How To Profit From The Drop In The Oil Price

Frank Suess | Apr 22, 2015 05:36AM ET

Over the past three quarters, the world has watched oil prices plummet from over $100 to its current price of $51/barrel of the grade West Texas Intermediate (WTI). Due to oil’s vital role in the global economy, this massive decline naturally raises questions as to the reasons behind the decline and the perdurability of these lower oil prices. Today we will give you a more in-depth analysis of what is going on in the oil market and offer potential investment implications resulting from these developments.

A look at the oil market and recent developments taking place

The main reason why the oil price took a nosedive last year was the fundamental change in oil market dynamics, as the US surpassed Saudi Arabia as the world’s largest oil producing country. This changing of the guard was largely due to the boom in the US shale oil industry, which the US has invested heavily in during the past few years. This development helped the US not only in becoming less reliant on foreign crude, but also contributed to an increase in (available) supply in the global oil market.

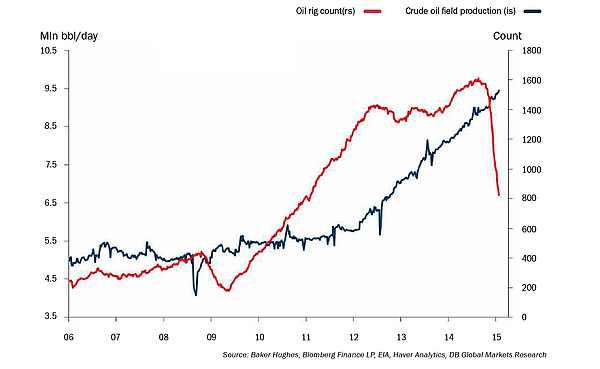

Figure 1: US oil field production and rig counts

The boom in the shale oil industry was made possible by the improvement in technology, which in turn reduced production costs in the industry. According to the US Energy Information Administration (EIA), the US was able to boost its daily drilling of crude oil to an average of 8.7 million bbl/d (barrels per day), up from around 5.6 million bbl/d back in 2008. Although oil production remains resilient thus far - partly due to the fact that many oil companies hedged the oil price - the number of US oil drilling rigs has fallen sharply and declined for 18 straight weeks to the lowest level since December 2010 (Figure 1). However, as a result of the price plunge, the EIA is now less optimistic, expecting a lower output from the shale oil industry starting in May.

The Organization of Petroleum Exporting Countries (OPEC) plays a decisive role in the world oil market and produces approximately 40% of the total oil output. Due to its large market share, they are capable of controlling the price by changing the amount of oil supplied. Although OPEC’s earnings have already dropped by 11% in 2014, they are now at 2010 levels and are expected to take an even stronger hit in 2015. OPEC is nevertheless insisting on maintaining their production quota and refusing to cut back on production to push the price upward, which would in turn also increase its earnings.

OPEC remains mum as to why they continue to maintain this production capacity. However, it does seem likely that their aim is to preserve their market share and weaken shale oil producers. Since OPEC countries have relatively low production costs, they are able to cope with extended periods of low oil prices compared to their global competitors.

So, are there any other factors that contributed to the drop? Historically there appears to be a strong negative correlation between the price of oil and the US dollar. It however remained unclear if this correlation was still valid, given the surge in US shale oil production. Examining the current circumstances, it appears that this negative correlation between the oil price and the USD still holds true.

Another factor that may have played a role in the price decline is more speculative in nature and therefore much more difficult to verify. Could the price decline be an intentional move to hurt the Russian economy, an economy that is highly dependent on income from energy exports? We should highlight that crude oil represented about 33% of Russia’s export revenues in 2013, according to the EIA. This is significant, considering that about 50% of Russia’s federal budget revenue that same year was derived from mineral extraction taxes and export customs duties on oil and natural gas.

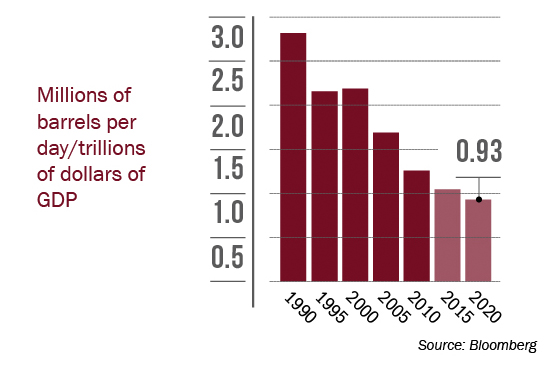

Figure 2: Oil consumption becomes more efficient

Up until now we’ve concentrated on the supply side of the oil equation. What about the demand? The IMF recently published their Gross Domestic Product (GDP) growth predictions in their World Economic Outlook (April 2015): World economic growth in 2015 is estimated to be up to 3.5% after having a 3.4% growth rate in 2014. This growth prediction is slightly better than it was 3 months ago. However, these growth rates are not high enough to have a noticeable effect on oil prices from the demand side, as was the case during the period of exceptionally strong growth during the period 2003-2007.

The normalization of global growth rates might also be seen as a reason for a weakening global demand for oil, especially when coupled with an ever-increasing efficiency in energy usage. We came across an interesting chart (Figure 2) that shows a decreasing relative importance of oil in the economy due to the increase in energy usage efficiency. This is a long-term trend that will likely impact the future demand for oil.

Where is the price heading?

