Gold Speculators Sharply Decreased Net Bullish Positions For 2nd Week

Zachary Storella | Sep 20, 2015 01:35AM ET

Weekly Large Trader COT Report: Gold

Gold speculative positions dropped to lowest level in five weeks

GOLD Non-Commercial Positions:

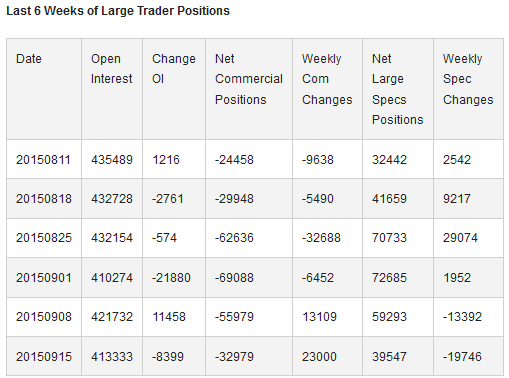

Gold speculator and large futures traders sharply cut their gold bullish positions for a second straight week last week to the lowest level in five weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +39,547 contracts in the data reported through September 15th. This was a weekly change of -19,746 contracts from the previous week’s total of +59,293 net contracts that was registered on September 8th.

The drop of -19,746 net contracts in the weekly net speculator positions was due to a fall in the weekly bullish positions by -9,390 contracts that combined with a gain in the weekly bearish positions by 10,356 contracts.

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) decreased their overall bearish positions for a second week to a net total position of -32,979 contracts through September 15th. This was a weekly change of +23,000 contracts from the total net position of -55,979 contracts on September 8th.

SPDR Gold Shares (NYSE:GLD):

Over the weekly reporting time-frame, from Tuesday September 8th to Tuesday September 15th, the price of the (GLD) Gold ETF which tracks the gold spot price, declined from approximately $107.52 to $105.90, according to ETF price data of the SPDR Gold Trust ETF (GLD).

COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts. All information and opinions on this website are for general informational purposes only and do not constitute investment advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.