Implications Of An Elevated Equity Risk Premium For Asset Allocation

Blog of HORAN Capital Advisors | Dec 03, 2012 02:20AM ET

Assessing the equity risk premium (ERP) is an important factor for investment professionals and corporate finance officers. I will forgo discussing the importance to a CFO in assessing the ERP and focus on investment professionals. Given the importance of the ERP one will find a surprising amount of disagreement around how to determine the appropriate ERP level. One can perform a "Google search" on "equity risk premium" and find an inordinate amount of research on the topic.

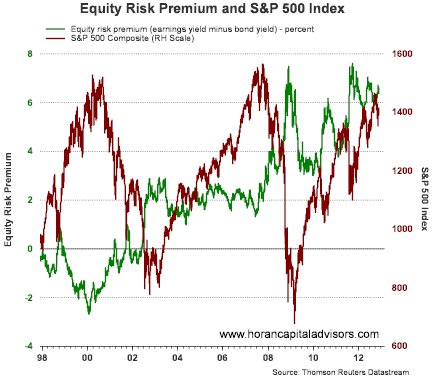

For investors though, determining the appropriate ERP level should play a part in ones asset allocation decision. In short, the equity risk premium quantifies the additional rate of return an investor requires to compensate for the risk of investing in stocks versus a risk free asset, the 10-year treasury bond in this case. If an investor has a view that the market is under valued and likely to go higher, then ones view is the ERP will decline in the future. Conversely, if the investor has a view that the market is over valued and likely to go lower, then the investor believes the ERP will increase in the future. As can be seen with the green line in the below chart, the ERP is trading at near a historically high level. The basis for the calculation of the ERP is the earnings yield for the S&P 500, that is, the inverse of the index's P/E ratio.

As I noted, the ERP calculation used in the above chart is based on the market's earnings yield. Essentially, this is an ex post calculation and what is most important for an investor is the prospective expected market returns or ERP. For readers that are interested in a more detailed discussion of the ERP, Does the Stock Market's Equity Risk Premium Respond to Consumer Confidence or Is It the Other Way Around? , provides support that so long as consumer confidence does not remain at near historical lows, long term investors can find the current risk/reward of the equity market attractive. The cited research in the article indicates satisfactory equity returns can be achieved with relatively low downside risk.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.