How To Collect 8.7% Yields Each And Every Month: PGX, PTY, APLE

Contrarian Outlook | Sep 08, 2019 02:04AM ET

How much do you need to save to retire comfortably? Not as much if you think if you buy the right monthly dividend payers.

How you invest your retirement portfolio is more important than how much you have. Especially today, with “dumb” retirement money collecting just 1% in safe bonds.

That 1% won’t even get it done if you save the $1.7 million most Americans believe they need. (And don’t worry, they are wrong anyway. You don’t need nearly that much money to retire on dividends alone.)

Financial experts are incorrect, too. Here is more advice based on, well, not knowing which dividends to buy in retirement:

The truth is, most of these estimates involve a combination of fixed-income investments (no growth!) and tired blue-chip stocks (little growth and insufficient yield!). In reality, as long as you’re in the right kind of dividend stock, you can retire on half of what the conventional wisdom says you need.

But what’s the “right kind of dividend stock”?

Yes, you want a high headline dividend yield. That’s what most “first-level” investors look at. The mistake they make is never looking past yield, and toward other important factors.

You need a healthy dividend that’s primed for growth . And you need actual business growth, too. Your nest egg needs to grow in retirement to offset the occasional big-ticket emergency that could claw away at your income-producing potential.

A monthly payout is pretty helpful, too.

I don’t know about you, but my electric utility and wireless provider don’t send bills every quarter. They come each and every month, whether I want them to or not. But most of the blue chips that traditional retirement investors would have you pile into typically only dole out income each time the season changes.

I prefer a reliable stream of monthly income, which you can get from monthly dividend stocks and funds.

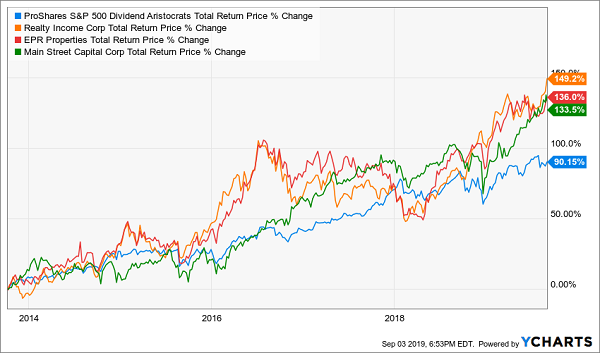

This isn’t just a convenience play. Monthly dividend stocks can put up some serious outperformance once you factor in their often Street-clobbering payouts. Just look at how this three-pack of big-name monthly dividend payers have done against the bluest of the blue-chip dividend stocks: the Dividend Aristocrats.

Hail to the REAL Dividend Royalty!

But not all monthly payers are built the same. Stocks that distribute cash every 30 days or so are nice, but not if they don’t check off our other checkboxes. So which monthly dividend payers do make the grade?

Invesco Preferred ETF (PGX)

Dividend Yield: 5.3%

Let’s start with preferred stocks, which are an undercovered but fantastic source of regular dividend income.

If you haven’t come across preferred stocks before, think of them as a blend of common stocks and bonds. Companies typically offer these as a way to raise capital, and they like common stock, they represent ownership in the underlying business. They even pay dividends like common stock.

But those dividends are fixed, like bonds, and preferred stocks also tend to trade around their par value, again like bonds. So most of your upside is coming in the form of substantial income payments.

Invesco Preferred ETF (PGX) is one of several exchange-traded funds (ETFs) that allow you to easily and cheaply invest in a basket of preferred stocks. PGX charges just 0.52% annually for access to a wide array of 281 preferred holdings, primarily from financial companies such as Citigroup (NYSE:C), Bank of America (NYSE:BAC) and PNC Financial Services (NYSE:PNC), though it carries utility, real estate and other sectors’ preferreds, too.

The upside? You’re getting a 5%-plus annual yield, with dividends paid monthly, without having to research all these individual issues.

That said, preferred index ETFs like PGX have a common weakness: Their indexes can’t account for credit risk the way an expert manager can. That’s why I typically suggest which is why I typically suggest getting your preferred exposure from actively managed closed-end funds (CEFs) .

Preferred CEFs Leave ETFs in the Dust

Pimco Corporate & Opportunity Fund (PTY)

Dividend Yield: 8.7%

Speaking of closed-end funds, let’s move on to PIMCO Corporate & Income Opportunity (NYSE:PTY).

Corporate & Opportunity is a straight-up diversified bond fund managed by one of the best in the fixed-income biz. Pimco, which has amassed $1.84 trillion under management, boasts more than 260 fixed-income mutual funds, ETFs and CEFs.

