Hoping For More QE? Get Ready For A Rough Surprise

Phoenix Capital Research | Jul 03, 2013 04:06AM ET

Yesterday was another day of bad economic data with the ISM report showing the worst employment figure since September 2009.

The bulls believe that bad economic data means more QE. The problem with this is that they’re ignoring the fact that this current spat of bad data is coming out while QE 3 and QE 4 are occurring.

At any other time in the last four years, bad news could open the door to more QE as every QE plan had a fixed timeline in place. So there was always the possibility of more QE coming if economic data worsened once a particular program came to an end.

However, today the Fed is already running two QE programs that are correctively pumping $85+ billion into the system per month. So the fact that bad economic data is coming out now indicates QE is losing is effect.

This does NOT open the door to more QE now. If the Fed tapers QE in the future then yes, it might engage in more QE later down the road. But the idea that the Fed will increase QE when it’s already running $85 billion a month is misguided.

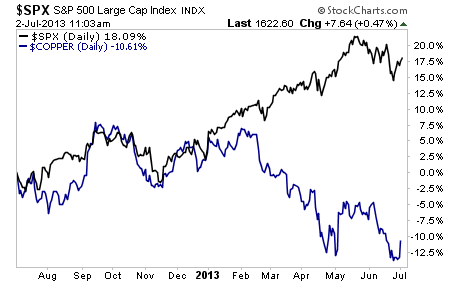

Copper, the commodity with a PhD in economics, gets this. Stocks do not.

Guess which asset class is in for a surprise in the coming months?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.