China's Regulators Are Too Late

Bill Holter | Jul 13, 2015 08:52AM ET

In the last article "An indication of PPT failure", many readers wrote in and either asked what the various acronyms were or admonished me for using so many without explaining them. I will try in the future to assume the reader does not know what we're talking about and at least spell out any acronym used. As for the last article;"PPT" = plunge protection team,"ROW" = rest of world

Today, let's look at China and their recent efforts at preventing their equity markets from collapsing. First, it should be understood they are "too late". I can say this because their PE ratio even after the collapse of 25%-40% (with some stocks not even trading Friday), the Shanghai Exchange still trades at over 60 times earnings. In other words, at today's rate of earnings, it will take 60 years worth of earnings to equal what investors are willing to pay now. They have allowed and even fostered a bubble of epic proportions to form, no amount of effort can stop this bubble from collapsing.

This past week, China took the crazy steps of making it "illegal" for institutional accounts to sell ...for the next six months!How will pension plans make promised payments? Will they send out IOU's until it's "legal" to sell again? There were also reports of brokers refusing to accept sell orders at all. Let's say this, the harder China works at closing the exit doors and not allow sales will only work to put more pressure on the world's other equity markets. This was one of the points I was trying to make when I wrote about the crisis "crossing borders" last week.

Think of it this way, what would you personally do if you were locked into the market here in the U.S.? What if our markets were closed, yet the Canadian or other European bourses were open? Would you consider selling something short elsewhere as a hedge because you are trapped long in the U.S.? Even if it is not the same company exactly, would you sell let's say Fiat (NYSE:FCAU) or Mercedes short as a hedge against being long shares of Ford Motor Company (NYSE:F)? Or forget even being industry specific, would you at least try to sell another bourse short and do it in dollars?

Do you see my point?China closing her markets will put pressure on other markets because being trapped can make for some "desperate people"...and you know what they say desperate people do!

Another reason the Chinese market will not recover is that speculation has run rampant and a cleansing is coming. Forget about opening four million retail accounts per day or hairdressers quitting their jobs to "day trade", the amount of margin built up and being used is staggering.

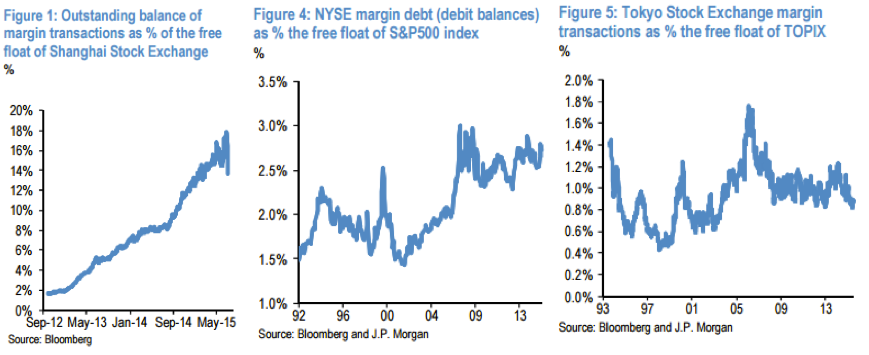

If you look at the margin debt on the Shanghai, you will see it was a very similar percentage to that of the U.S. and double that of Japan just three years ago. Since then, margin debt rose NINE-FOLD to 18%! Just in the last month during their crash, this number has dropped nearly 4 percentage points but is still as unsustainable as is a PE ratio of 60 times earnings. The huge margin debt suggests that selling will "FORCE" more selling because of margin calls. China's equity market is a wildfire already burning!

Skipping backwards as mentioned above, selling pressure from China is going to bleed over and into foreign markets. This is how the advent of plunge protection teams will fail as "borders" will be crossed. Today's world is one where everything financial is truly global. We see this and know this simply by looking at balance sheets and counter parties. We will see this and also feel it shortly as sovereign PPTs become pressured from outside bourses. This is no different than in trade where one nation devalues its currency to steal market share in a "beggar thy neighbor" fashion. By the way, our "glitch" of last week in my opinion was the first surge of selling across borders, with MUCH MORE to come.

A recent article was penned comparing China to a "Field of Dreams" where ghost cities were built in a huge miscalculation. It was said they built these cities with the expectation of rural farmers moving in and buying up all of the overcapacity. I highly disagree with this thought process. For well over three years it has been my belief the Chinese knew exactly what they were doing by building roads to empty cities that had their own runways and airports, sewage, drainage and complete utility systems at the "ready".

Why would they have done this?It is such a waste of capital right?Well yes, if it was "real capital" this would be correct. It is my belief the Chinese already knew "how" this was all going to end. They knew the financial system was a Ponzi scheme that could ONLY CONTINUE with new and more debt being added.

They also knew the credit system will ultimately collapse in a heap upon itself. No, this is no Field of Dreams, "if we build it they will come", on the contrary ... their thought process is "If we build it we will have it"!They also have accumulated the world's largest hoard of gold with this thought process.

Look at what China has done?They have overcapacity everywhere. They have unused plant, equipment, machining capability, housing and infrastructure ...but guess what? IT IS ALL NEW!!!Now let's make a comparison to the U.S., the only thing we have that's new are a bunch of McMansions built all over the place. We have little capacity to produce anything. Our roads, bridges and mass transit systems are all old and in many cases in disrepair. Our "grid" is a century old and at risk of being taken down by an EMP.

Moving along to the "end game", if a financial collapse is coming and credit everywhere is defaulting, then what exactly is left? Financial assets of all sorts will be rendered valueless, but physical "structures" will still remain. They may (will) change ownership via default but they will still remain and be "usable". China has played the game and used credit to build real things for the future. We invented the game and used credit to "eat" for the here and now. The global "game of credit" will mathematically end, and it will end badly. The U.S. will be beaten badly in the very game we created!

China has known for many years where and how this would end. It is one of the reasons they have accumulated the largest hoard of gold in the world and are also the largest gold producer. The credit bubble will pop and yes China will be hurt but they will be left with new infrastructure and more gold than anyone else in the world. A pretty good position to be in if we all have to start over!

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.