Gold Speculators Sharply Reduced Their Bullish Net Positions This Week

Zachary Storella | Apr 08, 2018 02:16AM ET

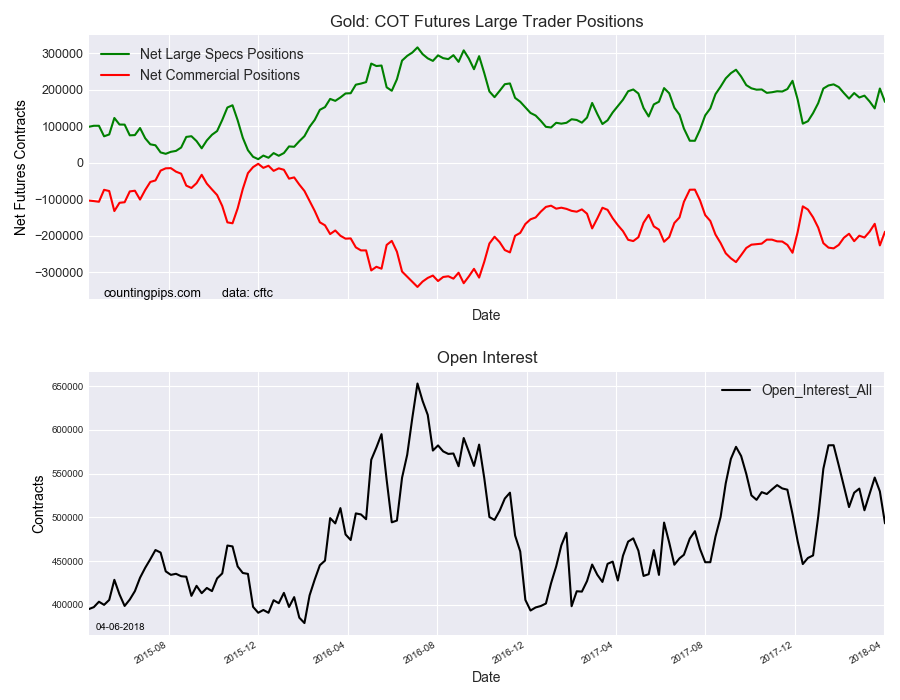

Gold Non-Commercial Speculator Positions:

Large precious metal speculators cut back on their bullish net positions in the Gold Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 166,589 contracts in the data reported through Tuesday April 3rd. This was a weekly reduction of -36,765 contracts from the previous week which had a total of 203,354 net contracts.

Speculative positions fell back below the +200,000 net contract level this week after a strong gain in contracts last week (+54,623 contracts) pushed the overall bullish position above that threshold last week.

The gold speculative position has now declined for seven out of the past ten weeks as sentiment across the major precious metals (silver, gold, copper) has been weak.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -188,865 contracts on the week. This was a weekly increase of 37,495 contracts from the total net of -226,360 contracts reported the previous week.

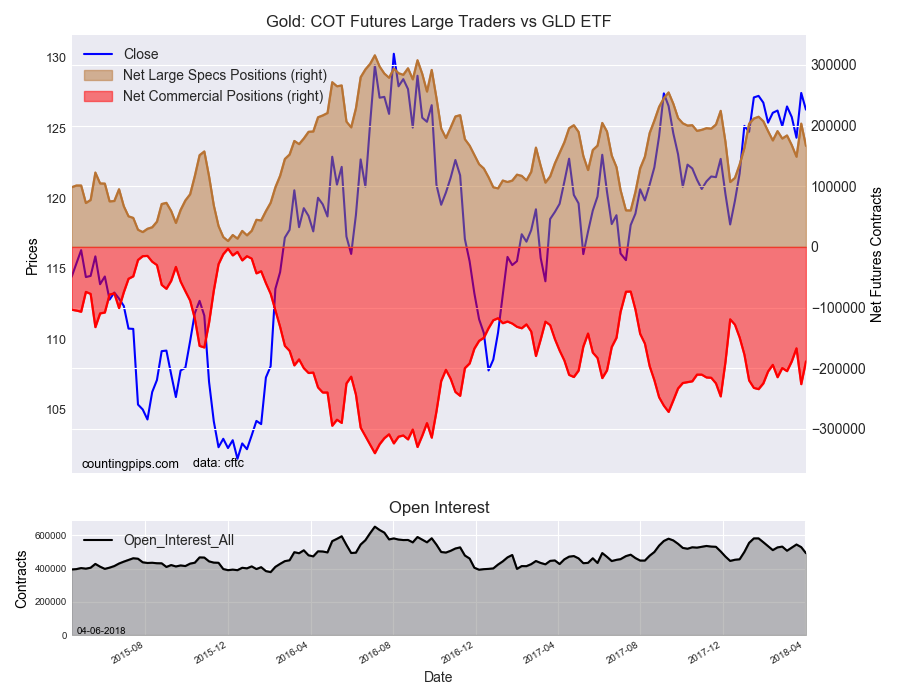

SPDR Gold Shares ETF (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $126.30 which was a decrease of $-1.19 from the previous close of $127.49, according to unofficial market data.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.