IBM Fundamental Analysis By The Numbers

Chuck Carnevale | Oct 19, 2018 03:59PM ET

All investing is not done with the same objectives or goals in mind. This applies to investing in common stocks just as it does to investing in real estate, commodities, fixed income vehicles, fine art or collectibles – and any other investment that comes to mind. There are times when investors are looking for maximum total return, which is often automatically associated with buying a stock. However, there are also investors looking for high current income, or a growing income stream. Other investors might be more concerned with safety than they are return. Or as Will Rogers so aptly put it: “I am not so much concerned with the return on my capital as I am with the return of my capital.”

I bring this up because my experience suggests that people tend to be myopic when it comes to investing in stocks. For example, there are those that believe that you should only invest in a stock that can beat the so-called market. Similarly, there are those that believe you should only invest in a stock with the objective of generating a high total rate of return. Therefore, if a stock is not meeting those specific objectives, then it is often considered a bad stock.

For example, in 2015 I wrote an article titled “Retirees: I Did Not Buy IBM (NYSE:IBM) To Sell; It’s About the Dividend Income, Stupid. ” Although I was having a little fun with the title, I was also attempting to point out that I was investing in IBM solely for its growing dividend income stream and safety. When that article was published, International Business Machines (NYSE:IBM) was offering a current dividend yield of 3.7%. More to the point, the dividend has increased each year since at an average growth rate of approximately 9 to 10%. Moreover, IBM has also generated substantially more dividend income than I would have gotten had I invested in the S&P 500. Consequently, IBM has met and even exceeded my expectations and objectives thus far. Therefore, I have been very pleased with my IBM holding.

On the other hand, IBM was trading at a price of approximately $141 when I wrote the cited article versus the $130 it currently trades at as I write this article. However, many might be surprised to learn that I could care less about what IBM is currently trading at. The reason is simple, as I also stated in the title, I did not buy IBM to sell, instead, I bought IBM for the opportunity to earn an above-average and growing income stream over the long run. I believe that objective remains intact, and I am therefore content to continue owning this A+ rated blue-chip. This recalls a comment the venerable Peter Lynch once made about IBM. Peter said, and I quote: “no manager has ever been fired for buying IBM.”

What About IBM’s Future?

To be clear, I want to restate that I purchased IBM for its above-average yield and for the safety that I perceive relative to that yield. In other words, I originally believed – and continue to believe – that IBM is fully capable of offering me an above-average generation of spendable dividend income that is growing faster than inflation. Furthermore, I do consider IBM undervalued, and as a result, I am not concerned about losing a great deal of money on this investment over the long run. In other words, I believe IBM’s problems are already priced into their stock. On the other hand, I am not willing to rule out the opportunity that IBM will deliver on its strategic imperatives for growth, thereby providing exceptional long-term total rate of return in the future. However, I also realize that I will need to be patient that will not occur overnight – if it ever occurs.

It was obvious to me when I purchased IBM and remains so today that IBM is a technology company in transition. Furthermore, this is not the first time that IBM has found themselves in this situation. I have been following IBM since the mid-1970s and watched it endure significant challenges in the late 1980s and early 1990s. In fact, I used to utilize IBM as an example of a low growth cyclical tech stock that I would not invest in. However, IBM proved me wrong, as it produced strong and consistent growth throughout the late 90s through 2013. From there it has suffered 3 years in a row of negative earnings growth (2014 through 2016) and has since produced growth below 2% per annum.

In summary, IBM is a formidable technology icon whose origins date back to the 1880s and whose operations have transcended several technology revolutions. Moreover, the company finds itself once again in transition with management, aware and attempting to right the ship by shifting its portfolio to higher value software and services. Although this includes strategic initiatives and investments in the cloud, the company also believes that companies cannot afford to move everything there. Consequently, the company sees itself in a hybrid IT world, at least according to Morningstar.

