Gold Should Like Promise From Fed Not To Hike Rates For Years

Sunshine Profits | Sep 17, 2020 10:33AM ET

The latest FOMC statement and economic projections signal that interest rates will stay at zero until the end of 2023. This is excellent for gold.

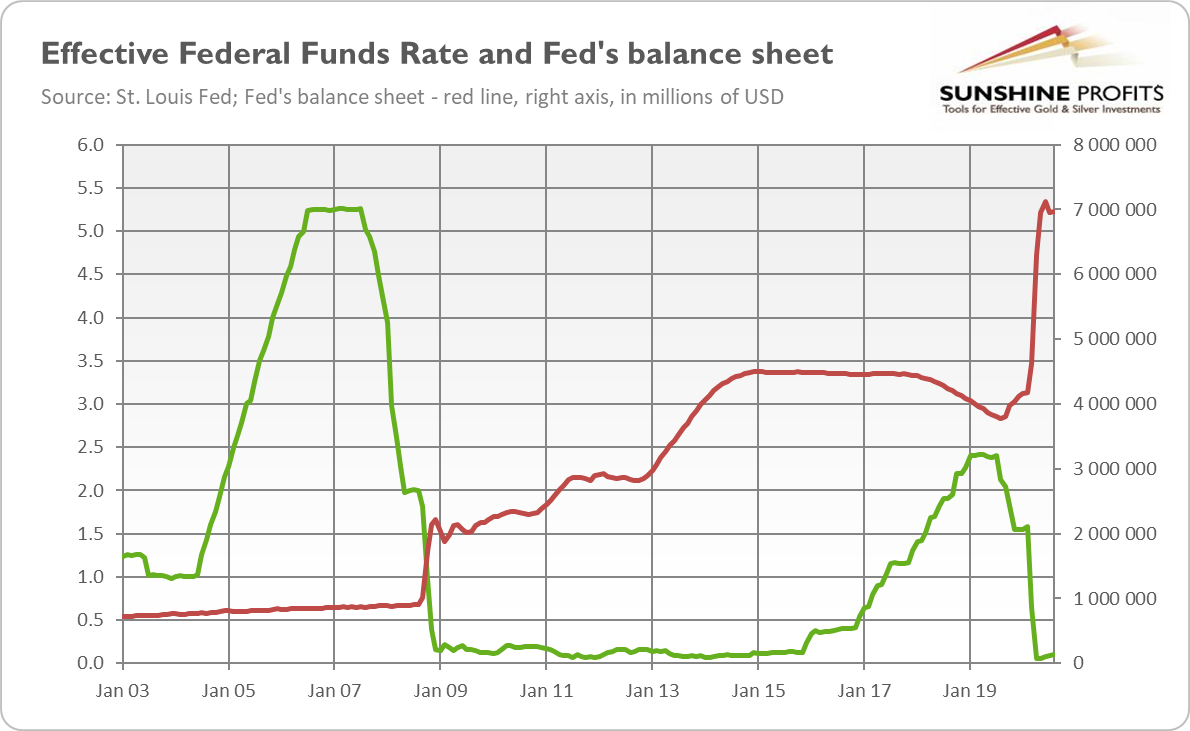

Yesterday, the Fed’s balance sheet .

Nevertheless, the statement is changed significantly from the July edition, as it reflects the central bank’s new monetary strategy adopted in late August, which assumes the targeting 2% inflation over time and not on a yearly basis.

First of all, the members of the committee have acknowledged the shift from the flexible inflation targeting into a flexible average inflation targeting that allows the compensation of subdued inflation in one period with higher inflation later:

The committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. With inflation running persistently below this longer-run goal, the committee will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well anchored at 2%. The committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.

Second, and perhaps even more importantly, the Fed announced that the new economic conditions must be met before the inflation reaches 2% and is on track to rise above this level:

The committee decided to keep the target range for the federal funds rate at 0 to 1/4% and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee's assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.

What does the above mean for the gold market?

