How Berkshire Hathaway Evolved To A Conglomerate Of 80 Companies

David Kass | Mar 06, 2017 12:48AM ET

Summary

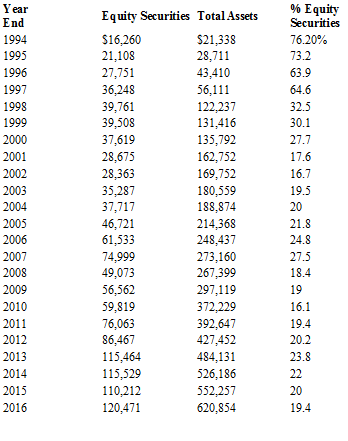

As recently as 1994, Berkshire Hathaway B (NYSE:BRKb, NYSE:BRKa)’s equity securities equaled 76% of total assets.

At year-end 2016, Berkshire Hathaway’s equity securities equaled 19% of total assets.

Berkshire’s focus on acquiring businesses has resulted in a conglomerate of 80 companies.

Warren Buffett acquired Berkshire Hathaway (NYSE: BRKa), a textile manufacturer, in 1965. In 1967, Berkshire paid $8.6 million to buy National Indemnity Company, a small but profitable Omaha-based insurer. In 1985, Buffett shut down the textile business, but retained its corporate name. The property casualty branch of the insurance industry has been the engine that has propelled Berkshire’s expansion since 1967.

Since premiums were paid in advance of claims, Berkshire used this “float” along with underwriting profits to grow the company through investments and acquisitions. Subsequent acquisitions of GEICO in 1995 and entry into the reinsurance business, through the purchase of General Re in 1998, substantially added to Berkshire’s stake and float in this industry.

As of December 31, 2016, Berkshire Hathaway had acquired approximately 80 companies within its four major sectors of operations: (1) Insurance, (2) Regulated, Capital Intensive Businesses, (3) Manufacturing, Service and Retailing Operations, and (4) Finance and Financial Products. Berkshire’s largest acquisitions were BNSF (Burlington Northern Santa Fe Railroad) in 2010, Precision Castparts in 2016, Berkshire Hathaway Energy in 1999, Marmon (manufacturer of transportation equipment including rail cars) in 2007, Lubrizol (lubricants) in 2011 and IMC (formerly Iscar – machine tool manufacturer) in 2006.

As these acquisitions were being made, the relative importance of Berkshire’s equity securities as a percentage of total assets has declined substantially. As recently as 1994, Berkshire’s equity securities equaled 76% of total assets. As of year-end 2016, it comprised only 19% of total assets. This ratio dropped sharply in 1998 to 33% from 65% the year before with the acquisition of General Re. Since 2001, Berkshire’s portfolio of equity securities has averaged about 20% of total assets. As of December 31, 2016, Berkshire’s largest equity holdings consisted of: Wells Fargo (NYSE:WFC) valued at $28 billion, Coca-Cola Company (NYSE:KO) ($17 billion), and International Business Machines (NYSE:IBM) ($13 billion).

From Berkshire Hathaway’s annual reports 1994 – 2016: (dollars in millions)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.