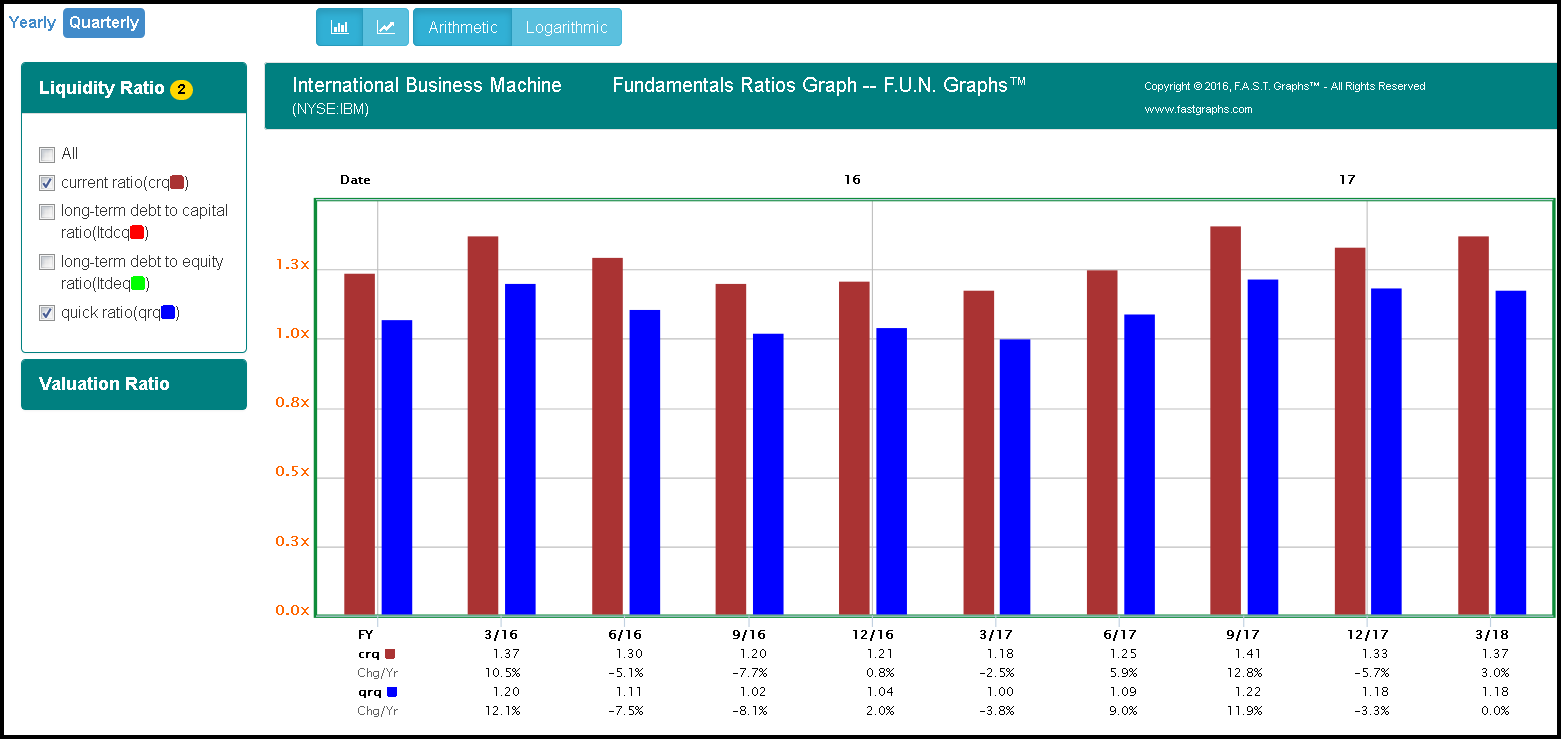

Will IBM, or can IBM be successful with its current initiatives? Clearly the jury is still out. However, there are bright spots. Nevertheless, since my objective for investing in IBM is income and safety, their future growth is less important to me than the sustainability of their business. A quick glance at IBM’s acceptable current ratio of 1.37 and quick ratio of 1.18 suggests that there is little worry that IBM will not remain an ongoing concern:

