Gold Holds Steady but Could Rise on Tariff Developments

Andrey Goilov | Jul 15, 2025 02:55AM ET

The price of gold XAU/USD remains stable at $3,354 per troy ounce this Tuesday, recovering some of the previous day’s losses. Market attention remains firmly fixed on US trade policy developments.

President Donald Trump has formally notified leaders from 25 countries of new tariffs, including a 30% levy on imports from the EU and Mexico, set to take effect on 1 August. Trump warned that nations responding with retaliatory measures could face even stricter US restrictions, though he left room for further negotiations before the tariffs are imposed.

Investors are now awaiting the release of the US Consumer Price Index (CPI) for July, which may offer fresh clues on the Federal Reserve’s next steps regarding interest rates.

While physical gold demand remains steady, central bank purchases continue to provide strong strategic support for prices. Meanwhile, the US dollar’s trajectory is having little immediate impact on gold’s movements.

Technical Analysis: XAU/USD

H4 Chart:

On the H4 chart, XAU/USD broke above the 3,340 level, hitting its local target of 3,373. Today, the market has seen a technical pullback to 3,340 (testing from above) before initiating a new upward wave towards 3,400. Once this wave concludes, we anticipate a corrective retracement to 3,340, followed by a potential further rise to 3,434. This scenario is supported by the MACD indicator, where the signal line remains above zero and pointing firmly upwards.

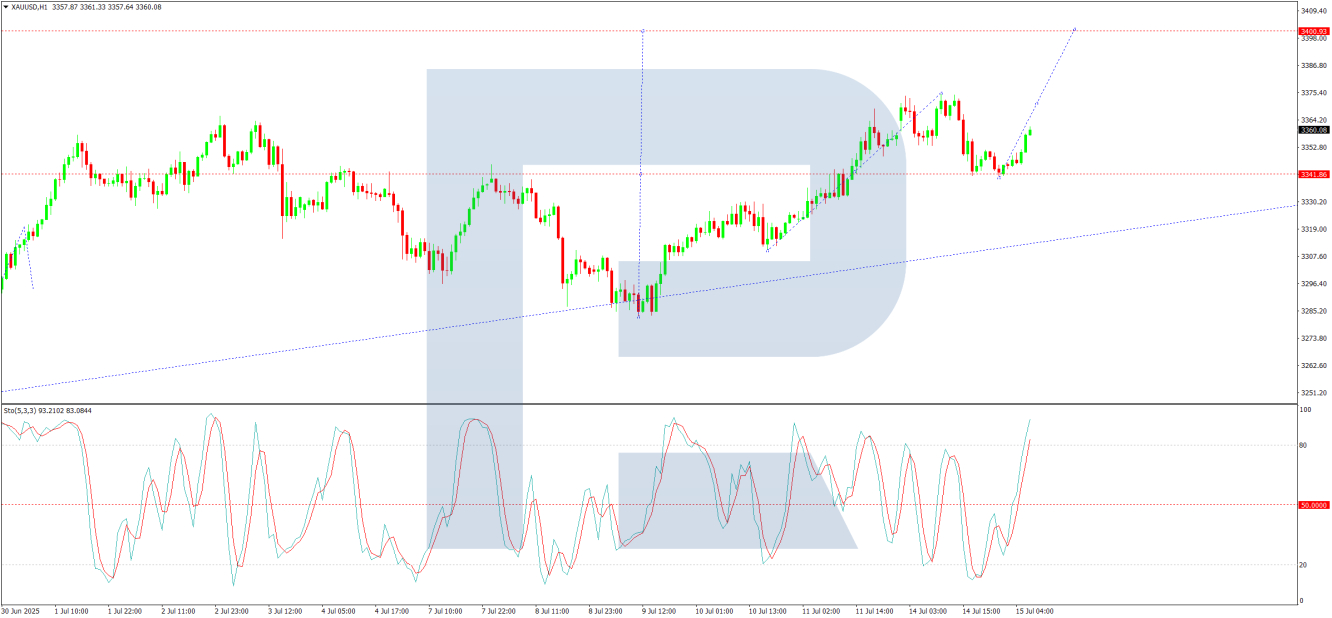

H1 Chart:

On the H1 chart, the correction to 3,340 has completed, and the next growth wave towards 3,400 is underway. Today, we expect an advance to 3,370, after which a brief consolidation phase may form. A breakout above this range would reinforce bullish momentum towards 3,400. The Stochastic oscillator aligns with this outlook, with its signal line above 50 and rising sharply towards 80.

Conclusion

Gold’s near-term trajectory hinges on trade policy shifts and US economic data, while technical indicators suggest further upside potential after consolidation.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.