Managers Alfred Murata and Mohit Mittal typically will invest at least a quarter of the fund in corporate debt, with the rest spread across a wide array of other income-producing securities.

For instance, at the moment, roughly a third of the fund is in corporate debt (24% high-yield, 7% investment-grade), another 31% is in mortgage-backed securities, and another 22% is split between developed-market and emerging-market sovereign debt. Munis and U.S. government bonds are among PTY’s other debt sprinklings.

Management earns its fees, too. Pimco Corporate & Opportunity has made an absolute mockery out of indexed funds like the iShares Core U.S. Aggregate Bond ETF (AGG) over the years.

The AGG Looks Like It’s Standing Still Next to PTY

However, 2019’s red-hot run for bonds has left PTY with one massive strike against it: a big, fat premium. This Pimco CEF trades at a 27% premium to its net asset value right now, which means you’re essentially paying $1.27 for every dollar in bonds. In truth, this fund almost always trades at a premium, but right now PTY trades at more than double its five-year average!

I’ll tell you what I told Wall Street Journal’s Nick Ravo: “Never buy a CEF trading at a premium.”

Apple (NASDAQ:AAPL) Hospitality REIT (APLE)

Dividend Yield: 7.5%

Let’s move on to real estate investment trusts (REITs), which is where you’ll find a batch of monthly dividend payers.

Apple (NASDAQ:AAPL) Hospitality REIT Inc (NYSE:APLE) is one of America’s largest hotel REITs. Its portfolio currently includes 234 hotels – 125 under the Hilton (HLT) brand, 108 under Marriott (MAR) and a lone Hyatt (H) hotel – across 34 states.

Apple (NASDAQ:AAPL) Hospitality is what’s referred to as “rooms-focused” or “select-service,” which is a middle ground between “limited-service” and “full-service.” To put that in normal speak, these hotels might have a restaurant, but its offerings will be limited. They might have a computer for guest use, but not a full-blown business facility or conference rooms. They’ll look nice, and they’ll be comfortable … but resorts, they are not.

Apple (NASDAQ:AAPL) pays a very healthy yield of more than 7% via a dozen monthly 10-cent distributions. And that cash is conservatively managed, with dividends accounting for just 70% of funds from operations (FFO, an important metric of profitability for REITs). That payout hasn’t budged since its 2015 IPO, however.

Maybe APLE Will Grow Into Its Dividend, But Its Dividend Won’t Grow

But what worries me about APLE – and other hotel REITs, for that matter – is the recession risk. Apple (NASDAQ:AAPL) Hospitality’s properties are among the most vulnerable to any slowdown or about-face in American economic growth, and that’s a very real concern, especially so late in what is the longest economic expansion in our country’s history.

In short: Apple (NASDAQ:AAPL) doesn’t make the grade, either.

But now I’ll show you a few stocks that do.

How Retirees Can Collect $3,000 Per Month in Dividends Alone

By now, you’ve picked up on a vital lesson: Monthly dividend stocks can be every bit as flawed as the no-growth blue chips I’ve warned you against.

These “B-level” players offer up nice headline yields, sure. But once you dig down into what really makes them tick, you start to see the kinds of flaws that will hamstring your retirement portfolio:

But you won’t have these issues with the A-graded picks in my “8% Monthly Payer Portfolio.”

This all-star roster includes eight monthly dividend payers that deliver uber-safe yields of more than 7% each. So forget $1.18 million, $3.8 million or $10 million … with this portfolio, you can score a comfortable retirement with a mere $500,000 nest egg.

Even at that relatively thin amount of savings, you’ll still be collecting a fat $3,000 in pure income each and every month!

This easy, buy-and-hold dividend strategy can net you not just an average 7.2% annual yield, but also 10%-plus average price upside. That takes care of a critical retirement component that too many professionals overlook: The need to expand your nest egg in retirement because people are simply living much longer than old financial models are equipped to deal with.

You don’t need to learn some strange options tactics or complex trading routine. You can live off a $500,000 portfolio indefinitely by following just two simple steps:

- Sell off your “buy and hope” portfolio: The financial media has pushed so-called “safe plays” like Coca-Cola Company (NYSE:KO) and Procter & Gamble (NYSE:PG) on to investors for years. But these companies don’t deliver the kind of yield you need to maintain your current quality of life in retirement.

- Buy my 8 favorite monthly dividend payers.

That’s it!

This portfolio includes some truly amazing dividend stocks, including …

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.