Gold: Macro Conditions Keep Supporting Long-Term Outperformance Over Equities

Yvonne Blaszczyk | Jan 18, 2024 01:10PM ET

This year’s record-high gold price and anticipated stellar gold prices in years to come are signaling a turning point in the financial system as we know it. The U.S. economy is facing critical risks with an avalanche of factors in the background, including but not limited to southern border crises, the prospects of strong republican leadership and divisive narrative, easing of U.S. monetary policy with interest rate hikes ending, anticipated rate cuts, continued geopolitical turmoil and U.S. funding of futile wars and armed conflicts around the world.

The most recent military strikes by the U.S. and U.K. on the Houthis, a Yemeni militant group, further inflame the already sensitive political situation, affecting the economies of the U.S. and Europe directly. This complex multitude of factors profoundly depletes the domestic resources in the U.S. while forging ahead with an unprecedented gross national debt that currently exceeds $34 trillion.

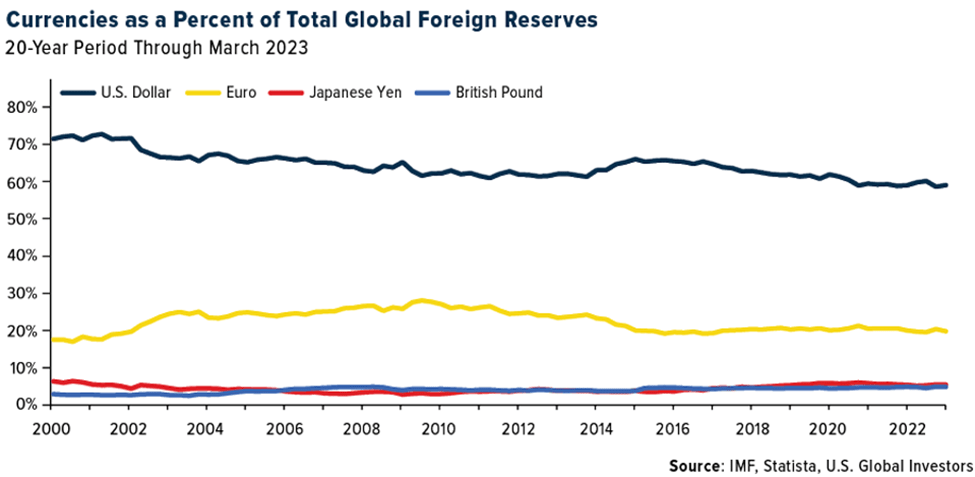

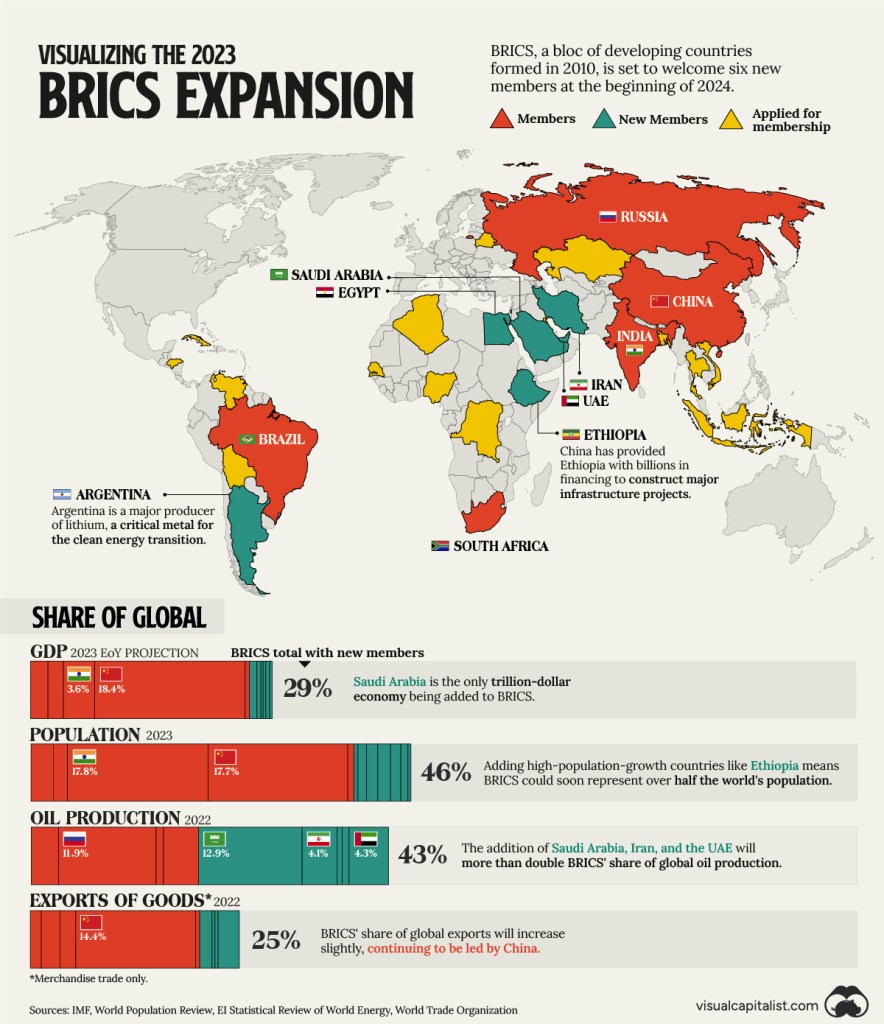

The rising tidal wave of the BRICS coalition and its focus on gold-backed currency is a catalyst for further gold price increases in the future and serious competition for the U.S. dollar as the world’s dominant reserve currency. BRICS is a serious economic and political block with the powerful founding partners Brazil, Russia, India, China, and South Africa aiming at the global financial system and ultimately serving as a counterbalance to U.S. hegemony.

With the recent expansion and entrance of new members, including Iran, Egypt, Ethiopia, Saudi Arabia, and the United Arab Emirates, BRICS will double its global oil production and represent more than half of the world’s population.

Argentina’s new president has sparked another global controversy. Javier Milei has withdrawn the country from its planned entry into BRICS. For the emerging economies of BRICS, it may be a blessing not to include Argentina, with its economic problems and high debt. In the near future, Argentina will potentially face catastrophic social unrest ignited by dramatic peso devaluation to 800 pesos to the U.S. dollar from 390 pesos and government policies. Perhaps it would be an interesting option for President Milei to consider gold backed peso as a partial solution for natural resources-rich Argentina. Gold has always been and will be money.

The United States eliminated the gold standard in 1971, and since that time, the value of the U.S. dollar has been primarily backed by nothing. All leading market indicators point out the risk of staying invested without taking the “insurance” opportunity presented by gold.

During the last 100 years, there have been four periods when stocks generated zero growth while at the same time, gold has increased in value from $20.67 per ounce to $2,045.60 today.

For illustrative purposes, please note the gain needed to break even during various market declines:

Equity markets are overpriced by every conventional measure. They are heading for a significant correction, potentially reducing the wealth of most investors who can be otherwise insured by adding gold to a portfolio, not being swept by old paradigms, and missing the golden opportunity.

