How High Can EUR/USD And GBP/USD Go?

MaiMarFX | May 10, 2021 04:51AM ET

The U.S. dollar held losses after Friday’s NFP report missed the market’s high expectations. U.S. jobs rose by only 266K in April, while 1 million was projected. What we saw on Friday was a short squeeze as traders gave up on dollar long positions while the weak job number suggested the Federal Reserve will stick to its accommodative monetary policy stance for the time being.

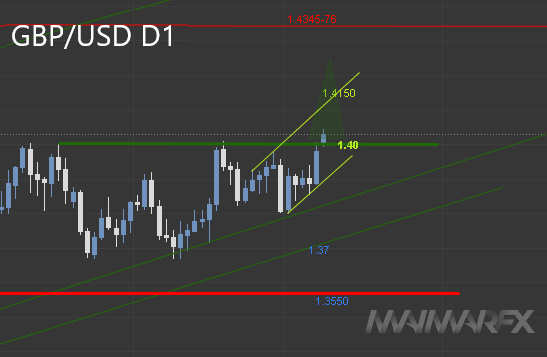

GBP/USD

The best performer on Friday was the British pound which broke above the crucial 1.40-resistance on the back of a weakening U.S. dollar on the one side, and last week’s Bank of England taper on the other side.

From a fundamental perspective, the economic outlook in the U.K. continues to be positive with the country ending its lockdown and vaccinating over half of its population.

As for the Scottish independence referendum, Nicola Sturgeon’s National Party fell one seat short of an outright majority after last week’s election, providing some relief for sterling investors.

While an independence referendum is not off the table, there seems to be no immediate political risk for the pound right now.

Technically, the short-term forecast is bullish—provided that the cable holds above 1.39. We see a next higher target around 1.4150, but for bullish momentum to continue, we need to see the pound stabilizing above 1.40. If the pair breaks below 1.3920, chances could shift in favor of the bears. Today we are long at 1.4065.

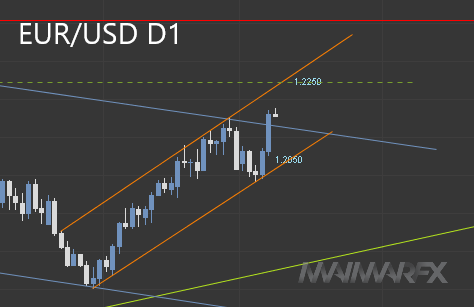

EUR/USD

The euro stabilized above 1.2130 and could now be on its way towards 1.2250. As long as the pair remains above 1.2040, we favor the uptrend.

DAX

The index trended upwards while the 15500-mark came back into focus. We will now wait for the DAX to break above the April high at 15518 in order to shift the focus to higher targets beyond 16000. A current support is seen at 15300. Today we went short at 15410 and reached our profit target at 15370.

On Wednesday, the U.S. CPI report will be of particular interest with inflation forecast to show an increase in April, putting pressure on the Fed to think about tapering sooner rather than later.

On the same day Bank of England Governor Andrew Bailey is scheduled to give his remarks on monetary policy which could have an impact on the pound.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.