How Should You Handle Johnson & Johnson?

InvestCorrectly | Apr 11, 2016 10:16AM ET

Johnson & Johnson (NYSE:JNJ) posted a mixed 4Q2015 in which EPS beat and topline disappointed but anagement guided positively for 2016 despite the risk of adverse currency shifts and slowdown in the global market. Solid perform of new products also continued to drive growth in Johnson & Johnson.

Can Johnson & Johnson’s diversified business model and solid financial position help it dodge the rough market conditions and for how long? This Johnson & Johnson analysis article examines the efforts the management is making to fuel more growth in the future and the risks that the company could run into that could potentially change the direction of its business. But first, here is a quick recap of last quarter’s earnings.

4Q2015 highlight

Johnson & Johnson (NYSE:JNJ) posted 4Q2015 EPS of $1.44, up 5.1% YoY and ahead of the consensus estimate of $1.42. But revenue reading of $17.8 billion disappointed. Revenue fell 2.4% YoY and missed the consensus estimate of $17.9 billion. Negative forex movement and pricing pressures in some markets took a heavy toll on the topline metric.

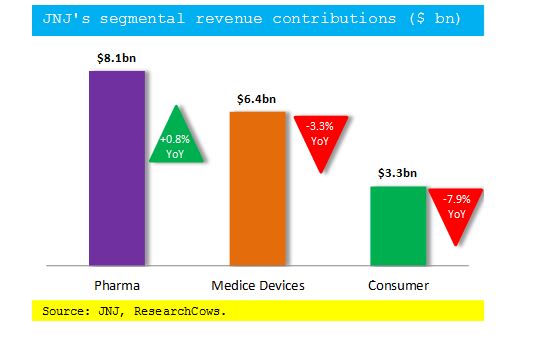

Segmentally, Pharmaceutical segment sales rose 0.8% YoY to $8.1 billion and Medical Devices sales fell 3.3% to come in at $6.4 billion. Consumer segment sales declined 7.9% to come in at $3.3 billion.

The chart below captures Johnson & Johnson’s segmental revenue contribution:

2016 guidance

Johnson & Johnson (NYSE:JNJ) is looking for 2016 EPS in the band of $6.43 to $6.58. Revenue is modeled in the range of $70.8 to $71.5 billion.

What’s exciting about Johnson & Johnson?

- Rich pipeline

Johnson & Johnson (NYSE:JNJ) has a rich portfolio of new drug candidates and candidates for label extension. Between 2015 and 2019, the management of Johnson & Johnson outlined plans to seek marketing approval of more than 10 new products. The management further emphasized that all of those new products have blockbuster potential.

Since 2009 until 2015, Johnson & Johnson had launched 14 new products. More than half of those products have already reached blockbuster status are have blockbuster potential.

To squeeze more money from its existing portfolio and also guard against generic threat, Johnson & Johnson is looking to for label extension opportunities. At least 40 drugs already launched or soon to be launched are candidates for label extension.

- Growth-themed deals

Johnson & Johnson boasts a well-oiled R&D department, which explains its solid portfolio of internally developed products, but the company leaves nothing to chance when it comes to pursuing new growth opportunities. The company has inked a number of growth-focused deals including two acquisitions that particularly strengthen its play in the advanced prostate cancer market.

Acquisition of Cougar Biotechnology added to Johnson & Johnson’s prostate cancer portfolio portfolio by bringing in Zytiga to the mix. Zytiga is approved for prostate cancer treatment and generated $2.2 billion in sales in 2015. An additional approval of Zytiga for chemonaïve prostate cancer victims nearly tripled its addressable market.

The acquisition of Aragon also added a key prostate cancer drug candidate to Johnson & Johnson’s pipeline. JNJ-927, the drug compound that Johnson & Johnson acquired through Aragon, is in Phase 3 development and is targeting pre-metastatic prostate cancer (CRPC) market.

Johnson & Johnson could use JNJ-927 as a defensive product in the prostate cancer market when Zytiga’s marketing exclusivity expires.

