How Analysts Expect PVH To Report

Estimize | Dec 05, 2013 01:51AM ET

PVH Corporation (PVH) stock has bounced around quite a bit this year but has managed to grow from a January opening of $113.3 to a current price of $130.75. PVH is an American clothing company which owns brands including Tommy Hilfiger, Calvin Klein, Van Heusen, IZOD, Arrow, and G.H. Strong reported sales growth in September for the Tommy Hilfiger and Calvin Klein brands have analysts eyeing even higher targets this quarter. PVH is expected to report earnings for FQ3’14 on Monday, December 9.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors. You can share your own estimates as well by visiting www.estimize.com.

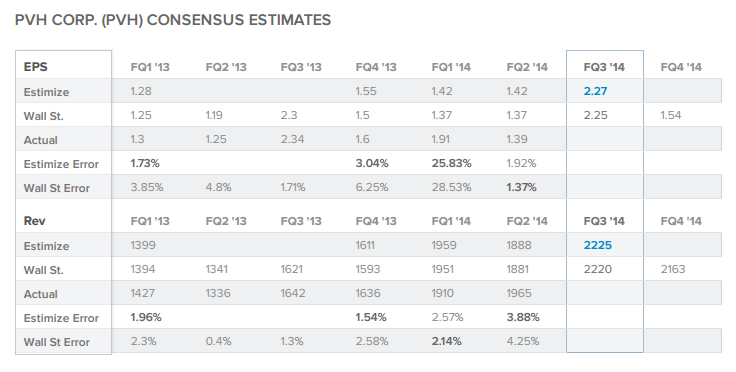

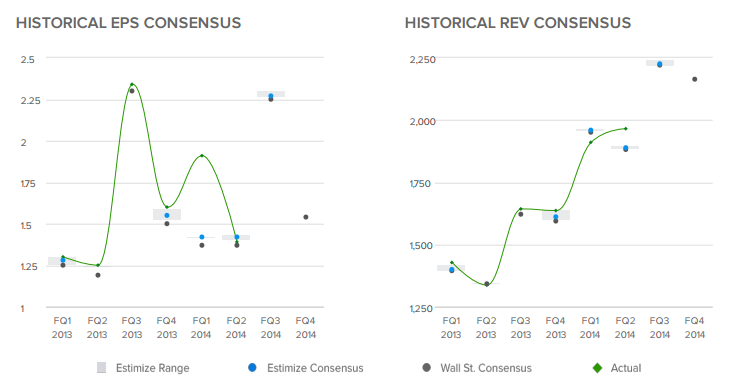

The current Wall Street consensus expectation is for PVH to report $2.25 EPS and $2.220B Revenue while the current Estimize consensus from 5 Buy Side and Independent contributing analysts is $2.27 EPS and $2.225B Revenue. Over the past 4 quarters for which there is sufficient data Estimize was closer to forecasting the reported EPS 3 times and more accurate in forecasting revenue 3 times. The Estimize consensus is more accurate than Wall Street 69.5% of the time because it represents unbiased market expectations. By tapping into a wider distribution of contributors including hedge fund analysts, asset management firm analysts, industry experts, and students Estimize is better able to capture the true market outlook. The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case, we’re seeing a smaller differential between the Estimize and Wall Street numbers compared to previous quarters.

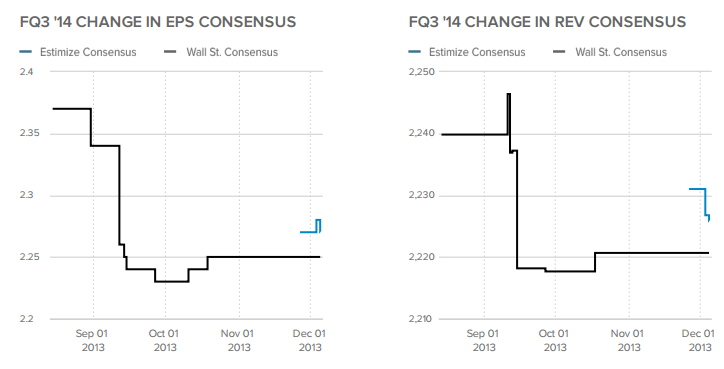

Over the past 4 months the Wall Street consensus trend for EPS has fallen from $2.37 to $2.25 while Wall Street revenue expectations have also decreased from $2.240B to $2.220B. The Estimize EPS consensus has both started and ended at $2.27 while the Revenue consensus has dropped from $2.231B to $2.225B.

The distribution of estimates published by analysts on Estimize range from $2.26 to $2.30 EPS and $2.214B to $2.238B Revenues. We’re seeing about an average distribution of estimates this quarter for PVH compared to previous quarters. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution signals the potential for greater volatility post earnings, a smaller vice versa.

The analyst with the highest estimate confidence rating this quarter is 1nvestor who projects $2.26 EPS and $2.222B Revenue. 1nvestor is ranked 5th overall among 3322 contributing analysts. Estimize confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy.

Given that PVH has beaten the Wall Street expectation for EPS 8 times in a row and that the Estimize consensus which is higher this quarter than Wall Street has been more accurate 3 out of 4 times, it seems that PVH is poised to beat Wall Street expectations for earnings again on Monday.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.