Indecision On The NQ E-Mini As Price Support Remains At 3500

Anna Coulling | Apr 27, 2014 12:06AM ET

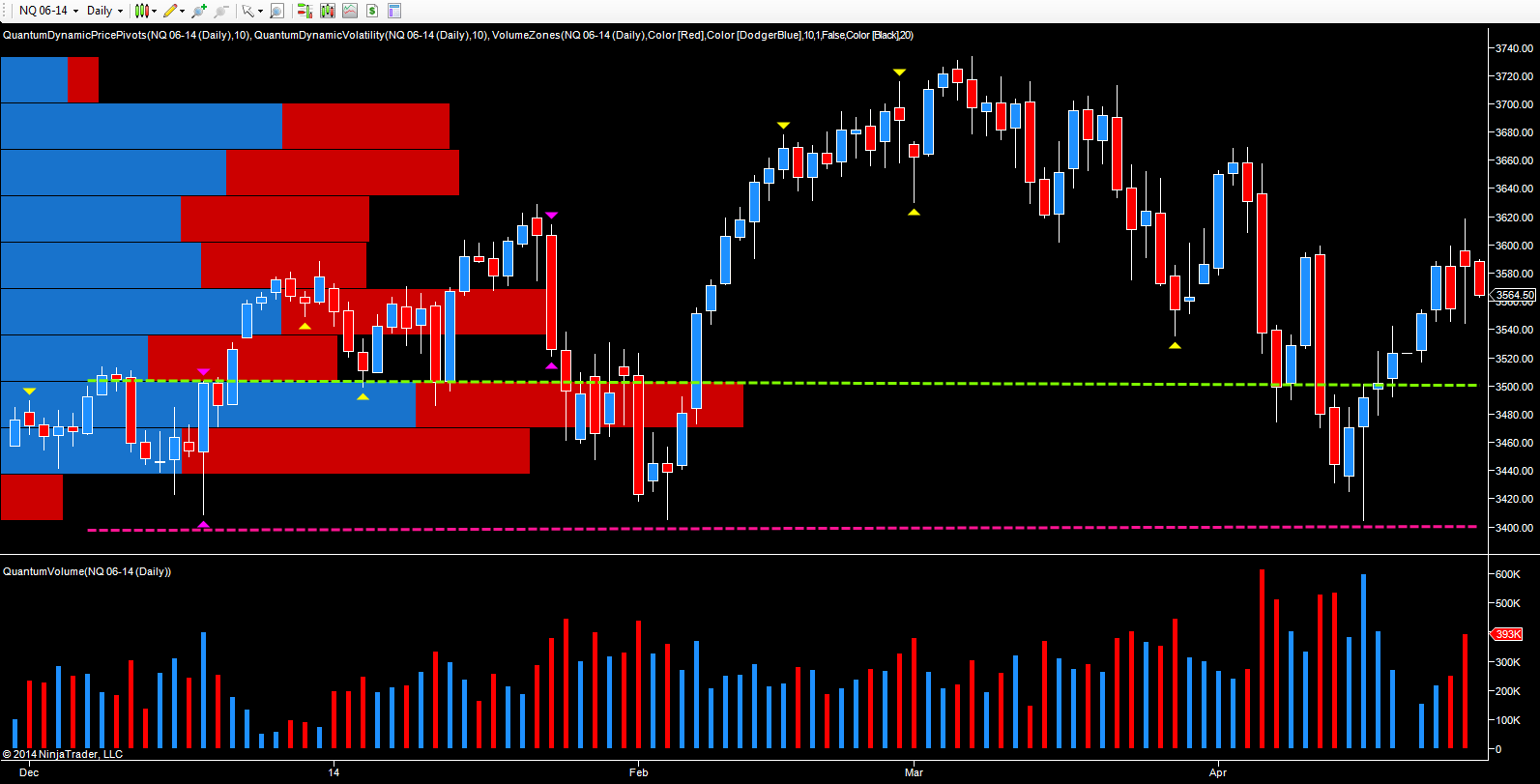

Yesterday was a day of indecision for many markets, with prices oscillating back and forth as recent short term trends stuttered to a halt once again. The NQ E-mini was a classic example, with the candle closing as a long legged doji, sending a clear signal of market indecision at this level, and a possible short pause or reversal. The recent bullish trend for the index was clearly signaled with the hammer candle and ultra high volume of two weeks ago, and indeed I wrote a post at the time, suggesting that the market was set to rally from this level.

However, the response so far has been weak with the consequent rise in the index, associated with falling volumes, clearly indicating a lack of strength in the move higher. Whilst some of this lack of volume could be attributed to the Easter holiday, nevertheless this lack of interest was also evident following the weekend, with the market rising on low volumes, before finally running out of steam in the 3600 area. Yesterday’s volume was high under the long legged doji candle with the index trading lower on Globex at 3567 at the time of writing.

The key level of price support remains at 3500 as shown with the green dotted line on the daily chart, a level that may be tested in the next few days. Provided this level holds firm, then the index should bounce back, but any breach here, is likely to see a test of the key 3400 region, with any break here signalling longer term bearish sentiment for equities.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.