Gold: Trend Change At Hand?

Jordan Roy-Byrne, CMT | Aug 28, 2015 10:37AM ET

Last week when we covered rebound targets in the precious-metals sector we also discussed the importance of gold's performance in real terms. It can be a leading indicator for the sector at key turning points. Since then, precious metals sold off in aggressive fashion alongside global equities. However, gold against equities gained materially. And that's something to keep an eye on as it hints that a trend change is boiling under the surface.

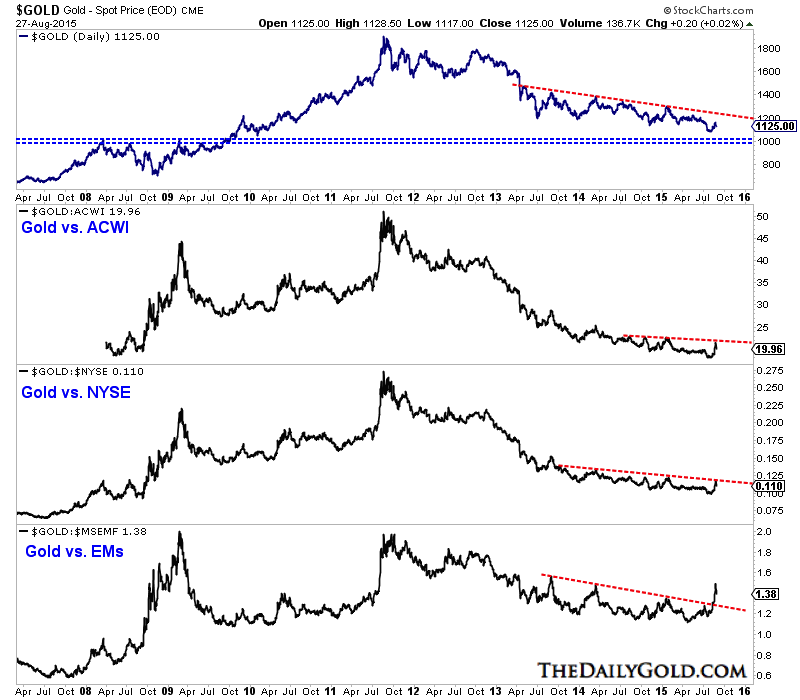

In the first chart we look at gold in nominal terms and against various equity markets.

Gold has pulled back after its rebound from $1080/oz to $1160/oz. It has resistance at $1160 and $1180 and support at $1080 and around $1000. We continue to believe gold’s most likely path is down to $1000/oz before the bear market ends.

Although gold’s rebound from $1080 could be over, its outperformance of stocks could be starting. We plot gold against the all-country index (ACWI), the NYSE and emerging markets. Gold relative to each market gained roughly 20% from the start of the month through Monday. Gold relative to emerging markets already broke out to a new high while relative to the others gold tested important resistance.

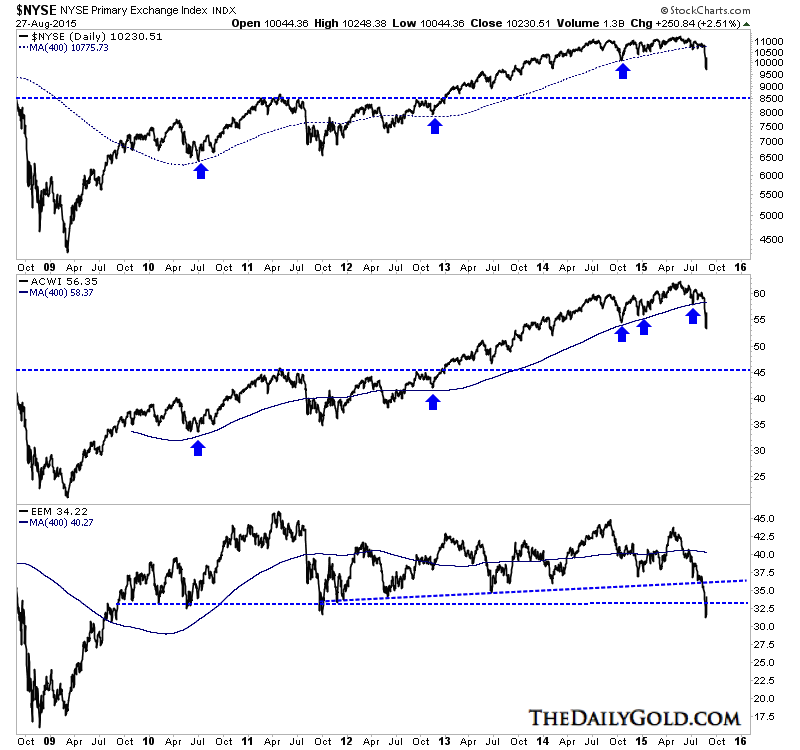

The equity markets have rebounded strongly this week but it is not much of a surprise given the previous sharp decline. We posted a chart a few days ago that argued for a bounce. The strong bounce over the past few days has not changed the broader technical condition, which is negative.

Below we plot the NYSE, (NASDAQ:ACWI) and (NYSE:EEM) with their 400-day moving averages. The first two lost the 400-d MA only a few weeks ago. Each has rebounded but traders and investors should be advised that as the market nears previous resistance it becomes susceptible to another leg down. If new lows are on the horizon then we would turn our attention to NYSE 8500 and ACWI $46, which mark a confluence of strong support. Emerging markets have led this move lower and have more downside potential. If the US market has new lows ahead of it then EEM has downside risk to the low to mid $20s.

Gold breaking its downtrend against equities could be the last thing that needs to happen for its bear to turn to bull. Another move lower in equities could trigger that break. We’ve written about how gold has already bottomed against foreign currencies and how it's nearing an all time high against commodity prices. However, gold relative to the equity market continued to decline and make new lows right alongside gold in nominal terms. There has been a strong negative correlation for four years. The relationship as of a few weeks ago may have begun to shift in gold’s favor. If that continues in the weeks and months ahead it certainly would have positive implications for precious metals and precious metals companies. As we navigate the end of this bear market consider learning more about our premium service including our favorite junior miners, which we expect to outperform into 2016.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.