Gold Slides Despite Soft US Jobs Report

MarketPulse | Jan 09, 2018 12:48PM ET

Gold has posted considerable losses in the Tuesday session. In North American trade, the spot price for an ounce of gold is $1310.88, down 0.72% on the day. On the release front, JOLTS Jobs Openings was unexpectedly soft, dropping to 5.88 million. This was well short of the estimate of 6.05 million. On Wednesday, the key event of the day is Import Prices.

Gold prices have shown strong gains since mid-December, leaving many investors scratching their heads. A robust US economy and a December rate hike from the Federal Reserve have increased the appetite for risk, and the stock markets have pushed higher since the New Year. This should translate into lower prices for safe-haven gold, but the base metal has jumped on the bandwagon and posted strong gains in early January. On Friday, gold touched a high of $1326, its highest level since mid-September. Will enthusiasm for gold continue? Much will depend on the strength of the US dollar – if the greenback runs into headwinds against the major currencies, gold could resume its rally.

When the Federal Reserve is in the headlines, it’s usually on the topic of interest rates. However, another important parameter is the Fed balance sheet, which has ballooned to $4.2 trillion. Starting this month, the Fed will reduce its portfolio, which grew tremendously during the financial crisis of 2008-2009. However, a strong US economy has allowed the Fed to begin trimming the balance sheet. Incoming Fed Chair Jerome Powell, who takes over in February, has estimated that the balance sheet could drop to anywhere between $2.4 trillion to $2.9 trillion after several years of cuts. Fed policymakers have not indicated a magic number for the balance sheet, but the cuts indicate a vote of confidence in the US economy.

XAU/USD Fundamentals

Tuesday (January 9)

- 6:00 US NFIB Small Business Index. Estimate 108.4. Actual 104.9

- 10:00 US JOLTS Job Openings. Estimate 6.05M. Actual 5.88M

Wednesday (January 10)

- 8:30 US Import Prices. Estimate 0.4%

*All release times are GMT

*Key events are in bold

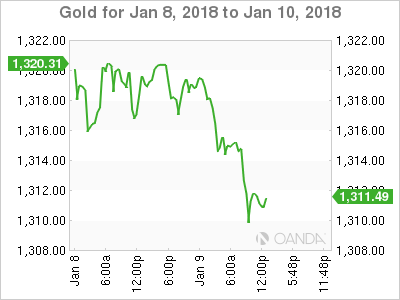

XAU/USD for Tuesday, January 9, 2018

XAU/USD January 9 at 13:30 EST

Open: 1320.34 High: 1320.55 Low: 1308.87 Close: 1310.48

XAU/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1260 | 1285 | 1307 | 1337 | 1375 | 1416 |

- XAU/USD was flat in the Asian session. The pair posted considerable losses in European trade and is showing limited movement in North American trade

- 1307 is a weak support line. It could break during the Tuesday session

- 1337 is the next resistance line

- Current range: 1307 to 1337

Further levels in both directions:

- Below: 1307, 1285, 1260 and 1240

- Above: 1337, 1375 and 1416

OANDA’s Open Positions Ratio

XAU/USD ratio is unchanged in the Tuesday session. Currently, long positions have a majority (58%), indicative of trader bias towards XAU/USD reversing directions and moving to higher ground.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.