By cashing out of some investments today and buying gold, investors will likely preserve their portfolios’ store of value and be poised to invest in highly discounted stocks, bonds, and ETFs after the correction.

Looking back at 2008, even non-correlated investments like REITs suffered significant declines. The Dundee Dream Office REIT declined by 84%, even though rental income was unchanged, resulting in dividend yields of 30% for investors who purchased at the end of the correction. Today, the situation is very different in a post-lockdown paradigm.

Staying invested to achieve minimal potential gains in the next few years does not justify risking losses. Investors could hold cash during this period, but inflation will result in losses of purchasing power of +/-8% or 18%, using the more realistic rate of Shadowstats.com. However, if investors hold gold bullion as portfolio insurance, they could realize positive gains.

The table below shows gains made during past corrections:

With the foresight of purchasing gold bullion, investors will potentially avoid significant losses and realize substantial gains, capturing the price gains now and later by buying other investments, such as discounted stocks, after the market correction.

Based on our research, we developed the BMG Diversified Hedge Fund that captures this win-win strategy for accredited investors. Our hedge fund initially allocates 100% to the BMG Gold BullionFund to be “parked” until a significant correction. On completion of the correction, the BMG Diversified Hedge Fund will allocate to a diversified portfolio of equities, fixed income, and selected funds that have outperformed their indexes and peers for the past ten years.

For illustrative purposes, the back-tested model based on a $25,000 investment generated $654,305.32 and bonus royalties of $46,594.93.

While this graphic is based on actual historical performance data, actual market conditions may vary in the future, and it may not be possible to achieve optimal results in executing the strategy of the BMG Diversified Hedge Fund. Past performance is no indication of future performance.

***

Disclaimer: The information contained in this article provides a general overview of subjects covered, and the expressed personal views and opinions are not intended to be taken as advice regarding any product, organization or individual, and should not be relied upon as such. Consult your investment and legal advisors regarding specific coverage issues. Information and opinions expressed in this article are provided without warranty of any kind, either express or implied, including, without limitation, warranties of merchantability, fitness for a particular purpose, and non-infringement. BMG uses reasonable efforts to include accurate and up-to-date information from public domains and sources but does not make any warranties or representations as to its accuracy or completeness. BMG assumes no liability or responsibility for any errors or omissions in the content of this article.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.