How These 7%-Yielding Funds Charge $0 In Fees

Contrarian Outlook | Nov 25, 2019 04:25AM ET

Members of not so much .

An Insider’s View

As one of the few analysts who focuses solely on CEFs—especially smaller CEFs, with market caps of $1 billion or less—I’ve had several conversations with managers at CEF companies from across the market.

A common theme? They’re all frustrated that the average investor doesn’t know the many benefits CEFs deliver.

Because on top of the roughly 7% dividend the average CEF pays out, there’s also the “trick” CEFs use to make fees essentially disappear—a benefit most people miss and we’ll delve into further on. (I’ll also name 2 CEF firms whose offerings have long histories of crushing the market.)

First, we need to talk about these funds’ discounts to their “true” value.

You may already know that a CEF is effectively “closed” from issuing new shares to new investors, which limits the supply of shares and stops management from diluting your stake. This has another great benefit: discounts!

Because of that limited number of shares, if the CEF’s portfolio (or “net asset value”) grows more than the market price, the fund will suddenly be priced at a discount to its net asset value (NAV, or the combined value of all the investments in the CEF’s portfolio).

And these markdowns can be huge.

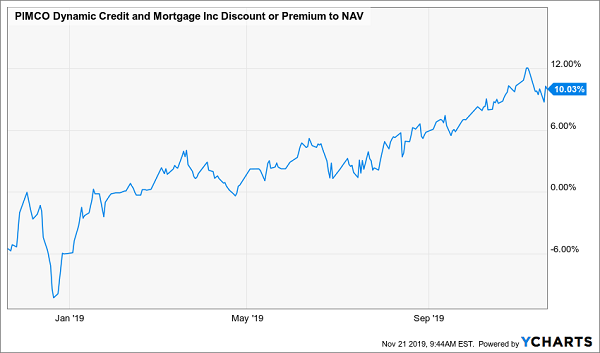

Take the PIMCO Dynamic Credit and Mortgage Income Fund (PCI), which has gone from a discount of 10% to a 10% premium in just under a year:

A Big CEF Bargain Disappears

The reason why this happened is simple: while the fund’s NAV has risen, the price of the fund has risen even more:

Strong Demand for a Good Return

Obviously, this is a great opportunity: buy a CEF at a huge discount and wait for it to go to a premium and you will reap big gains. But there’s a second reason why this matters—and it’s why a lot of fund managers wish CEFs were more popular.

It comes back to the “free” management fees I mentioned earlier.

Management “Sleight of Hand” Works in Your Favor

Let me explain it like this: imagine a fund has a 1% management fee and $100 in NAV. If you get the fund at a 10% discount to NAV, you’re paying $90 for that $100 in NAV.

Keeping in mind that we’re paying a $1 management fee for the privilege of getting that $100 in NAV for just $90, we’re essentially paying a dollar to get a $10 discount.

That already sounds like a good deal, but the real magic happens when the fund’s NAV goes up. If it rises 10% and pulls the market price up the same amount, that’s a $10 increase—but since we paid $90, this $10 gain translates into an 11.1% profit on our invested capital. That 1.1% extra return on our original investment equals 99 cents—or about the same as the fund’s fees!

In other words, by buying a CEF at a discount (if the discount is big enough proportional to the fund’s fees), we’re essentially sidestepping the fees—they’re cleared when the fund swings to trade at its net asset value or at a premium to its NAV.

This is why fund managers love CEFs: these funds give them a chance to charge fees the market ultimately pays for. It’s also why individual investors should love CEFs: they can take advantage of this to essentially get smart, active fund management for free.

The Major CEF Managers

So who runs the most CEFs these days?

While a lot of fund managers have told me they prefer CEFs for the reasons I outline above, the massive popularity of ETFs has forced many of these pros to focus on ETFs instead.

For that reason, many of the biggest fund managers are also well-known for their ETFs: BlackRock (NYSE:BLK), Invesco and Credit Suisse (SIX:CSGN) are all CEF issuers, and some of these companies have pushed for more CEF investment in recent years, even as market forces have caused them to ramp up ETF issuances, as well.

Here are the biggest CEF issuers by name:

Big Names Rule CEF Land

This shows you just how concentrated the CEF space is: of the near 500 CEFs currently tracked by , these 10 issuers alone account for over half.

2 CEF Firms With Market-Crushing Gains—1 Big and 1 Small

A lot of readers have asked me if it’s best to go with bigger fund managers, like PIMCO, whose $2 trillion in AUM has made it a larger economic force than many countries.

The answer is: it depends.

Sometimes the big players’ access to high-quality research helps their funds outperform. Take, for instance, the Pimco Income Strategy II Closed Fund (NYSE:PFN), whose portfolio has beaten the “dumb” corporate-bond index fund, the SPDR® Bloomberg Barclays (LON:BARC) High Yield Bond ETF (NYSE:JNK) since JNK’s inception:

Big Name Wins Out—This Time

But sometimes the smaller managers’ specialization means they outperform the market: for instance, the preferred-stock experts at the relatively small Flaherty & Crumrine Preferred Securities Income Fd (NYSE:FFC) have built a portfolio that’s more than doubled the return of the preferred-stock index fund: the iShares Preferred and Income Securities ETF (NASDAQ:PFF):

David Slays Goliath

Although Flaherty & Crumrine’s total AUM is small, and FFC has just $930.2 million in AUM (versus PFF’s $16.8 billion), it has crushed the index.

Why? Because Flaherty & Crumrine focuses all of its time and energy on the preferred-stock market, so it knows this area better than anyone else—its outperformance proves it.

It isn’t alone. Several CEF managers stay small and nimble, but because they’re experts, they crush the market as a whole and are able to do that for years. Yet investors often ignore these funds, instead being lured by the low fees and massive marketing dollars thrown at “dumb” index funds—and leaving a lot of gains (and income) on the table.

Alert: My Top 5 CEFs to Buy for 20% Gains—and 8% Dividends—in 2020

As I just showed you, the big players’ obsession with ETFs over CEFs is a problem for most investors because it distracts them from the high-yielding funds they need for retirement. Like the 5 other funds I want to tell you about now.

Here are 2 things you’ll love about these 5 off-the-radar buys:

- These unsung CEFs sport a massive 8% average dividend, and

- They trade at truly bizarre discounts to NAV that can’t last, so you’ll need to act now.

The upshot? When these CEFs’ discounts vanish—and swing to big premiums (as I fully expect), we’re looking at 20%+ price upside in the next 12 months, on top of that massive dividend!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.