GT Advanced Technologies: A Break Above $7?

Dragonfly Capital | Sep 10, 2013 01:59AM ET

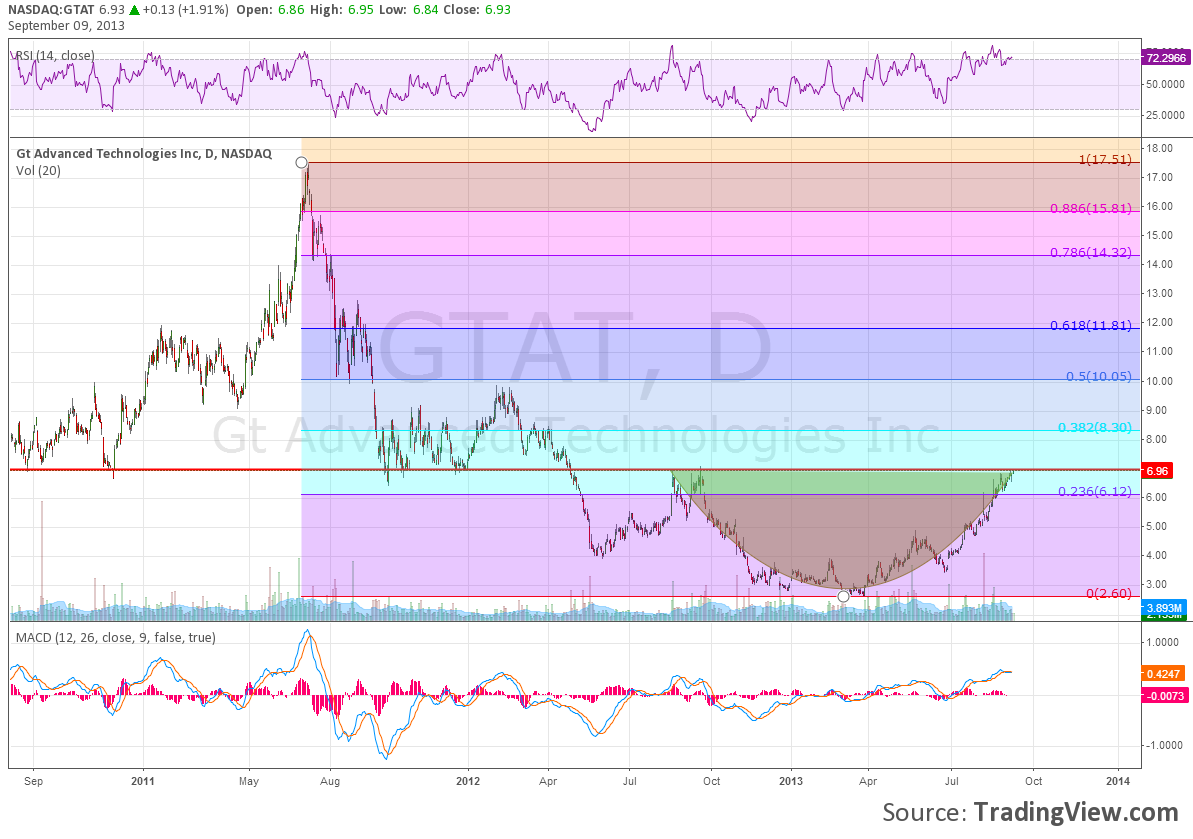

GT Advanced Technologies (GTAT) is showing again that the $7 level is very important to the stock. It has hit resistance 3 times in the last 12 months and was at support 4 times in the 12 months before that. This is how you define a major pivot point. The chart below shows that 7 falls between the 23.6% and 38.2% Fibonacci retracement of the move lower from the spike in May 2012. This time it arrives with a Relative Strength Index that is in the low 70s which could stall it out for a bit or reverse it, and a Moving Average Convergence Divergence indicator (MACD) that is positive but flattening.

These could give a clue that the Cup that has formed will be followed by a Handle lower. The Cup and Handle has a target higher at 11.40. Either way it is one to put on your radar. Either for a break above $7 now or a Handle forming for a future move.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.