Identifying Opportunities In International Dividend ETFs

David Fabian | Jun 23, 2016 06:53AM ET

When sorting through the list of available ETFs that offer high dividend yields, it’s very obvious that investors favor U.S. stocks. The overwhelming majority of assets are parked in funds with similar holdings such as AT&T (NYSE:T) and Johnson & Johnson (NYSE:JNJ). They also have low expenses, a high degree of daily liquidity, and have performed admirably when viewed over 3, 5, and even 10-year time horizons.

There is not much to complain about in U.S.-focused high dividend ETFs other than the lofty valuations and slowly deteriorating yields. This has many investors becoming concerned that the current pace of income and capital appreciation will be unsustainable when viewed through a long-term lens.

Those who have ridden through these cycles in the past may be ready to expand the scope of their investment focus in the months and years ahead. One option to consider are dividend ETFs with an international income emphasis. Many of these funds offer greater yields, more attractive valuations, or simply broader diversification qualities .

iShares International Select Dividend ETF (IDV)

IDV has one of the longest tenures and largest size in this category with over $2.7 billion in total assets. This exchange-traded fund tracks 100 foreign stocks with an emphasis on high dividend yields. Top country allocations include the United Kingdom, Australia, and Canada. Developed markets make up the majority of this fund, which charges a net expense ratio of 0.50% and offers a 30-day SEC yield of 5.25%.

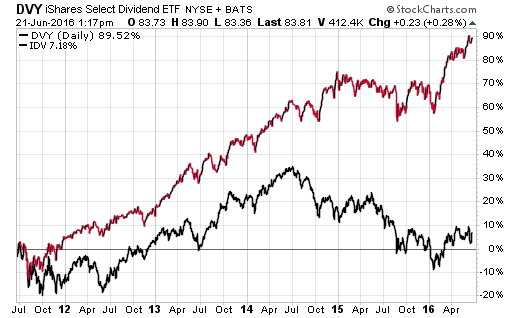

For comparison purposes, the iShares Select Dividend ETF (DVY) sports a yield of 3.27%. That means IDV offers a 60% higher dividend rate versus its U.S.-focused peer. Income from this ETF is paid on a quarterly basis as well.

Probably of greater importance to this discussion is the performance of IDV, which Barclays (LON:BARC) lists on their website as +0.71% annualized (total return) over the last 5 years through May 31, 2016. DVY has returned 12.68% annualized during that same time frame.

This gaping performance differential also helps explain why the P/E ratio of the underlying stocks in DVY is 19.47 versus 13.74 for IDV. Put simply, international stocks are much cheaper than their domestic counterparts because they have lagged on the way higher.

SPDR S&P International Dividend ETF (DWX)

Another comparable option to consider is DWX, which invests in a basket of 119 high dividend paying stocks outside the United States. This ETF has $944 million in total assets and charges an expense ratio of 0.45%. The current 30-day SEC yield is 5.85% and dividends are also paid quarterly.

Some notable remarks about the DWX index is that included companies are screened for liquidity and market capitalization requirements. Constituents must also demonstrate positive 3-year earnings growth and profitability. Emerging market exposure is also capped at 15% during each annual rebalancing cycle.

It may appear from a casual glance that DWX and IDV have a similar number of holdings, yield, and expense ratio. However, these two funds do have noticeable variances in country exposure and stock selection criteria. This will likely lead to differing returns over various market cycles as their exposure and position sizes exert themselves .

Vanguard International High Dividend Yield ETF (VYMI)

A relatively new fund in this category that I’m excited about is VYMI. Not surprisingly, this ETF has one of the lowest expense ratios in the group at 0.30% and is supported by a broader index of 890 stocks. This means that VYMI is a much more suitable option for those looking to achieve extensive diversification in a single investment vehicle.

VYMI also has more exposure to Asia/Pacific stocks with 20% of its portfolio and 16% dedicated to emerging markets. This makes for a highly differentiated portfolio offering versus the traditional model of more tightly grouped dividend paying indexes.

Vanguard has yet to post yield statistics for VYMI and the two initial dividends have been lumpy. It will be interesting to compare this offering versus its peers after a full year of distributions have been paid. My instinct is that this fund will have a modestly lower yield than IDV or DWX in conjunction with its larger number of holdings.

The Bottom Line

For contrarians who are looking for a mean-reversion opportunity , this gap in performance and fundamental valuations should not go unnoticed. The hard part is being able to determine when it will eventually narrow and having the patience or fortitude to capture that opportunity.

Further complicating the waters is the practical fear that international stocks have recently shown greater volatility and undiscernible trends versus U.S. markets. There is no way to know whether international stocks will just gradually drift higher as U.S. stocks stagnate or if it will take a more pronounced shock to global markets in order to induce a new momentum trade.

In my opinion, this opportunity is one that will likely offer forward-looking investors a sizeable advantage in the years ahead.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.