of online stores and merchandise, thus facilitating purchases. Average spending per user on tablets is therefore 20% higher than on smartphones but since more people have smartphones, their overall share of ecommerce spending is lower. Given the unique advantages of smartphones and tablets, it appears that they are working in conjunction to boost total online retail sales.

Overall retail trade through smartphones and tablets grew 81% in 2012 and is expected to grow over 55% in 2013 (eMarketer Jan 2013). While growth rates will come down thereafter, they will remain in the strong double-digits range. At any rate, the inherent cost savings and convenience of “showrooming” ensures that the trend will continue.

Continued advancements in technology are improving navigation and customer experience on ecommerce sites, which is improving reviews and thus drawing more traffic to the sites.

The digital consumption of books, music, video and games all over the world is extending the reach of these goods and thereby boosting sales. Therefore, previously unconnected electronic goods, such as TVs and game consoles are now being modified to enable connectivity. On the other side of the fence, online versions of books, music, video and games that can be downloaded and consumed on a traditional computer or any other connected device are becoming available.

Since the shift in consumption patterns is resulting in multi-functional electronic gadgets that are no longer optimized for a particular activity, there is a great drive to develop technologies that could improve the quality of each experience.

Free shipping remains a major lure.

Top-Selling Items

The 10 hottest individual product categories in ecommerce are women’s apparel, books, computer hardware, computer software, apparel, toys/video games, video DVDs, health and beauty, consumer electronics and music.

Apparel is a huge market and although online sales are currently under 10% of total apparel sales, the category already generates the most dollars. Selling tools, such as zoom, color swatching and configurators are helping the process. Even primarily brick-and-mortar outfits like Macy’s (Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.