Gold Versus USD: Correlation Is Not What Most Think

Mike (Mish) Shedlock | Dec 23, 2019 12:28AM ET

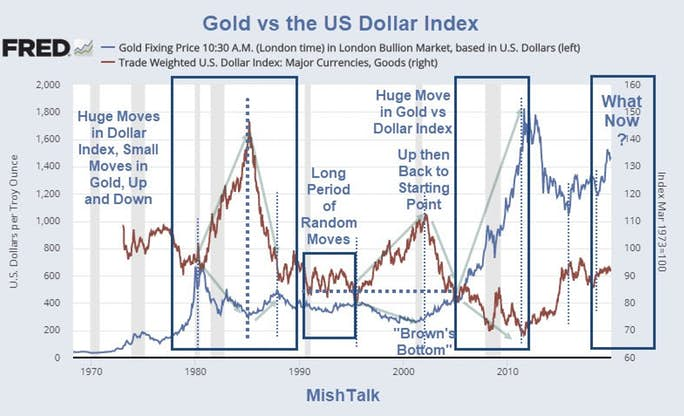

Gold is not as correlated to the U.S. dollar as most think.

I commented on this a few days ago in my article, Gold Surprisingly Correlated With the U.S. Dollar.

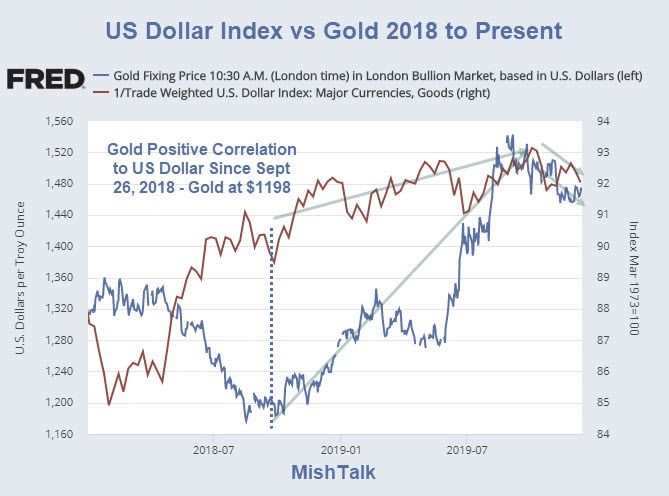

Gold has been positively correlated to the U.S. dollar for well over a year.

Most of the time gold is inversely correlated to the U.S. dollar.

The problem, as the lead chart shows, is that the strength of moves in gold versus the strength in moves in the U.S. dollar are totally random.

Look at the period between 1995 and 2005. A huge jump in the dollar index yielded a relatively small decline in the price of gold.

Between 2005 and 2012 gold went on a long one-way tear up regardless of what the dollar did. The net result was a huge blast higher in gold versus the move in the U.S. dollar index.

A few days ago someone Tweeted I was wrong about the positive correlation between gold and the dollar, stating that the correlation was between gold and miners and the S&P 500.

That idea is more than silly as the following charts shows.

Gold Versus S&P 500

XAU Versus S&P 500

Don't use short-term charts as a basis for making generalized statements.

Path Of Least Resistance

That is another one of those blind statements that feeds the widespread belief that gold is largely about the dollar.

Let's look at this still one more way.

Various Price Points Of Gold

With the U.S. dollar right where it is now, gold has been at $450, $380, $1080, and $1480.

Moreover, and as shown above, sometimes gold has a positive correlation to the U.S. dollar and sometimes negative.

Gold's Big Surge

Gold went on a huge surge from roughly $450 to $1924 with the U.S. dollar index falling from roughly 90 to 72.70.

Gold then fell to $1045 with gold bears coming out of the woodwork. Moves in the dollar once again do not explain. Here is a chart that does explain.

Gold vs Faith in Central Banks

If you believe the Fed has everything under control, then the primary reason to own gold is insurance in case you are wrong.

But one look at repo action and QE that allegedly is not QE ought to be enough reason to convince anyone that the Fed does not have things under control.

Price Target?

I have no price target, but I do have this observation:

If the dollar falls to 72.70 and gold acts the same way, gold will be at well north of $2000.

That is an "if and" statement, not a prediction. Yet, I do think $2000 gold has a very good shot. Dollar fundamentals help.

Dollar Fundamentals

- The Fed is no longer tightening. The consensus opinion is the Fed is in for a long pause. I believe the Fed's next move is another series of rate cuts. For discussion and an amusing set of "dot plots", please see Fed Eyes Long Pause, No Rate Hikes in 2020

- European central banks are starting to see the folly of the negative rate. If the ECB joins the rate hike party or at least stops QE, that will put upward pressure on the Euro and negative pressure on the dollar.

- Without a doubt, the U.S. stock market is extremely overvalued. This has led to dollar inflows from foreigners. When, not if, that reverses, the U.S. dollar will reverse as well. For discussion, please see Where Will the Stock Market Be a Decade From Now?

- The U.S. also suffers massively from a Ticking Time Bomb of Record High Corporate Debt. When that breaks, it will not be good for U.S. equities.

Where Are We?

Not only are gold fundamentals excellent, dollar fundamentals help.

Got Gold?

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.