Gold Vs. Paper And Digit Dollars

Gary Christenson | Jun 16, 2015 12:26PM ET

Gold Versus The Status Quo

Gold has been a store of value for 1000s of years. You can’t purchase gasoline with gold but it has no counter-party risk and is valued world-wide.

In contrast, paper and digital dollars, euros, pounds and yen are debt-based fiat currencies backed only by the faith and credit of the governments and central banks that issued them. Devaluation and higher consumer prices are all but guaranteed.

It should be an easy choice, but clearly there is more to the story.

The power and influence of the status quo is immense. Consider the forces and institutions that support the status quo, usually in opposition to honest money as represented by gold.

Your central bank: The Fed issues dollars as Federal Reserve Notes, which are a liability of the privately owned central bank. Those fiat dollars create tremendous wealth and power for the central bank. A modified gold standard would restrict their wealth and power.

Your government: The government wants to borrow and spend to excess without the limitations imposed by a modified gold standard and honest money.

Banking and Finance: Fractional reserve banking and the profitability of the banking and finance sectors depend upon the creation of digital dollars. Clearly this sector does not want its profitability restricted by the use of gold as honest money.

Military Contractors and Security Contractors: The US government purchases hundreds of $Billions in weapons and contractual services. If government expenditures were restricted by actual revenues, the military and security contractor profits would collapse. They do not want their profitability restricted by the use of gold as honest money.

Big Pharma and Health Care: How many hundreds of $Billions are spent each year by the US government to purchase drugs and services? This sector does not want honest money that would restrict their revenues.

Transportation, Energy, Communications: It is the same story in these sectors.

Food Stamps, Welfare, and Social Programs: Don’t cut my benefits! Borrow and spend policies are necessary to maintain the flow of benefits in these programs. No politician wants the EBT cards to malfunction or quit working.

The list goes on, but the bottom line analysis is simple. The status quo is huge, powerful, and expanding because more people every year depend upon the continuing flow of fiat dollars, euros, yen, and pounds to the favored businesses and individuals. No politician wants to crash the status quo “money printing” and spending machine.

The opposition to gold is formidable, intense, and well-financed. You might liken the situation to a baseball game where the anti-gold interests own the field and equipment, make and enforce the rules, and if needed, have employed a sniper to terminate the opposing pitcher.

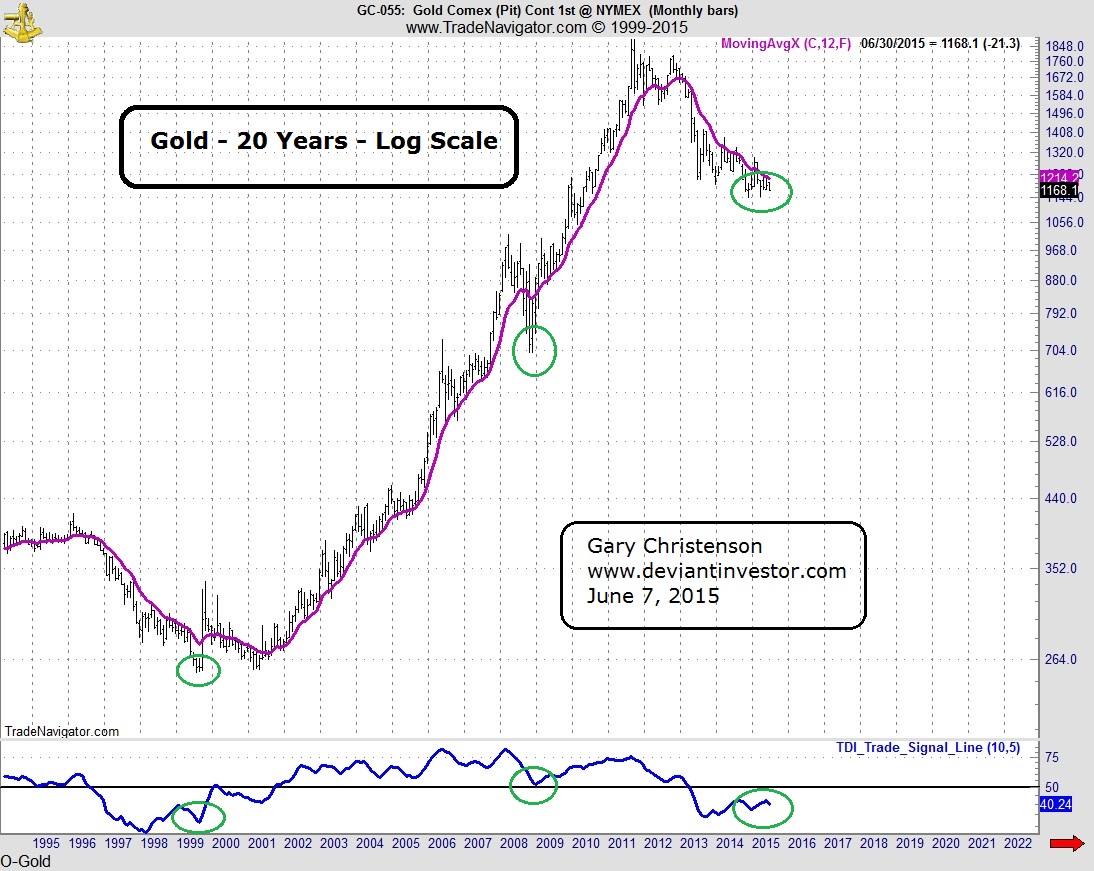

In spite of the opposition, gold has risen from about $255 in 2001 to nearly $1,200 in June of 2015. Similarly, silver has risen from $4.01 in 2001 to about $16 today. The status quo is not all-powerful. Gold and silver prices can rise, but they are controlled. When gold and/or silver prices again streak higher we will know that the status quo and the financial system are on shaky ground.

A history of fiat currencies showed that nearly 600 paper currencies no longer exist. The usual reason was that those currencies were printed to excess by governments or banking authorities. If you live in the United States, Europe, Japan or the UK this might sound familiar.

As a side note, gold was valuable when the first paper currency was created and when it died. Gold is still valuable today, 600 dead currencies later.

If the financial and political elite could increase their wealth and power more effectively with a gold standard, then the gold standard would still be in use, paper currencies would not be printed to excess, and money would remain controlled and honest. Obviously the powers-that-be prefer the current financial system.

The financial system is unlikely to materially change without trauma. Catastrophic failure is possible. Don’t expect gold to crash in price or disappear. About 3 Billion Asians and their governments will disagree if you think gold is no longer important. Note the following graph which shows gold demand in China and India.

But if you want an anti-gold story, look at this infographic from Harry Dent. He will reassure you that your fiat dollars are solid and that gold prices are going much lower. He stated, “Gold is the WORSTinvestment to make until around after 2023.”

I disagree.

Conclusion:

The status quo is heavily slanted in favor of fiat currencies, against gold, and maintaining their power and wealth. The anti-gold sentiment is quite strong. It reminds me of two thoughts:

If everyone is thinking the same thing, no one is thinking.

If everyone is leaning over the same side of the boat, watch out.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.