Gold Sets Up For Massive Move Higher

Chris Vermeulen | Mar 02, 2020 01:14PM ET

Our research team believes the recent downward price activity in gold and silver are indicative of past price patterns we saw in gold during the 2007 to 2012 rally. Throughout almost every rally in precious metals (gold), there have been a number of moderate to serious price corrections taking place within that extended rally. The current downside move is moderately small compared to historical price rotation in gold and potentially sets up a massive upside rally to levels above $2100 per ounce.

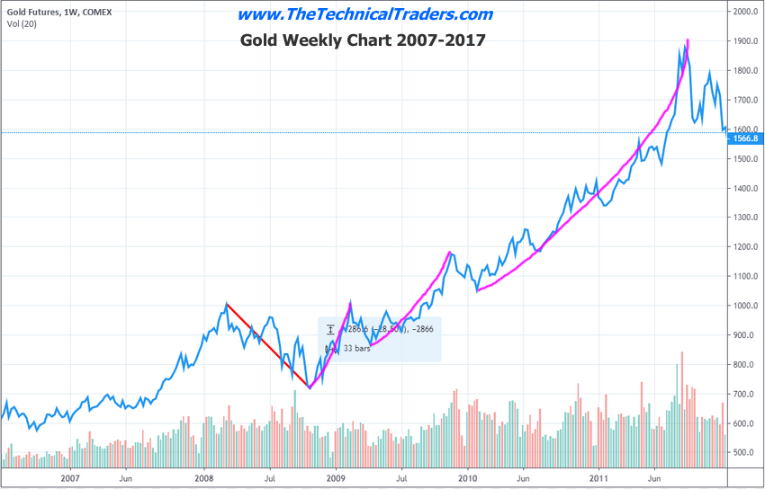

The chart below highlights the downside price rotation that took place just before and as the U.S. stock market collapsed in late 2008 and 2009. Notice how gold lost nearly 28% right as extreme market weakness began to become present in U.S. stocks. Then pay attention to how gold rallied from $730 in multiple upside price legs to a peak just below $1900 – well above 110%. Could the same pattern already be setting up in 2020?

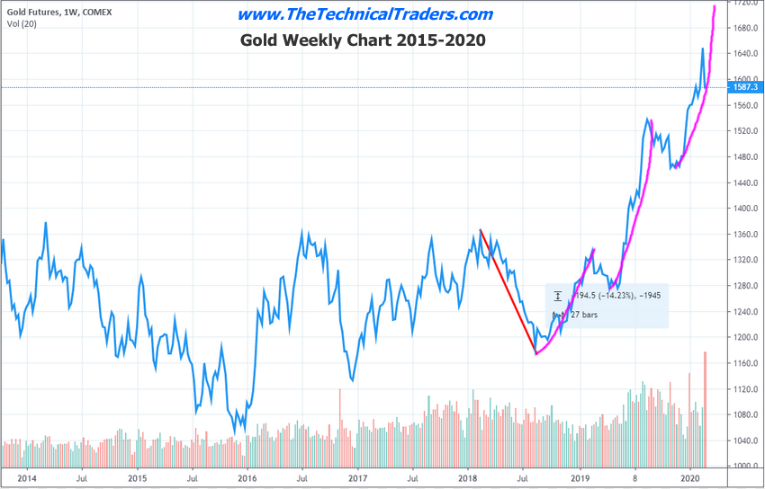

Weekly Gold Chart Trend Is Clearly Up

The current gold chart above highlights what we believe is a similar price pattern when gold collapsed as the downturn in the U.S. stock market took place between October 2018 and December 2018. Subsequently, gold then rallied to levels nearing the previous peak level (near $1380), then rallied even further to $1540. We believe the current downside price rotation is similar to the downside price rotation that took place in August/Sept 2010 – just before gold went from $1050 to $1890 (+85%). If a similar type of rally were to take place from the current $1587 lows, gold's peak price may be near $2935.

Gold/Silver Ratio Screams Bargain

This last chart shows the true potential for a silver rally based on historical levels of the gold-to-silver ratio. There has never been a time since 1990 that the ratio has been this high (93.9). Historically, traditional levels are closer to 74-76. If gold rallies above $2100 and the gold-to-silver ratio contracts to the historical 74 to 76 level, silver will likely rally to levels above $40 to $50 per ounce. If gold rallies to our projected peak level of $2935 and the ratio reverts, silver could go to levels well above $65 per ounce.

This downside move in both gold and silver is an incredible opportunity for skilled traders. Don't miss the opportunity to get into a precious metals position near these levels – before the real rally begins.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.