Gold Reaches $2,000 Amid U.S. Dollar Depreciation

Sunshine Profits | Sep 11, 2020 02:55PM ET

Think about this number: $2,000. Theoretically, it’s just a number, one of many. But somehow we feel that jumping above this level was a big event in the gold market. After all, gold surpassed this psychologically important point for the first time in history, reaching record high, as the chart below shows.

How did gold manage to achieve it? The obvious reason is the coronavirus crisis and its economic consequences. But let’s be more specific. The first driver was the elevated risk perception spurred by the safe-haven demand for gold .

The second explanation is the Fed’s easy , and boosted the gold prices.

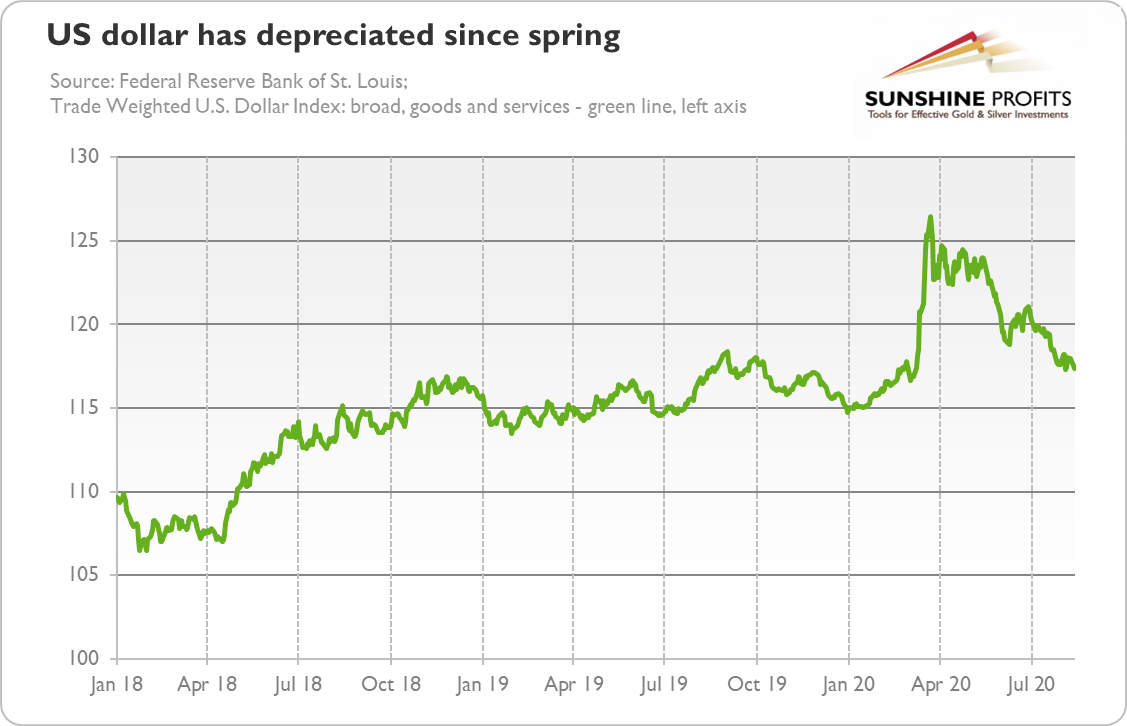

The third reason is the U.S. dollar’s depreciation. As one can see in the chart below, the greenback lost more than 7% in value since its March high, reversing a safe-haven rally amid coronavirus crisis.

Although the weakening of the U.S. dollar partially reflected the Fed’s accommodative stance and the increase in the risk appetite, we should not forget about investors’ growing demand for a safe-haven alternative to the dollar. I mean here that the loss of confidence in the U.S. government, Trump’s weaponization of the fiat currencies , some people could switch to gold.

To be clear, I’m not writing about the demise of the U.S. dollar’s, as the reports about its fall are, as always, greatly exaggerated. I’m analyzing here the economic reasons behind the greenback’s sharp depreciation – in order to draw investment conclusions for precious metals investors.

First, the dollar tends to weaken during risk-on episodes, so when market sentiment improved after the worst phase of the coronavirus crisis, the greenback simply corrected after previous gains. Second, the U.S. central bank eased its monetary stance in the response to the economic collapse, slashing divergence in interest rates across the Atlantic (see the chart below), which reduced capital inflows into America and triggered a shift in holdings in favor of other markets.

Third, the U.S. did a poor job in containing the fiscal deficits , which also leads to large external deficits.

So, what’s next for the dollar and gold? Well, with improving health and economic situation in the U.S., the downward pressure on the greenback should weaken. On the other hand, the adopted ultra dovish stance makes the Fed similar to the financial crisis . But gold should move in tandem with the greenback, then.

Summing up, gold has recently jumped above the psychologically important level of $2,000, while the U.S. dollar depreciated sharply. Some analysts link these two events and claim that the public debt , gold can shine even without serious weakness in the dollar.

That’s great – but even greater is the fact that it is likely that the greenback started a cyclical decline in spring amid the banana-republic-style money creation and debt monetization by the Fed. There could be a rebound in the short-term (for example, because of negative economic data out of the Eurozone economy), but I wouldn’t be surprised if the U.S. dollar would be next year below the current levels. It goes without saying that gold would benefit from further potential depreciation of the greenback.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.