How Will The U.S. Election Impact Markets?

Faraday Research | Nov 02, 2016 11:58AM ET

The seemingly never-ending spectacle that is the US presidential election campaign is entering its final act. By the end of the night on November 8, either Hillary Clinton or Donald Trump will become the new president-elect of the world’s largest economy. While it seems like the media has dissected every aspect of the upcoming election, from email servers to hand sizes, comparatively little ink has been spilled about how election could affect global asset markets.

This special report seeks fill in those gaps. In the following sections, we provide an overview of the US election process and timeline; a look at a couple of the candidates’ most market-moving economic policies; and an examination of how markets have historically reacted under different political regimes, including actionable takeaways to use in your own trading.

What Do Polls Say?

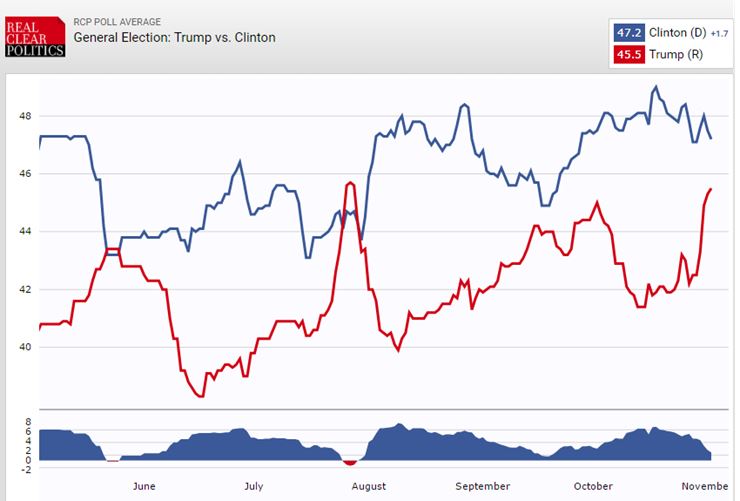

Opinion polls have been volatile throughout the national campaigns, though Hillary Clinton has generally maintained a lead over her Republican rival. That said, last week's news that the FBI has reopened its investigation into Clinton's controversial email server has brought Donald Trump back within striking distance. According to poll aggregator Real Clear Politics, Clinton is currently polling at 47.2% nationally vs. 45.5% for Trump and the situation remains highly fluid:

Source: Real Clear Politics (November 2 2016)

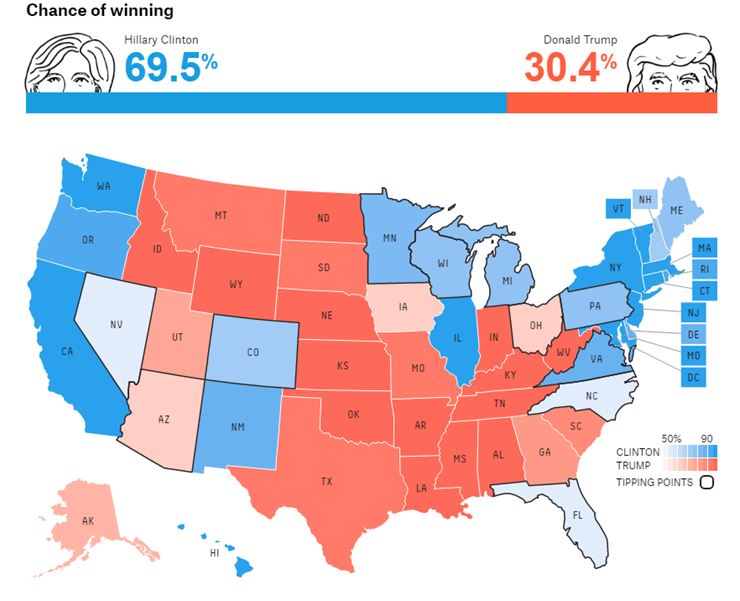

We’re traders, not political pundits, so we won’t try to handicap the likelihood of each outcome. Overseas bookmakers are giving Hillary Clinton a 70/30 chance of winning the election. The experts at the election forecasting site FiveThirtyEight.com agree that these odds are accurate. Based on the website’s “Polls-only” model, Editor in Chief Nate Silver and company currently give Clinton about a 70% chance of taking the oath of office, though that forecast will of course change as new polls come in:

