How To Make 15% To 19% Annually From Stocks

Contrarian Outlook | Feb 19, 2020 04:37AM ET

“Efficient market” believers are adorable, but they are also wrong. It is possible to make 15% to 19% per year, every year, from perfectly safe dividend stocks.

In a moment, I’ll outline this little-known yet simple formula. But first, let’s talk about what not to do–just in case you’re following bad advice today!

Sure, the market has been rolling in recent years, but most individual investors aren’t able to keep up with the indices. In fact, most have no clue how to make 15% per year or more in any market, bull or bear.

“Buy and hope” investing is what most of your peers do. They purchase shares and root for them to appreciate in price. Unfortunately, they have no specific plan detailing how they are going to profit from their stocks.

Inevitably, pullbacks happen, and this is their undoing. They get scared and sell, often near lows.

Now granted, even “tangible” fundamental drivers like revenue and profit growth are no guarantee that your shares will rise in price. For example, have you ever been frustrated when a stock you owned sold off after a supposedly “good” earnings report? If so, you may have muttered…

“The Stock Market Doesn’t Make Any Sense.”

Which is true. And why we must force it to make sense.

Buy and hope won’t do. We are cash flow investors, who require stocks to “pay us back” for the capital we invested to purchase them. And there are three—and only three—ways a company’s stock can pay us:

- A cash dividend,

- A dividend hike, and/or

- By repurchasing its own shares.

Total up these three “shareholder return” vehicles, and we’ve got the return that we should expect from any given stock we buy.

For example, let’s look at AT&T (NYSE:T). I often hear from readers: “Yo Brett, check out AT&T’s dividend! Should we buy it?”

Sure, AT&T pays 5.5% today, and its dividend is likely to get paid. However, that’s about all we can expect from Ma Bell.

Over the past five years, the firm’s dividend has barely inched every 12 months. Like with an old married couple, you can feel the begrudging obligation behind each of these “token” dividend gestures:

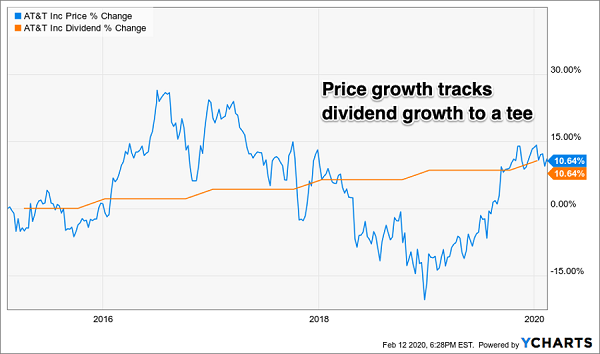

5-Year Div Growth: 10.64%, 5-Year Price Growth: 10.64%

A 2%-ish payout raise each year means shareholders are earning 10.64% more today than they were five years ago. And the stock they bought then? It has also appreciated by an equally mediocre 10.64%. Not per year—that’s the total over the entire five years!

While “first-level” investors fixate on stocks’ current yields—which are widely published and available—serious dividend growth can be a valuable source of hidden yields for calculated contrarians like us.

The Prerequisite for 15% to 19% Annual Returns

If we want to make 15% or more per year in the stock market, it will take some combination of current yield plus dividend growth to get us there. However, I am not aware of any 15% yield today that is on solid footing.

But there are at least a few good firms who are able to raise their dividends by 15%, 17% or even 19% or more per year. As their payouts increase, so do their stock prices.

Let me show you an example.

While AT&T (NYSE:T) was phoning in its lame “penny payout” increases, my Hidden Yields subscribers were purchasing National Storage Affiliates Trust (NYSE:NSA), a growing self-storage play. NSA had a smart strategy of investing in facilities in locations that were growing the fastest. As the population in areas like the Sunbelt exploded, so did demand for NSA’s properties.

This led to higher rent checks and higher dividends for investors. Rather than having to wait an entire year for a raise, my readers who bought NSA enjoyed raises, on average, every six months. All together, these totaled a 50% cumulative dividend hike in just 3.5 years:

Better Than Ma Bell: A 50% Raise Over Just 3.5 Years

With dividend growth like this, you’d expect to enjoy 50% price appreciation, more or less. But we did even better because we bought NSA when its price dipped below its “dividend magnet.” In other words, we bought a pullback that didn’t have a solid fundamental footing and benefited from a “market error in our favor.”

Leaving T in the Dividend Dust

If you’re looking to get rich in stocks (and to be honest, who isn’t!) then there’s a simple secret. Always buy the dividend that is growing the fastest.

The Simple and Safe Way to Earn 15% to 19% Every Year from Stocks

Rather than send you on a wild “stock screen” chase, where you have to:

- Filter for dividend growth,

- Evaluate future cash flow prospects for each firm, and, most importantly,

- Decide if right now is an optimal time to buy…

Let me save you the hassle. If you sign up for (which has delivered 19% total returns per year since inception), I’ll send you my seven favorite “high growth dividends” to buy today.

These stocks should grow your money by 15% per year, regardless of what the broader market does. This means you’ll double your money every five years. Plus, you’ll sleep well at night, owning firms that generate plenty of cash flow for any business cycle.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.