Gold Miners Fund Has Reached Expected Resistance

Tom Pizzuti | Jun 11, 2021 01:14PM ET

As a follow-up to our late-March post about an expected bounce in the gold ETF, we wanted to alert readers that price in the related gold miners ETF also bounced. Now, the gold miners fund has reached an important resistance area where a reversal is possible.

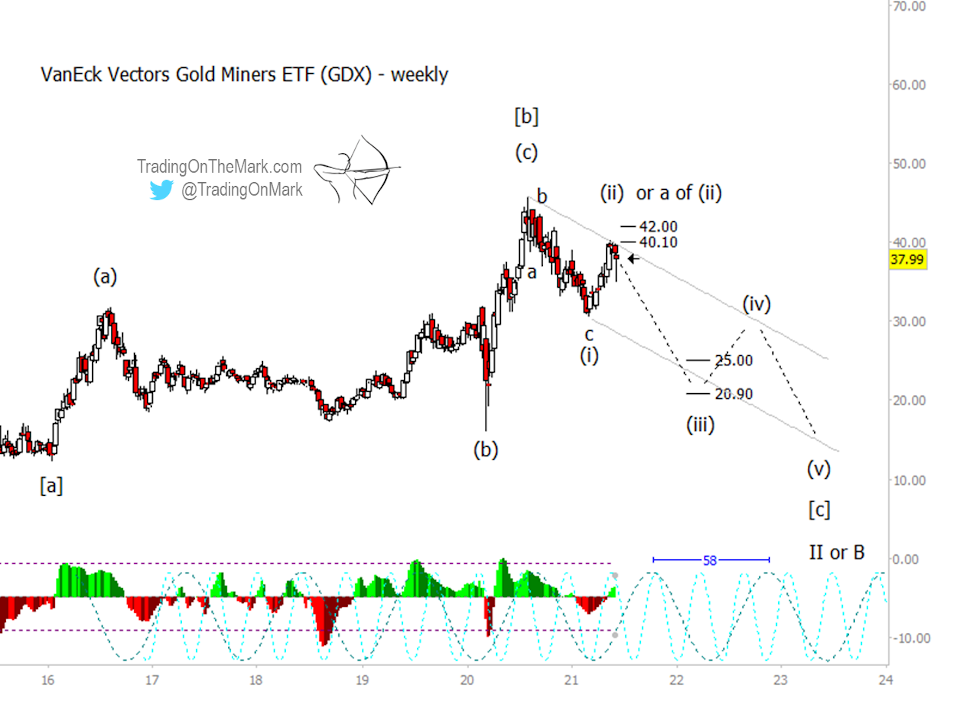

Here's we offer our primary Elliott wave scenario for the VanEck Vectors Gold Miners ETF (NYSE:GDX).

Following the 2020 high in GDX, we're looking for a multi-year downward impulsive structure to develop. That would be consistent with GDX and the metal itself trying to complete the downward/sideways pattern that began back in 2011. A downward five-wave structure would be wave [c] of something – the conclusion of a decade-long structure that might be either a wave II or wave B.

Right now, it's possible that sub-wave (ii) of the downward structure is ending, or at least pausing. Note that price has tested 40.10, which was the higher resistance level we showed in April and is also approximately a Fibonacci 61.8% retrace up to the 2020 high.

While the current area is a candidate for price to embark on downward sub-wave (iii), we also cannot rule out the possibility that sub-wave (ii) will require more time to develop. Thus, current high area might represent just part 'a' of (ii). Another test of recent resistance at 40.10 or possibly even the next level at 42.00 is possible before price can break downward. Thus, we have labelled the current high on the chart as sub-wave "(ii) or a of (ii)".

The weekly GDX chart above sketches out the possibility that the entire downward wave [c] might take the form of an ending diagonal. A diagonal-style overlap between sub-waves (i) and (iv) would allow the entirety of wave [c] to take on the "motive wave" decisiveness that's needed in order to complete the larger corrective structure while also testing near the area of the previous wave [a].

Based on the 58-week dominant cycle – the slower of the two cycles shown on the chart – ideal timing for the lows of sub-waves (iii) and (v) would be in May 2022 and June 2023. Preliminary support areas for sub-wave (iii) include 25.00 and 20.90 based on Fibonacci extensions down from sub-wave (i).

Trading On The Mark provides detailed, nuanced analysis for a wide range of markets including crude oil, the S&P 500, currencies, gold and treasuries.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.