Source: FiveThirtyEight.com (November 2 2016)

Presidential Policy And The Markets

Before we delve too deeply into specific policies, it's important to note that presidential policies would still have to garner support from Congress before being ratified into law. Both the Senate and House of Representatives are currently controlled by the Republican party, but Democrats could conceivably take the Senate with a strong showing on election day.

With that important disclaimer out of the way, it’s obvious the eventual president’s policies will be a key driver for markets. At a top level, investors view Hillary Clinton as the “continuity candidate.” This means that, if elected, her policies would make only relatively moderate changes to existing policy. By contrast, many of Donald Trump’s economic policies haven’t been entirely fleshed out, but will likely be focused around large tax cuts and aggressive renegotiation of international trade treaties.

Below, we highlight a couple of the most important economic issues on which Clinton and Trump differ, as well as the possible implications for specific markets:

Taxes: Which Candidates’ Are Best For Stock And Bond Investors?

Toeing the party line, Clinton proposes a modest tax cut for the middle class, paid for by raising taxes on individuals making more than $5M/year and increasing capital gains taxes on those earning above $400k/year. In our estimation, these changes would have little net impact on the national deficit, and by extension, the status quo in major asset classes.

Therefore, a Clinton presidency would be unlikely to provide any additional boost to US stocks, but bond investors may benefit from interest rates remaining lower for longer.

By contrast, Trump has proposed an across-the-board $4.4T tax cut, combined with a boost to infrastructure and defense spending, as well as a desire to gradually pay down the national debt. To say the least, it would be difficult to pursue all of these goals simultaneously, and we suspect that a President Trump would fall more in line with the Republican orthodoxy if elected president. In the short term, this would likely take the form of tax cuts for the rich and an expansion in the deficit, unless accompanied by a dramatic cut in domestic spending. Economics 101 tells us that deficit spending can provide a short-term boost for the economy, and therefore, equity markets, though that could be offset by long-term concerns about the sustainability of the national debt.

In terms of immediate impact, a Trump presidency could provide a boost to US stocks, though interest rates may rise as investors fear an expansion of the deficit.

International Trade: Big Implications For Mexico, China

Both candidates have courted blue collar manufacturing workers by proposing to renegotiate international trade deals, but Trump has been more consistent on this front. He has formally pledged to renegotiate NAFTA, label China a currency manipulator, and of course, build a wall with along the Mexican border.

There is no debating that international trade can hurt certain sectors of the domestic economy, but done right, it can be a net benefit for all countries involved. Not surprisingly, the international ramifications of Trump’s hard-line stance on trade have already started to manifest in the FX market. As Trump’s polls have improved in recent weeks, the currencies of Mexico and China have both fallen on fears about the potential for a less accommodative trade policy from the world’s largest economy.

With opinion polls currently showing a near toss-up between Clinton and Trump, the outcome of the US election will remain one of the most important drivers for the peso and yuan. If it starts to look like Donald Trump will be taking the oath of office, traders will look to sell both the MXN and CNH and ask questions later. By contrast, emerging market currencies as a whole could see a big relief rally if Clinton is elected.

If Trump comes out victorious on November 8, traders will look to sell both the MXN and CNH and ask questions later. By contrast, emerging-market currencies as a whole could see a big relief rally if Clinton is elected.

In the equity market, Trump’s protectionist policies would likely favor small cap stocks, which are more dependent on the domestic economy, at the expense of large multinational companies.

Energy: Potential 1M Barrel/Day Swing In US Oil Production

The two candidates also have dramatically different views on energy policy. Clinton has publicly stated her goal to have renewable energy “power every home in America within 10 years” and cut oil consumption by a third. Trump meanwhile promises to revive the fossil-fuel sector, including by eliminating onerous regulations on the industry.

