If Rates Have Peaked Then The Dollar Likely Has Too

City Index | Mar 21, 2019 09:08AM ET

Post-Fed, the Doves are on parade , treasury yields have fallen and bets for a cut in 2019 have increased. Certainly not a bad day in the office if you’re bearish USD.

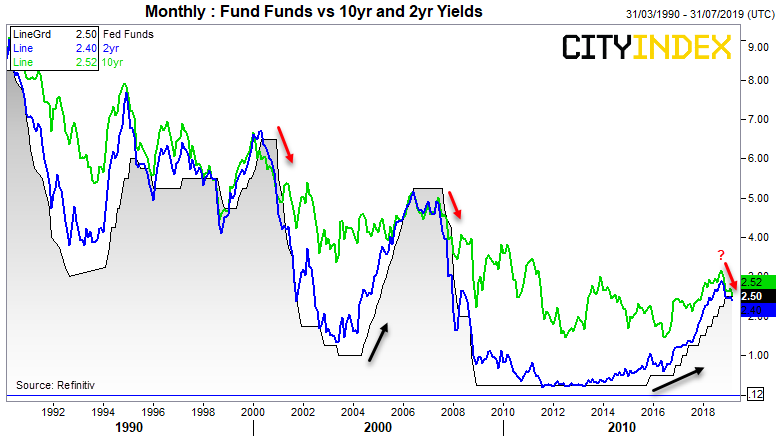

- Bond markets are hinting rates may have peaked at the Fed’s 2.25-2.50% target range

- A Fed pause could be positive for equities over the near-term

- USD could face mounting pressure

- USD/CHF teeters on the edge the of key support

Just yesterday we warned that the USD could face headwinds as we approach April , and that certainly seems to be more the case now. Only there is a real risk USD could remain under pressure for much longer, if bond markets are anything to go by.

With the Fed’s target rate stuck at 2.5%, it’s worth noting that the 2-year treasury yield has fallen to just 2.40%, the traders remain defiantly long (sentiment extreme?).

A Fed pause could be positive for stocks over the near-term (with potential for US markets to break to new high) and negative for bond yields (as money flows back into bonds). However, if the Fed do begin to cut this could be negative for stocks as it assumes the economy has derailed and earnings.

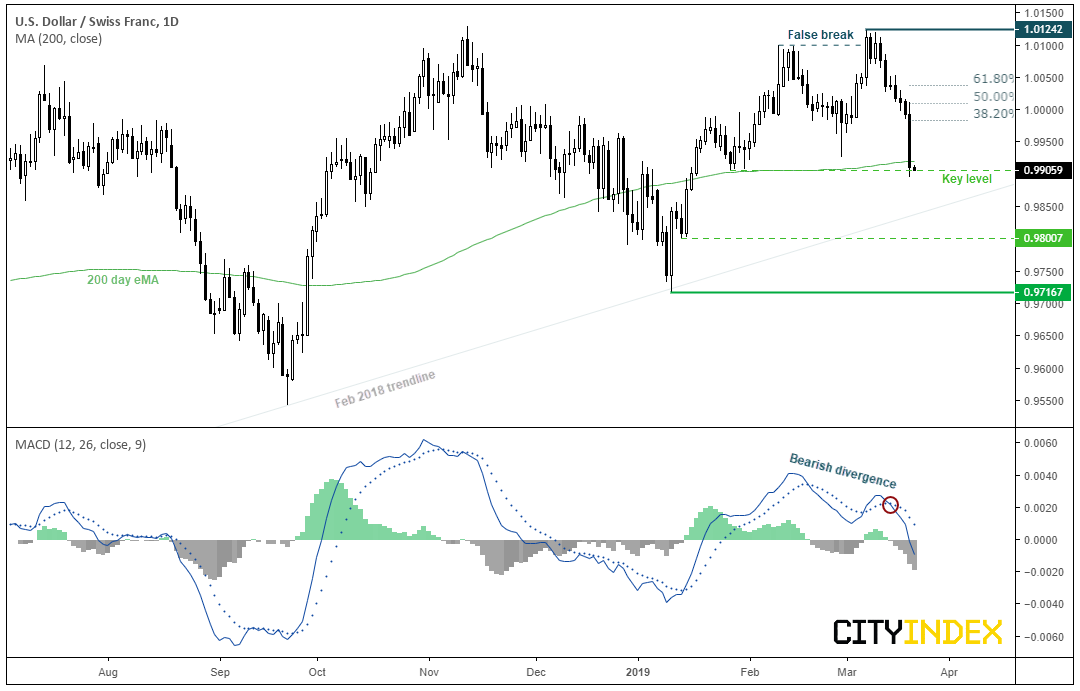

Going back to the US dollar, USD/CHF remains of interest around a bearish greenback theme. The Swissy has just endured its most bearish session this year, and now teeters on the edge of 0.9900 support. A clear break of this level brings the 0.9800 and 0.9718 lows into focus, although we’re hesitant to jump onto an extended move over the near-term.

USD/CHF has stalled near a structural low, is near its lower Keltner band and resides near the 200-day eMA. And as we’re heading into the weekend, its plausible to expect profit taking, after 7 consecutive bearish days. Therefore, caution is warranted around current levels as to avoid entering an over-extended move. If prices are to rebound, we can use a Fibonacci retracement to seek areas of weakness (as there are no clear structural levels to play with above).

But further out, we see its potential to head for the 0.9716 lows and beyond given the shift sentiment post-Fed, and the broader technical landscape. A false break above February’s high was coupled with a bearish divergence on the MACD. Moreover, a MACD sell-signal occurred on the 14th March, the histogram points firmly lower (showing the averages are expanding with bearish momentum) and we’ve also on track for a weekly sell-signal on the MACD.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.