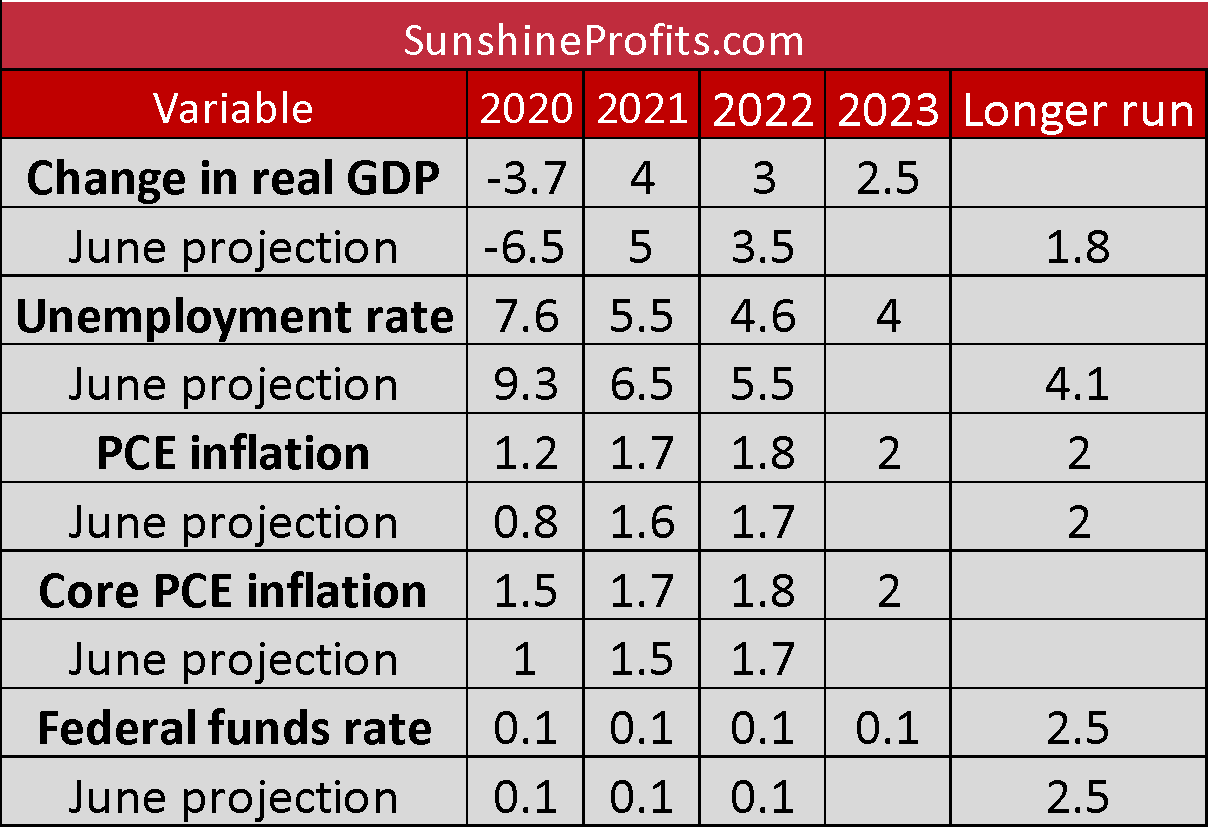

Well, the Fed’s statement is clearly unemployment rate lower, as the table below shows.

In particular, the FOMC expects that the GDP will decrease by 3.7% in 2020, increase 4% in 2021 and 3% in 2022, compared to the -6.5, 5 and 3.5% expected in June.

The unemployment rate is forecasted to be “only” 7.6% in 2020, compared to the 9.3% seen in June. The fact that the recovery has progressed quicker than expected is bad news for the gold prices. But still, the overall economic activity remains well below the pre-pandemic level.

When it comes to the PCE inflation, the FOMC now sees higher inflation in 2020 (1.2%) than June when they expected only 0.8%. However, the FOMC projects that the inflation rates will be below their target until 2023, which is an excellent excuse for continuing their dovish monetary policy , thus supporting gold prices in the process.

Indeed, the GDP for 2020.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.