It doesn’t take a genius to realize that the election’s outcome will have a massive impact on US oil production. Analysts have estimated that US production could fall by as much as 500k barrels a day if Clinton has her way, whereas Trump’s policies could increase production by a similar amount.

At the most basic level, a Clinton-induced decrease in oil production could push oil prices higher, whereas a Trump-led renaissance in oil supply would likely push oil prices down, though it’s worth noting that other geopolitical factors, including OPEC’s output, could overwhelm the impact of US politics.

The Federal Reserve: Buck’s Near-Term Fate Intertwined With Yellen’s

Arguably the most significant impact of the US presidency on global economic policy will be from the choice of the Fed Chair. Hillary Clinton’s campaign has said that it would like to increase the diversity within the Fed (read: fewer white, male bankers as Fed governors). That said, Clinton would be likely to reappoint current Chairwoman Janet Yellen (or perhaps current Fed Governor Lael Brainard, who is even more dovish); one way or another, a Clinton presidency would likely ensure that doves rule the Fed roost.

Trump, on the other hand, has a muddled public record when it comes to Dr. Yellen. In the past, he’s said both that he has great respect for her, but his comments of late have been far more critical, stating that Yellen should be ashamed of herself and that she’s leaving interest rates low to benefit Obama. At this point, it seems unlikely that Yellen would serve a second term under a President Trump, and her replacement would likely be more hawkish.

As for the short-term impact on the US dollar, expectations of a more hawkish Fed chair under a President Trump could provide a near-term boost to the US dollar. In contrast, continued dovishness from the world’s most important central bank would likely serve as a headwind for the greenback under Hillary Clinton.

Market Cycles: What Political Patterns Have We Seen Historically?

At Faraday Investment Research, we pride ourselves on basing all of our trading decisions on time-tested techniques. In that vein, we wanted to take a look at the track record of major markets and some of the cycles that have emerged in recent years:

Which Party Is Best For The Stock Market?

We’re not the first to ask this loaded question. Looking at the historical record first, it’s clear that the US stock market has seen higher gains under Democratic presidents: since 1945, the stock market’s average annual return was 9.7% with a Democrat in the White House, versus a 6.7% average return under Republicans.

Source: S&P Capital IQ

Before Democrats take a victory lap though, there are a couple of big disclaimers. First, it’s worth noting that this performance has hardly been uniform; in fact, the best stock market performance by president in the sample was under Republican President Gerald Ford, who oversaw an average return of 18.6% per year on the S&P 500. Furthermore, the stock market has seen its highest returns with a Republican-controlled Congress.

Frankly, we’d caution readers against making any meaningful changes to their investment plans as a result of the election. The sample size on this data is relatively small (only 12 presidents since 1945) and the impact of the president’s political party on the $18T US economy is often overplayed.

The US Dollar Bleeds Blue

The world’s reserve currency has also shown a preference for Democratic presidents, at least over the last couple of decades. Dating back to President George H.W. Bush in 1988, the US dollar index has tended to fall during Republican presidencies and rise under Democrats, including over the last eight years under Obama:

Source: Source: TradingEconomics. com, Faraday Research

Once again, readers should note that there are far more important macroeconomic factors that could upset this historical tendency and sample size here is extremely small.

EUR/USD: Will “Mid-Term Cycle” Return?

The last historical pattern to be aware of is the so-called “mid-term” cycle in EUR/USD. As the chart below shows, EUR/USD has shown a tendency to rise in the first half of the 2-year mid-term elections (November of even-numbered years to November of odd-numbered years) and fall in the second half:

Source: Stockharts.com, Faraday Investment Research

Unfortunately, this cycle did not manifest over the last two years. Instead, EUR/USD has been trapped in stasis between 1.05 and 1.15 for nearly two years now. Traders should keep a close eye to see if the previously-reliable mid-term cycle in EUR/USD shows signs of resuming after the elections.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.