How Does VXX Work?

Vance Harwood | Apr 22, 2013 03:04AM ET

VXX and its sister fund VXZ were the first Exchange Traded Notes (ETNs) available for volatility trading in the USA. To have a good understanding of how CBOE’s VIX® index—the market’s de facto volatility indicator. However since there are no investments available that directly track the VIX Barclays chose to track the next best choice: VIX futures.

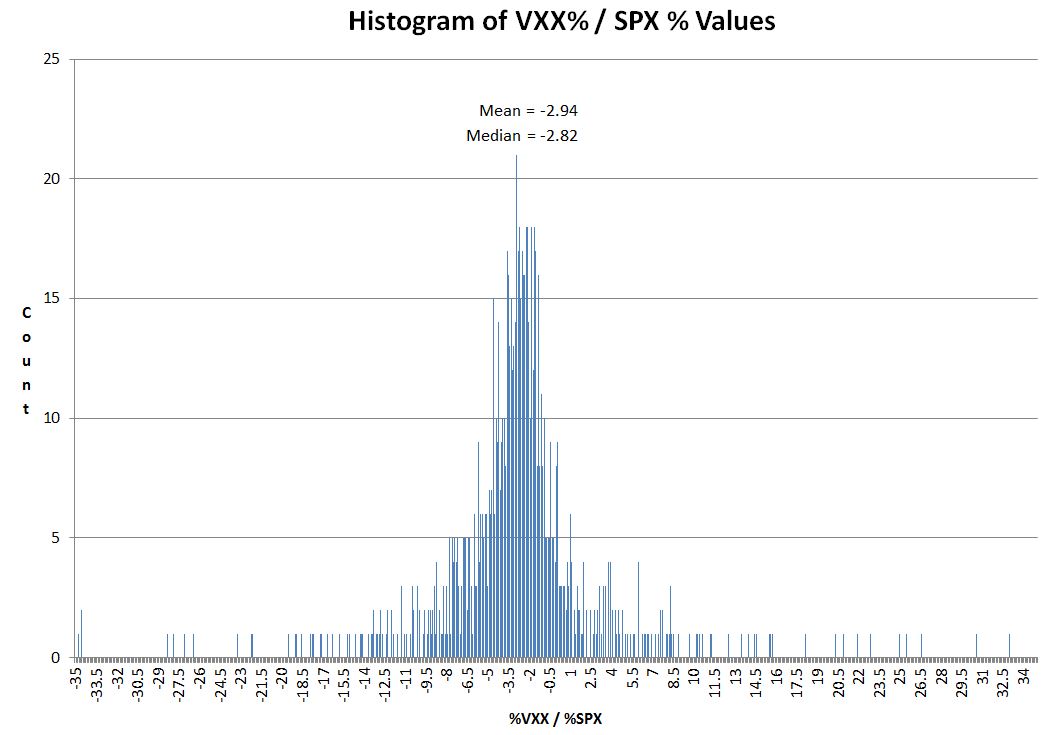

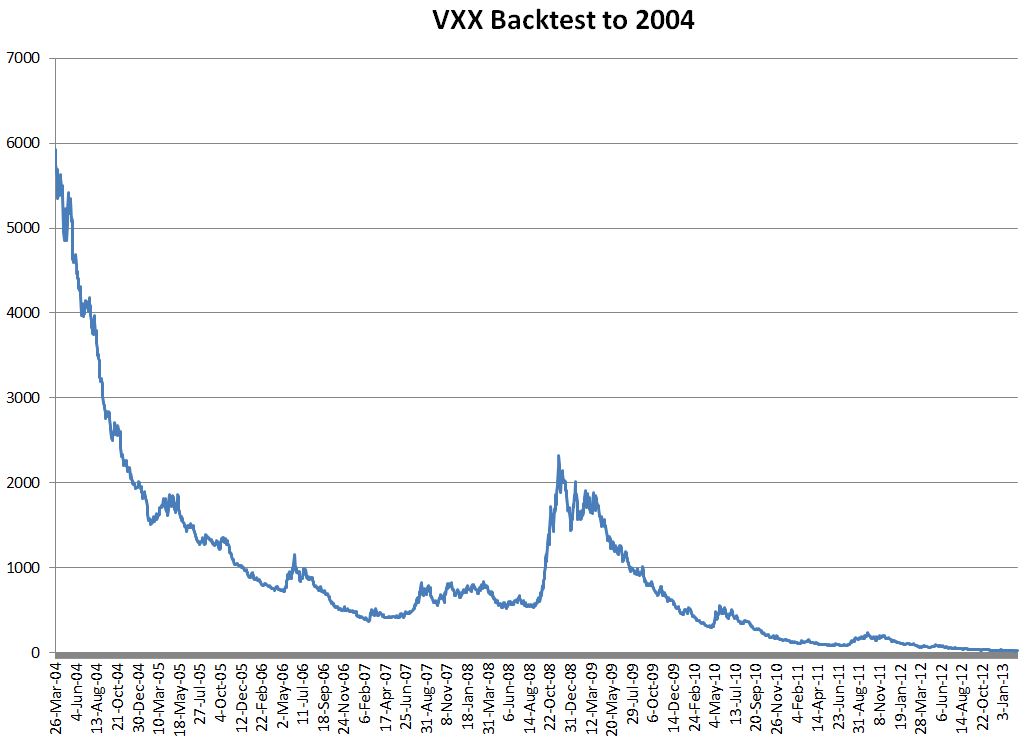

- With lethargic tracking to the VIX, erratic tracking with the S&P 500 and heavy price erosion over time, owning VXX is usually a poor investment. Unless your timing is especially good you will lose money.

- Barclays collects a daily investor fee on VXX’s assets—on an annualized basis it adds up to 0.89% per year. With current assets at $1.15 billion this fee totals around $10 million per year. That’s certainly enough to cover Barclays’ VXX costs and be profitable. But even if it was all profit it would be a tiny 0.1% percent of Barclays’ overall net income— which was $10.5 billion in 2012.

- From a public relations standpoint VXX is a disaster. It’s frequently vilified by industry analysts and resides on multiple Worst ETF Ever lists. You’d think Barclays would terminate a headache like this or let it fade away, but they haven’t done that even through 2 reverse splits—which suggests that Barclays is making more than $10 million a year with the fund.

- Unlike an Exchange Trade Fund (ETF), VXX’s Exchange Traded Note structure does not require Barclays to specify what they are doing with the cash it receives for creating shares. The note is carried as senior debt on Barclays’ balance sheet but they don’t pay out any interest on this debt. Instead they promise to redeem shares that the APs return to them based on the value of VXX’s index—an index that’s headed for zero.

- If Barclays wanted to fully hedge their liabilities they could hold VIX futures in the amounts specified by the index, but they almost certainly don’t because there are cheaper ways (e.g., swaps) to accomplish that hedge. If fact it seems likely Barclays might assume some risk and not fully hedge their VXX position. According to IndexUniverse’s ETF Fund Flows tool, VXX’s net inflows have been $5.99 billion since inception in 2009—and it is currently worth $1.15 billion. So $4.8 billion dollars has been lost by investors and an equivalent amount by Barclays if they were hedged at 100%. If they were hedged at say 90% they would have cleared a cool $480 million over the last 4 years in addition to their investor fees. Barclay’s affection for VXX might be understandable after all.

VXX is a dangerous chimeric creature; it’s structured like a bond, trades like a stock, follows VIX futures, and decays like an option. Handle with care.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.