ICF International (ICFI) Beats On Q3 Earnings And Revenues

Zacks Investment Research | Nov 08, 2019 06:43AM ET

ICF International, Inc. (NASDAQ:ICFI) reported solid third-quarter 2019 results, with earnings and revenues beating the Zacks Consensus Estimate.

Non-GAAP EPS of $1.12 beat the consensus mark by 3.7% and improved 10.8% on a year-over-year basis driven by strong operating performance. Revenues of $373.9 million outpaced the consensus mark by 0.6% and increased 12.3% year over year.

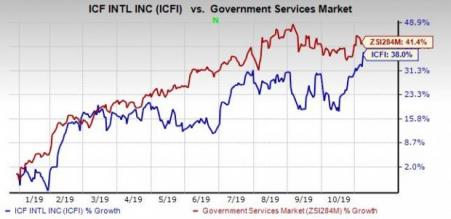

So far this year, shares of the company have gained 38% compared with 41.4% rally of the industry it belongs to.

Revenues in Detail

Revenues from government clients came in at $247.7 million and improved 11.4% year over year. U.S. federal government revenues of $148.2 million increased 5.6% year over year and contributed 40% to total revenues. U.S. state and local government revenues of $71.5 million rose 28.8% year over year and contributed 19% to total revenues. International government revenues of $28 million, up 5.5% year over year, contributed 7% to total revenues.

Commercial revenues totaled $126.2 million, up 14.1% from the year-ago quarter’s figure and contributed 34% to total revenues. Energy markets contributed 47% to commercial revenues and Marketing services contributed 45% to the same.

Backlog and Value of Contracts

Total backlog and funded backlog amounted to $2.5 billion and $1.3 billion at the end of the quarter, respectively. The total value of contracts awarded was $477.2 million, representing a third quarter book-to-bill ratio of 1.3, and a trailing 12-month (TTM) book-to-bill ratio of 1.0.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.