Gold Steady After Sharp Losses

MarketPulse | Feb 09, 2015 07:27AM ET

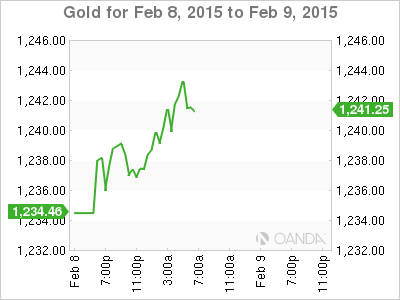

Gold prices are unchanged on Monday, as the metal is trading at a spot price of $1241.02. In the US, it’s a quiet start to the week, with just one indicator on the schedule – the Labor Market Conditions Index.

Gold dropped 2.4% on Friday, as US Nonfarm Payrolls improved to 257 thousand in January, up from 252 thousand a month earlier. This easily beat the estimate of 236 thousand. The strong reading has reinforced expectations for a mid-year interest rate cut by the Federal Reserve, which would be a boost for the US dollar.

The Greek government suffered a setback on Friday, as the Standard and Poor’s rating agency downgraded Greece’s debt from B to B-, which is just one level above default. S&P also kept the outlook as “negative”, which indicates that further cuts are possible. This follows the ECB announcement that it will no longer accept Greek government bonds as collateral for ECB loans as of February 11. For its part, Greece has pledged not renew the bailout program, which will expire at the end February. There will likely be more developments during the week in Brussels, as EU finance ministers meet on Wednesday, and German Chancellor Angela Merkel and Greek Prime Minister Alexis Tsipras attend an EU meeting on Thursday.

XAU/USD for Monday, February 9, 2015

XAU/USD February 9 at 11:25 GMT

XAU/USD 1267.42 H: 1268.84 L: 1262.39

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1215 | 1240 | 1255 | 1275 | 1300 | 1322 |

- XAU/USD has started the week with little movement.

- 1275 remains a weak resistance line. 1300 is stronger.

- 1255 is an immediate support level. 1240 is next.

- Current range: 1255 to 1275

Further levels in both directions:

- Below: 1255, 1240, 1215 and 1200

- Above: 1275, 1300, 1322, 1345 and 1375

OANDA’s Open Positions Ratio

XAU/USD ratio is pointing to gains in long positions on Monday. This is consistent with the pair’s sharp drop on Friday, which led to short positions being covered and thus an increase in open long positions. The ratio has a majority of long positions, indicating trader bias towards gold moving to higher ground.

XAU/USD Fundamentals

- 15:00 US Labor Market Conditions Index.

- 21:00 US FOMC Member Jerome Powell Speaks.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.