Gold’s Foremost Lesson From 2013

Przemyslaw Radomski, CFA | Aug 18, 2022 10:30AM ET

History rhymes as people tend to react similarly to similar price changes. What we see in gold right now is a repeat of almost a decade ago.

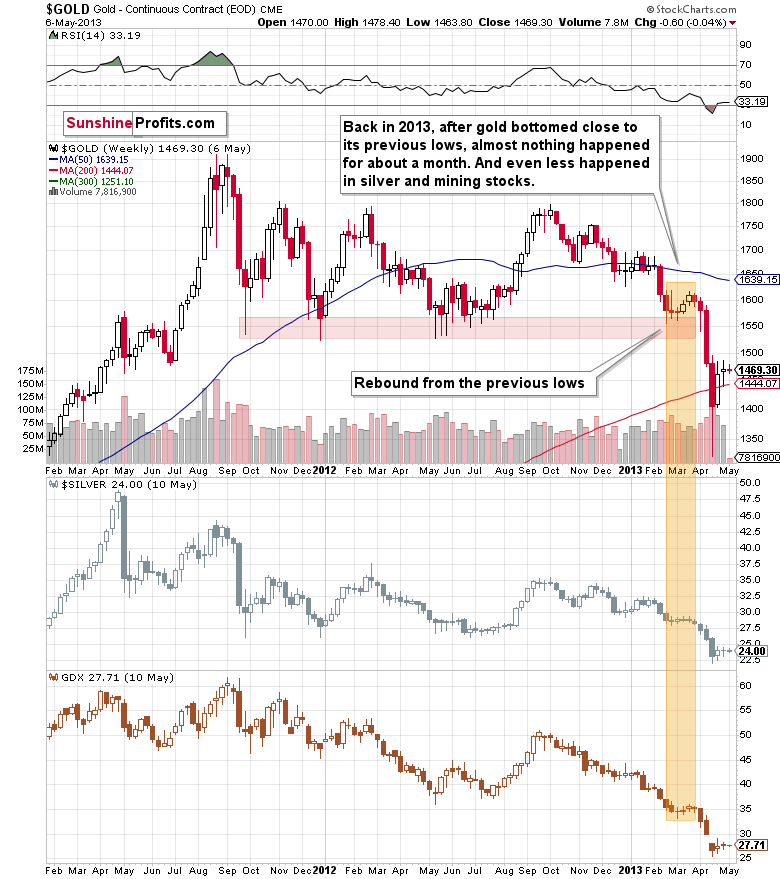

Gold is performing just as in 2013, and it has extremely important implications for the following weeks. Since I keep reading about how supposedly bullish the current corrective upswing is, I decided to dedicate today’s analysis to showing you just how perfectly normal it is for this correction to be taking place – in tune with what happened in 2013, not against it.

In other words, what we see now is not a bullish game-changer, but rather a very normal repeat of what we already saw almost a decade ago.

History rhymes as people tend to react similarly to similar price developments. The underlying reasons for price moves change, but the forces that really drive the buy and sell decisions remain the same. These forces are fear and greed. Thanks to this, even though the economic, financial, and geopolitical situations are different now than in 2013, the price moves continue to be very, very similar.

The exception is that back in 2013, there was no major military invasion in Europe, and we have one right now. This means that gold – being a safe-haven asset – was practically forced to rally. As gold rallied higher than it did in late 2012, it then declined in a more volatile manner. Since the decline was sharper this year than it was in 2012 and 2013, the correction that we see now is also more volatile. That’s perfectly normal. If you drop a ball from a higher level, it will also bounce higher before falling again, right? However, it will fall, nonetheless.

Let’s see what happened in 2013.

Now, let’s see what happened recently.

No, it’s not the same chart :). The first one shows gold’s performance between 2011 and mid-2013, and the second shows gold’s performance between late-2019 and today.

The price pattern in gold is so similar, because… history rhymes! Gold got too high too fast in 2011 and the same thing happened in 2020. In fact, if it weren’t for the huge amounts of money that were created due to the pandemic-related stimulus programs, gold would have likely declined instead of rallying. The proof here lies in the fact that, well, it invalidated the breakout above the 2011 high despite the above and despite the Russian invasion.

Think about it: if someone told you a few years ago that there would be a pandemic, global lockdowns, huge amounts of money being printed, double-digit inflation in many parts of the world, and a Russian invasion of Ukraine, would you believe that gold would fail to rally and stay above its 2011 highs?

Very few people would have likely believed that – and yet, that’s exactly what happened, and what’s still happening.

Yes, gold “wants” to decline before soaring (and yes, I do think that it will soar, but it’s simply unlikely before sliding first, similarly to what we saw in 2008), and since that’s the case, it has to decline in some sort of price pattern. What’s the most likely way for gold to decline? Since history tends to rhyme, the previous big declines provide guidance. In particular, the 2013 decline has been repeated to a very considerable (quite extreme, actually) extent.

What does this specific self-similarity tell us right now?

It’s telling us… Hmm, no.

Watch Out

If the pattern simply keeps repeating itself (which has been taking place for months!), then the huge slide is just ahead. The current correction and back-and-forth trading is likely just the calm before the storm.

Of course, the above is just my opinion, and I can’t promise any kind of performance of any market, including gold, but please note that the previous months’ weakness in gold and silver mining stocks vs. gold are also just like what we saw in 2013 before the huge slide…

I don’t even want to get into the “tiny” fact that while gold moved briefly above its 2011 highs in 2020, neither silver nor gold mining stocks were even close to something similar. Instead, they corrected about a half of their huge decline, and then they started another move lower – a move that continues to this day.

The markets are screaming an important message. However, it’s your choice if you decide to listen to them.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.