Greece Delays Payment To The IMF

Swissquote Bank Ltd | Jun 05, 2015 04:41AM ET

Market Brief

Greece will not make today’s €300mn payment to the IMF, despite the fact that Alexis Tsipras, Greece’s Prime Minister, announced yesterday morning that its government intended to make the payment. The cash-strapped country requested to make one single payment of €1.5bn at the end of June. In the US, the International Monetary Fund urged the Federal Reserve to delay the first interest rate hike to the first half of 2016 as it cuts US growth forecast for the second time this year. Christine Lagarde, IMF managing director, said: “the inflation rate is not progressing at a rate that would warrant, without risk, a rate hike in the next few months”.

Markets already delayed the beginning of rate tightening from June to September as the US economy suffered a harsh winter and other “temporary factors”. However, despite Janet Yellen’s confidence in the US recovery, it appears that the world’s biggest economy is about to stagnate longer. EUR/USD lost more than 1% from its 3-weeks high of yesterday from 1.1380 to 1.1230 this morning. US May’s NFPs are due this afternoon and median forecast is 226k (223k prior read) while wage growth should increase 0.2%m/m (0.1% prior read). We think EUR/USD will be sensitive to a low read and that it would accelerate the recent euro rally. On the other side, a big figure will be needed to move the dollar higher as recent data were broadly disappointing.

As broadly expected, the Bank of England meeting was a non-event as the rate-setting MPC decided to keep unchanged both its benchmark interest rate at 0.5% and its asset purchase facility at £375bn. GBP/USD moved sideways in the Asian session and is currently trying to break the 1.5338 support level, following lazily EUR/USD’s rise. On the downside, the cable will find support around 1.52 (psychological threshold and Fib 50% on April-May rally) while, on the upside, the sterling will need fresh boost to break the 1.58 area.

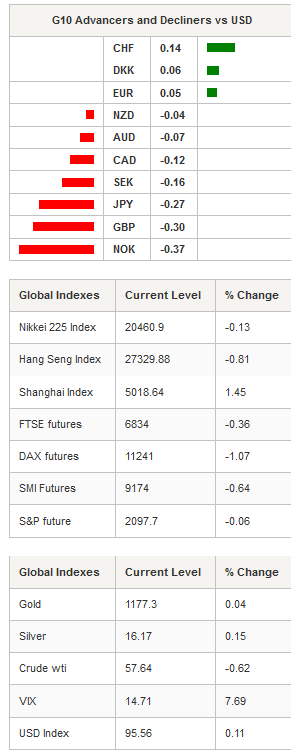

On the equity front, Asian equity returns are mixed this morning with the Shanghai Composite recovering from yesterday sharp selloff, up 1.45%. Hong Kong’s Hang Seng retreats -0.81% to 27,329, Japan’s Nikkei 225 is down -0.13% while Australian shares shares are down -0.11% as disappointing data keep coming in. AUD/USD is slowly grinding lower towards our $0.76 target after Australia’s trade balance for April considerably surprised markets on the downside as the deficit reached its highest level, ever. We expect the Aussie to continue its fall further, but we remain cautious about the NFP read of this afternoon as a surprise to the downside could reverse the momentum.

In Europe, equity futures are broadly lower this morning as Greece delayed payment and traders are getting for the US labour data read. Euro Stoxx is down -1.04%, the FTSE 250 retreats -0.36%, DAX is down -1.07% while Swiss shares are down -0.64%. USD/CHF is moving sideways for the last 3 days within the 0.9280-0.9420 range.

Today traders will focus on May’s Nonfram payrolls, unemployment rate from the US and wage growth from the US; unemployment rate from Canada; Industrial production from Norway.

Today's CalendarEstimatesPreviousCountry / GMT SZ May Foreign Currency Reserves 524.5B 521.9B CHF / 07:00 SP Apr Industrial Output NSA YoY - 4.80% EUR / 07:00 SP Apr Industrial Output SA YoY 1.50% 2.90% EUR / 07:00 SW May Budget Balance - 7.0B SEK / 07:30 NO Apr Industrial Production MoM - 1.50% NOK / 08:00 NO Apr Industrial Production WDA YoY - 2.30% NOK / 08:00 NO Apr Ind Prod Manufacturing MoM -1.70% 3.20% NOK / 08:00 NO Apr Ind Prod Manufacturing WDA YoY - 4.10% NOK / 08:00 NO Norges Bank Regional Network Report - - NOK / 08:00 UK May BoE/GfK Inflation Next 12 Mths - 1.90% GBP / 08:30 CA 1Q Labor Productivity QoQ -0.20% -0.10% CAD / 12:30 US May Change in Nonfarm Payrolls 226K 223K USD / 12:30 CA May Unemployment Rate 6.80% 6.80% CAD / 12:30 US May Two-Month Payroll Net Revision - - USD / 12:30 CA May Net Change in Employment 10.0K -19.7K CAD / 12:30 US May Change in Private Payrolls 220K 213K USD / 12:30 CA May Full Time Employment Change -10 46.9 CAD / 12:30 US May Change in Manufact. Payrolls 5K 1K USD / 12:30 CA May Part Time Employment Change 40 -66.5 CAD / 12:30 US May Unemployment Rate 5.40% 5.40% USD / 12:30 CA May Participation Rate 65.8 65.8 CAD / 12:30 US May Average Hourly Earnings MoM 0.20% 0.10% USD / 12:30 US May Average Hourly Earnings YoY 2.20% 2.20% USD / 12:30 US May Average Weekly Hours All Employees 34.5 34.5 USD / 12:30 US May Underemployment Rate - 10.80% USD / 12:30 US May Change in Household Employment - 192 USD / 12:30 US May Labor Force Participation Rate - 62.80% USD / 12:30 US Fed's Dudley Speaks on Economy and Policy in Minneapolis - - USD / 16:40 US Apr Consumer Credit $16.000B $20.523B USD / 19:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1254

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5326

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 124.71

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9315

S 1: 0.9287

S 2: 0.8986

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.