Gold Suffered In June, With Likelihood It Will Continue To Struggle

Sunshine Profits | Jul 01, 2021 09:43AM ET

June was a terrible month for gold. Without a fresh crisis or a strong dovish signal from the Fed, gold may continue its disappointing performance.

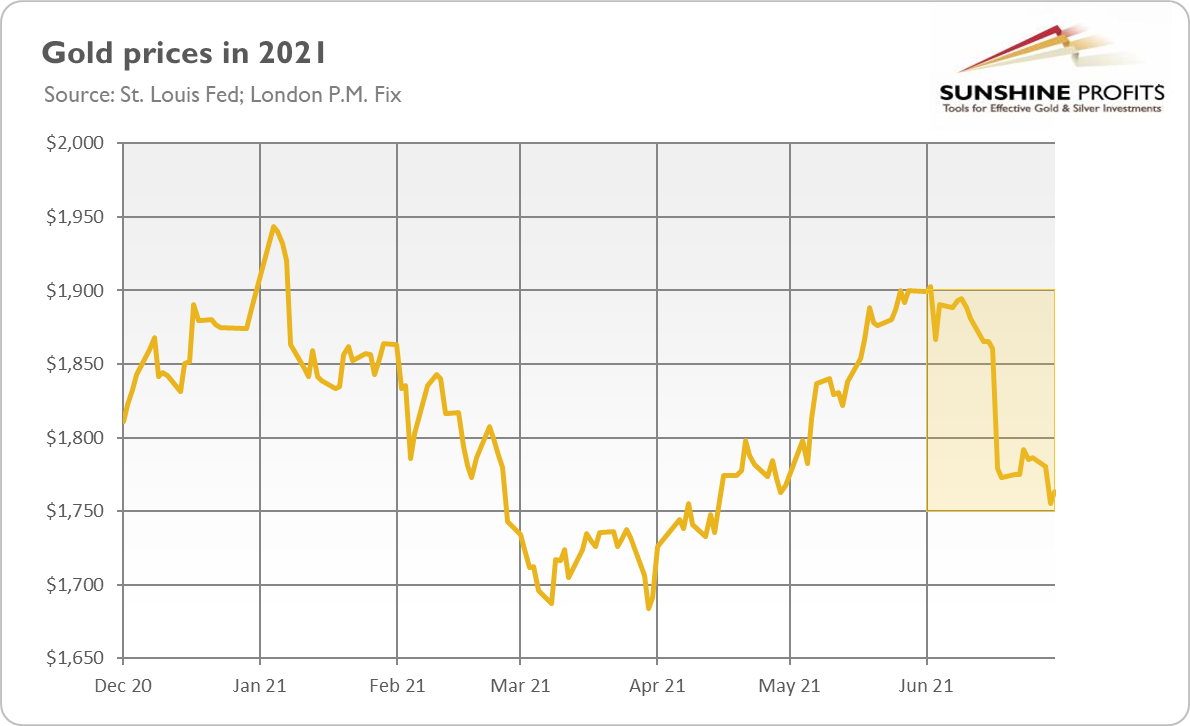

As the chart below shows, the yellow metal plunged more 7.2% in the last month, the biggest monthly decline since November 2016. As a result of the June rout, the whole first half of this year was awful for gold, which lost 6.6% in that period, the worst performance since H1 2013.

The dive was a result of the latest hawkish , the change was sufficient to alter the crowd psychology. As a result, the market narrative has shifted from “the Fed will tolerate higher inflation, staying behind the curve” to “the Fed won’t allow inflation to run wild and will hike earlier because of the stronger inflationary pressure.”

The subsequent comments from the Fed officials helped to consolidate the new narrative. For example, only this week Richmond Fed PresidentThomas Barkin noted that the U.S. central bank has made “substantial further progress” toward its inflation goal in order to begin tapering quantitative easing . Meanwhile, Fed Governor Christopher Waller stated that the Fed could begin tapering as soon as this year to have an option of hiking interest rates by late next year. Dallas Fed President Robert Kaplan went even further, saying that he “would prefer [a] sooner” start of reducing the pace of Fed’s asset purchases than the end of the year.

The hawkish U-turn among the Fed led to higher nominal inflation , as they believe that the Fed will tighten its monetary policy sooner than previously thought. Such expectations boost the market interest rates, making the dollar more attractive compared to its major peers, while non-interest-bearing assets such as gold become less alluring.

However, this narrative, like all narratives, may quickly change. If we see more disappointing economic data coming, the Fed could return to its previous safe-haven assets such as gold may increase again.

Furthermore, if inflation turns out to be merely transitory, as the Fed and the pundits believe, the U.S. central bank will remain behind the curve, and gold may survive. Or, the Fed will have to lift the interest rates aggressively, increasing the risk of recession .

What is important here, the rally , and without any crises or dovish signals sent by the Fed, it will struggle.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.