Besides outright acquisition deals, Johnson & Johnson is also fond of pairing efforts with strategic partners. The company is working with Achillion Pharmaceuticals Inc (NASDAQ:ACHN) to develop a treatment for hepatitis C.

- Solid new products launch record

Johnson & Johnson (NYSE:JNJ) has recently launched a number of new drug products that are quickly gaining blockbuster status. The company’s recent new launches include Stelara and Simponi. These products are not only doing well on the market, but comparison tests have shown them to be more effective than rival therapies from other companies. For example, Stelara beat Amgen, Inc. (NASDAQ:NASDAQ:AMGN)’s Enbrel in a measure of effectiveness on patients afflicted by plaque psoriasis.

To strike while the iron is still hot, Johnson & Johnson is working to expand the treatment mandate of these drugs by testing them for other indications. As for Simponi, the drug recently received EU approval for the treatment of rheumatoid arthritis.

Zytiga, which raked in $2.2 billion in sales last year, has also had its label expanded to include treatment of chemonaïve prostate cancer. The label expansion significantly widened the drug’s patient population.

- Attention on emerging markets

Every multinational pharmaceutical company these days has some plans for the emerging and developing markets and Johnson & Johnson is no exception. The reason emerging markets have become attractive in the recent times is the increased emphasis on healthcare access with insurance overage expanding to cover more population. The widening healthcare market in the emerging economies is seeing Johnson & Johnson double down in markets such as India, China and Brazil.

- Huge addressable market

A huge growth opportunity lies ahead for Johnson & Johnson (NYSE:JNJ) in the pharmaceutical segment. Predictions by IMS Health show that the global pharmaceutical market will increase at compound annual growth rate of about 3% from 2014 to 2019. The market was worth more than $1 trillion at the end of 2014.

What’s worrying about Johnson & Johnson?

- Generic threat

A number of Johnson & Johnson (NYSE:JNJ)’s key drugs are set to lose their marketing exclusivity, thus getting exposed to generic competition. For example, Remicade is already battling competition from copycats called biosimilars in the EU market. Invega is another product struggling to overcome generic competition. In the U.S., patents for Zytiga and Xarelto are being challenged.

Although only a small number of Johnson & Johnson’s blockbuster products are facing generic threat or might soon face generic competition, the fact that they are large revenue contributor means that Johnson & Johnson’s revenue flow could be greatly hampered.

- Negative forex movement

Johnson & Johnson has a significant portion of its operations abroad, which means massive exposure to unfavorable currency movements. A stronger U.S. dollar is offsetting Johnson & Johnson’s gains abroad as international sales are worth less when converted to the reporting currency which is USD.

- Slowdown in China

Johnson & Johnson (NYSE:JNJ)’s consumer business is facing growing pressure in China. Demand in the market has slowed down as economic cold spreads and a rise of new rivals is also limiting the sale of Johnson & Johnson’s consumer products.

- Pipeline disappointment

Johnson & Johnson invests huge amounts of money and time to develop a drug, but the company also has a history of failed drug developments. A number of its candidates have failed to secure regulatory approval at the last minute. In some other cases the company has been forced to terminate work on certain candidates. As much as the management is optimistic that they will launch 10 new products in the next five years, there is no guarantee all of the candidates it will be seeking regulatory approval for will be cleared. Failure to get a product that has cost so much money to develop usually comes as a major setback and Johnson & Johnson is prone to that risk with its ambitious rollout plan for the next five years.

- Label warning

After a box warning was added to the label of Johnson & Johnson (NYSE:JNJ)’s Procrit, sales of the drug contracted nearly 14% to just $1.1 billion in 2015. Label warning ensures increased safety for users of a particular product, but it hurt sales like in the sale of Procrit. There is no knowing which of Johnson & Johnson’s existing products, especially blockbusters, could fall victim to negative label edit.

Takeaway

Johnson & Johnson (NYSE:JNJ)’s new product launches have been a huge success and its growth streak could accelerate if the coming launches also become success.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.