How To Play The Great Game Of Country ETFs

Wall Street Daily | Jun 01, 2016 06:13AM ET

You’ve probably read about larger than life investors like George Soros who scour the world for the best opportunities and bet on anticipated economic and political events.

These titans of finance are playing a grand game as they move capital across a global chessboard.

Not all that long ago, pursuing this sort of investment strategy was beyond the reach of the individual investor.

But not anymore…

First of all, the amount and quality of investment information available in print and on the internet is staggering.

Second, low-cost, tax-efficient, transparent exchange-traded funds (ETFs) have opened up a whole new world for investors.

ETFs allow investors to go long and short on asset classes previously open only to professional investors. This includes foreign currencies , commodities such as coffee and wheat, foreign bonds, real estate, frontier markets, precious metals, and 194 country ETFs that enable you to invest in an overseas stock market with a click of your mouse.

These country ETFs have fascinated me for a long time and, while a strategist with the Union Bank of Switzerland (UBS), I developed a simple but effective country ETF rotation strategy that I’ve managed for more than seven years.

Let me share with you how it works…

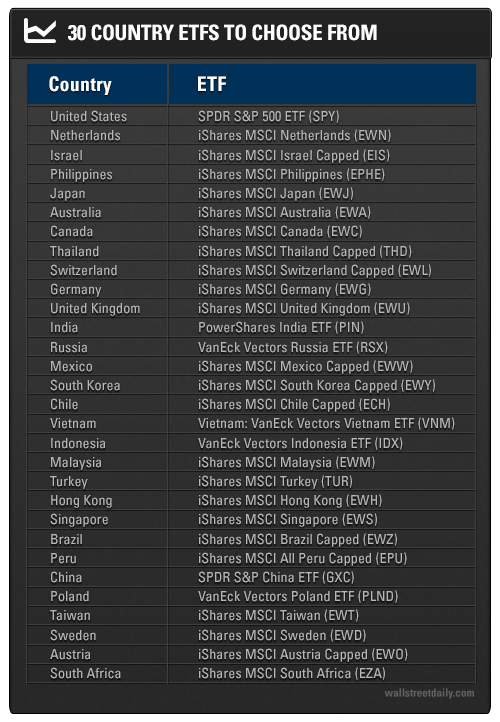

The proxy for America would be the S&P 500 Index, tracked by the SPDR S&P 500 ETF (NYSE:SPY). For Australia, it’s the iShares MSCI Australia (NYSE:EWA); for Japan, it’s the iShares MSCI Japan (NYSE:EWJ); and for Mexico, it would be the iShares MSCI Mexico Capped (NYSE:EWW).

There are more than 40 ETFs for China, but the best proxy would be the SPDR S&P China (NYSE:GXC).

To keep it manageable, here’s a list of 30 country ETFs that you could choose from:

Look for Extreme Value and Growth

Now comes the challenging part of selecting the countries and deciding on the weightings in your country portfolio.

First of all, you certainly don’t want to use a “buy and hold” strategy.

For my country portfolio, I use seven factors to choose and weight the countries, but a simpler strategy is to pick countries at the extreme of value and momentum.

Pick the five countries that are demonstrating the best momentum, and then pick five countries that have the worst performance over the past year but are in an uptrend. For the latter group, my shorthand formula is “out of favor, undervalued, and in an uptrend.”

To illustrate this country strategy, let me briefly explain the changes I made to the country portfolio at the beginning of 2016, and how things are going so far this year…

Seeing the slower growth and challenges that China was facing, as well as the weakness in Japan, I dropped both of these countries and replaced them with weightings to the Philippines, Hong Kong, and Thailand.

Some of the worst-performing countries in 2015 were in Latin America, are were heavily dependent on commodities. So I added deep value exposure to Brazil, Peru, and Colombia.

Anticipating a marginal rebound in energy and commodity prices, I increased exposure to both Russia and Canada. I also trimmed exposure to America based on high valuations, and added a bit to Israel, thinking that its market looked pretty cheap.

So how are things going? China and Japan are both in double-digit negative territory, while the Philippines and Thailand are up 10.6% and 13.9%, respectively. I was wrong on Hong Kong, which is down 2.1%.

Peru is up 47.1%, Brazil is up 26.2%, and Colombia is up 14.5%, while Russia has gained 16.3%, and Canada has increased 14.5%. This is all much better than I expected, so I’m beginning to take some profits off the table while sticking with Israel, which is down 3.3%.

Given that the S&P 500 proxy for America is up 2.6%, our 17.3% overall gain in our country rotation portfolio so far this year looks pretty darn good.

There’s much more to the country rotation story than this, of course. For example, many of these country ETFs have options that go out as long as two years. Some Brazil ETF call options are up over 260% this year.

What’s the next move for my Country ETF Rotation Portfolio? I’m looking closely at European country ETFs, which have suffered 15 weeks of consecutive fund outflows, according to UBS.

There has to be some great value there, since the quality European multinationals that are at the top of these country ETFs aren’t tied to Europe, but do business all over the world.

In closing, I encourage you to put together a country portfolio of your own. Not only will it give you great diversification, it’s a lot of fun.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.