The EIA expects Brent crude oil prices to average $59/bbl in 2015 ($75/bbl in 2016). OPEC explains that the recent improvement in oil demand in Europe and Asia has played a part in the recent pick-up in the oil price. The EIA also expects that prices may pick up towards the end of the year to an average of $67/bbl in the fourth quarter.

While OPEC members have maintained they will not cut production, there is great uncertainty in the market due to the drop in oil drilling activity and shutting down of oil rigs, particularly in North America after shale oil production reached a record-high. The break-even points for shale companies vary strongly and some shale oil producers are already operating at a loss. The full impact of the drop in oil price will be seen when the companies that have been hedging the oil prices eventually have to cope with much lower oil prices. We believe that the oil supply will remain relatively stable in the coming years.

The demand side, on the other hand, depends strongly on the economy’s performance and the severity of the winter season. Emerging markets generated most of the demand growth in the oil market in recent years. Therefore, lower economic growth rates are likely to affect the demand growth of oil. It is also worth mentioning that the shale oil boom has led to a massive growth in oil storage and available storage is becoming increasingly rare, with the Strategic Reserve of the US Department of Energy operating at 95% of capacity and commercial storage at around 75%. We see similar developments in the global storage capacities, which are likely to reduce the amount of demand that can be expected from storage facilities due to the lack of capacity. It is therefore possible that we could see new lows in the oil price in the coming months.

Excluding any unforeseen events, we expect that the oil price will stabilize at current levels and trade sideways for some time. In the case of a positive boost on oil demand coming from a better-than expected economic environment, we may see a slight increase in oil prices. However, we find it unlikely that the price will go beyond $90 for the foreseeable future.

How are countries impacted by the oil price?

Clearly, the winners from the drop in the oil price are the oil importers who are now benefitting from the lower cost on their oil expenses, even taking advantage of the current price levels by storing up on oil before the price picks up again. When we consider those importers, some are more obvious than others.

Major oil importers include China, Japan, India and the West. The World Bank previously estimated that every 10% of decline in oil prices will help boost the Chinese economy by 0.1-0.2%. If the calculation of the World Bank is correct, we can assume a 0.5%-1.0% boost to the Chinese economy due to the price decline last year. India is also another beneficiary. It is one of the largest oil consumers worldwide and dedicates about a third of its budget to energy subsidies. The decline will help save foreign currency reserves and will reduce its current account deficit.

Meanwhile, Japan, who has been suffering from a trade deficit for several quarters, will see less pressure on its energy bill, which has been particularly challenged since shutting down its nuclear reactors after Fukushima in 2011. The developed economies are also winners of low oil prices, but we’ll take a look at the impact on these countries in the next section.

On the losing side, we have Russia, the Gulf region, South American oil exporters and basically all other oil producers. Russia represented 15% of the world’s total world oil supply in 2014, but it has been particularly squeezed by the drop in oil prices due to its poor economic performance, sanctions, and the political pressure in relation to the Ukrainian matter.

The Gulf region, and Saudi Arabia in particular, was not severely affected by the drop in the oil price. Due to their low production costs, they can still generate profits at current levels. However, these countries have huge social plans in place that are dependent on a higher oil price. If oil prices remain at these low levels for a prolonged period of time, the World Bank estimates the region will be hit by losses of $ 215 billion in oil revenues p.a., which represents more than 14% of their combined GDP. This, in turn, will affect the spending plans and investment strategies which they have been handling quite comfortably during times of higher oil prices. Saudi Arabia alone earned an estimated $ 246 billion in 2014, or about one-third of the cartel’s total export revenues. However, they seem keen on exporting heavily to maintain market share rather than cut production to support a higher price for oil.

What sectors are expected to gain?

When we consider the impact on the economy, the drop in the oil price certainly raised deflation concerns. The collapse of the oil price led to a decline in the energy component of the CPI and thus led to a reduction in inflation, moving it further way from the target rate of 2%. However, we believe that this will give central banks more leeway to pump more money into the system.

With the oil price, and thus inflation, declining, the consumer seems to be the biggest winner. In general, cheaper oil for transportation and heating increases the consumers’ purchasing power and private demand in oil-importing countries because they have more to spend otherwise.

So if the consumer is the most likely winner from the oil price decline, which sectors do we expect to do well? In our view, consumer staples and retail companies will see a boost in sales as consumers have more disposable income available to spend. With the increased spending power, in conjunction with the strong dollar, companies exporting heavily to the United States would stand to see an even higher boost in sales.

Manufacturing companies will benefit from lower transportation and packaging costs. The logistics and transportation sector will certainly benefit from lower energy bills and airlines will undoubtedly benefit as energy represents around 30% of their total operating costs. Mining and farming sectors stand to see a huge impact on their operating expenses. Energy represents about 30% to 40% of operating costs for mining, while it can range from 40% to 50% for farming.

How can investors profit from the oil price decline?

Timing the oil price for speculative purposes is extremely difficult. The volatility in oil prices, especially in the short- to medium-term, can be expected to stay high. Instead of investing directly in oil or oil companies, we would therefore look to invest in equities from the certain countries or sectors we highlighted here that are most likely to profit from the current price developments.

This article is an excerpt from BFI Insights Q2 2015 which appeared on Mountain Vision, the portal from BFI Wealth Management.

‘"For Americans looking for improved asset protection and interested in learning about solid and compliant planning options offshore, BFI is organizing an Inner Circle Wealth Forum ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.