Before I talk about why I believe IBM’s growing dividend is safe and likely to continue, I want to point out that dividends are paid on a per-share basis. Additionally, one of the most often cited criticisms of IBM in recent times has been their aggressive share purchases. In 2007 IBM had 1.39 billion shares outstanding. At the end of fiscal year 2017 their share count had fallen to 922 million shares. Therefore, skeptics are arguing that IBM has only maintained their recent earnings levels because of financial engineering.

IBM Common Shares Outstanding (CSHO) 2007-2017

To some extent, those criticisms have some validity. On the other hand, as a minority shareholder, I am primarily concerned with the level of the company’s operating results that each share of stock I hold will receive. Therefore, as previously stated, dividends (which were the primary reason for my investment in IBM) are paid on a per-share basis. Consequently, when the company purchases its own shares, the shares I and other minority shareholders own are receiving a bigger piece of the dividend pie. Consequently, the probability that my dividends will continue to increase is enhanced because of IBM’s share purchases.

Additionally, I would like to add that I am generally neither for nor against a company repurchasing its shares. More specifically, I am in favor of a company repurchasing their shares when their valuation is low – as IBM’s has been for the past 10 years. Conversely, I am against a company purchasing their shares when their valuation is high. Stated more simply, I only like to see a company buying their shares when I would also personally be willing to invest in those shares. In other words, I consider buybacks prudent and attractive when a company’s valuation is low, and I consider it reckless behavior if a company is buying their stock when their valuation is high.

How Safe Are IBM’s Dividends? FAST Graph Analyze out Loud Video

With the following video I will present a by-the-numbers look at why I consider IBM’s dividend both safe and likely to continue growing in the future. Additionally, I will present a fundamental evaluation of IBM’s current fair value to include the potential for that value to increase in future time.

Summary And Conclusions

I do want to be clear that I recognize the undeniable reality that IBM is facing significant challenges in today’s technology environment. Andrew Lange in an analyst note update on August 27, 2018 had this to say:

“IBM is in the middle of yet another digital revolution, and while the jury is still out on the long-term strategic and financial success of initiatives like analytics and cloud computing, we think rising sales from these products will mostly offset slow declines in legacy businesses. IBM’s large, profitable, and sticky core operations will protect the company from any precipitous slide in competitive positioning, but we think its economic moat has narrowed, as we have concerns about the economics and competitive dynamics of its newer initiatives.

IBM’s pervasiveness across the enterprise IT landscape is undeniable, as the company has been at the forefront of providing high-quality IT hardware, software, and services on a global scale for decades. Still, enterprise adoption of cloud computing, commoditization of hardware, and exposure to legacy IT services mean that IBM needs to pivot. Its core operations are stagnant, and the company is doubling down on higher-growth “strategic imperatives,” to counteract the growth shortfall.”

Therefore, with all things considered, I believe IBM continues to represent an attractive dividend growth stock in today’s persistently low interest rate environment. Whether the company will ever grow again, or whether the shares will ever produce significant levels of capital appreciation remains a question mark. However, I believe the certainty that the company will continue offering a growing dividend income stream is reasonably high.

In closing, IBM is an iconic technology enterprise with enormous financial resources and significant entrenchment into the IT departments of large and small organizations throughout the world. Technology is an ever-changing industry, and IBM has been forced to evolve many times over its long history as a technology leader. Of course, there is no guarantee that IBM will succeed with the current initiatives. However, I for one am not yet ready to count them out. Consequently, I hope to continue to collect my dividend income for years to come. And who knows, valuation is low enough that upside surprises could happen in the next 5 to 10 years. Finally, I feel that I’m being paid adequately with the growing dividend to patiently wait. Caveat emptor.

Disclosure: Long IBM.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.