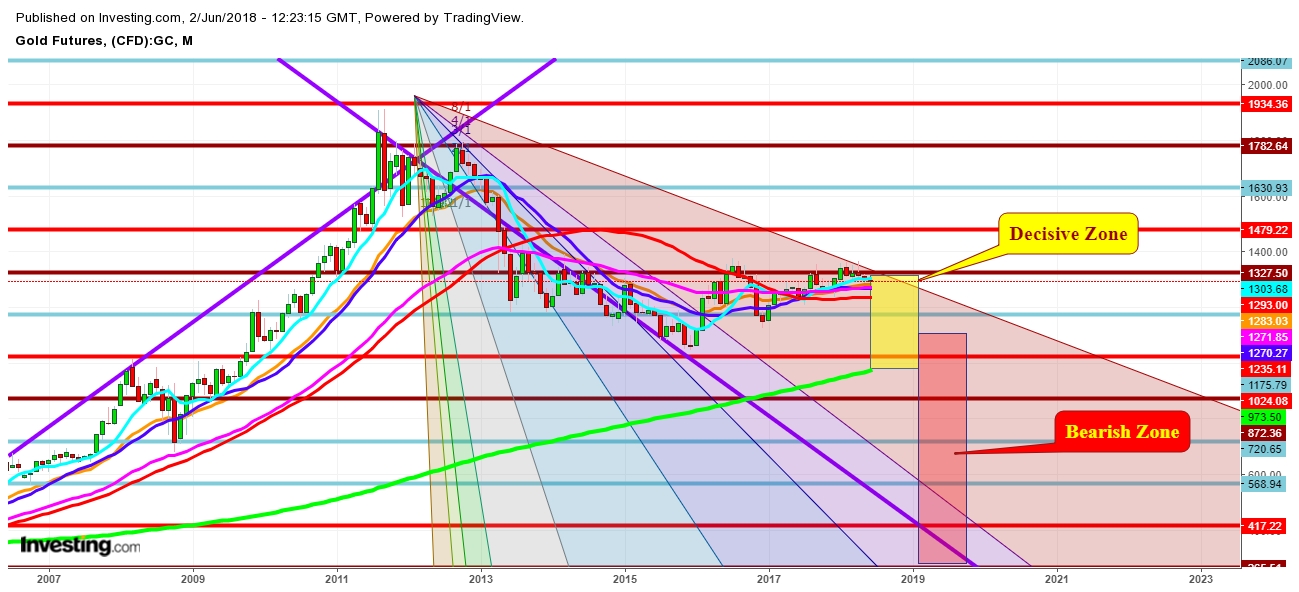

Gold Enters Decisive Zone Amid Growing Geopolitics While On Downward Trend

Satendra Singh | Jun 03, 2018 02:28AM ET

Since my last analysis of the movement of Gold futures I've found that the gold futures have entered into “Decisive Zone” while on a downward trajectory. The jobs report showed broad gains and the Fed would add a fourth rate hike to its projections at its September meeting.

As Italian political turmoil subsided, markets saw weaker demand for safe-haven assets such as gold. The country has been unable to form a government since an election in early March, but the euro-skeptic populists and pro-EU establishment lawmakers renewed efforts to build a coalition rather than force a new election.

The U.S. dollar index that tracks the greenback against a basket of six major currencies added 0.16% to 94.11. The greenback oscillated around the 94 value on Friday morning.

Dollar-denominated assets such as gold are sensitive to moves in the dollar – a gain in the dollar makes gold more expensive for holders of foreign currency and thus decreases demand for the precious metal.

U.S. President Donald Trump’s administration refused to extend the reprieve on tariffs on imported steel and aluminum for the EU, Canada and Mexico while threatening more tariffs on other imported products such as automobiles, clouding the global trade outlook. To understand the following charts, check this out.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.