Growth Still Leading Equity-Factor Race As Value Sinks In 2018

James Picerno | Nov 29, 2018 06:31AM ET

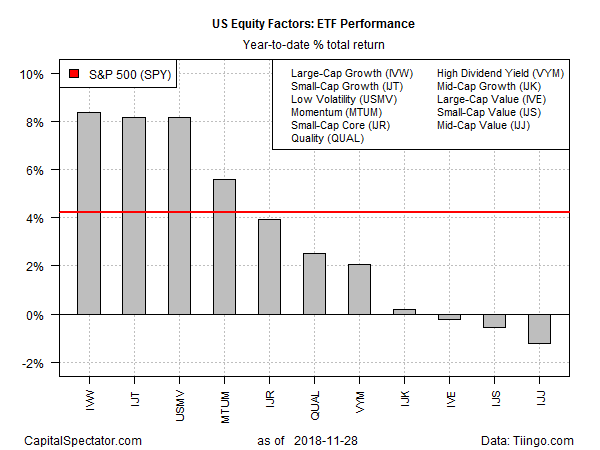

Despite a turbulent run for the US stock market over the past two months, the growth factor’s edge is intact by a solid margin relative to value, based on a set of ETFs. Although year-to-date equity returns generally have been trimmed recently, the growth-value divide remains stark, with the former still posting a healthy gain in 2018 while the latter has deteriorated to a slight loss.

Large-cap growth remains in first place by a nose for year-to-date performance through yesterday’s close (Nov. 28). The iShares S&P 500 Growth (IVW) is up a solid 8.4% so far in 2018. Second place for this year is currently split between iShares S&P Small-Cap 600 Growth (IJT) and iShares Edge MSCI Minimum Volatility USA (USMV) – each fund is ahead by 8.2%.

On the flip side, three value-factor ETFs have slipped into the red for year-to-date results, posting mildly negative returns for the small-, mid- and large-cap buckets. The iShares S&P Mid-Cap 400 Value ETF (IJJ), a mid-cap portfolio, suffers the deepest setback, falling 1.2% so far in 2018.

Interested In Learning R For Portfolio Analysis?

By James Picerno

Whatever’s driving value stocks down this year, no one can blame a broad definition of equity beta. The SPDR S&P 500 (NYSE:SPY), a widely followed benchmark of US equities, is up 4.2% year to date.

Some investors have been encouraged by value’s modestly firmer performance over the past month relative to growth. Is that a sign that a leadership transition is underway? Perhaps, but it could easily be noise. Indeed, the year-to-date profile at the moment still favors growth by a substantial degree. As the chart below suggests, the upside momentum in large-cap growth stocks (IVW), for instance, remains considerable vs. its value counterpart (IVE).

Growth’s sizable edge in the large-cap space holds up for the trailing three-year period, too.

The growth factor’s performance leadership won’t last forever, but for the moment it’s not yet obvious that a sustainable renaissance in value has arrived

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.