Gold – Macroeconomic Fundamentals Improve

Acting Man | Jul 10, 2018 02:31AM ET

A Beginning Shift in Gold Fundamentals

A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm.

The list of gold fundamentals that have improved is short, but at least there is now such a list:

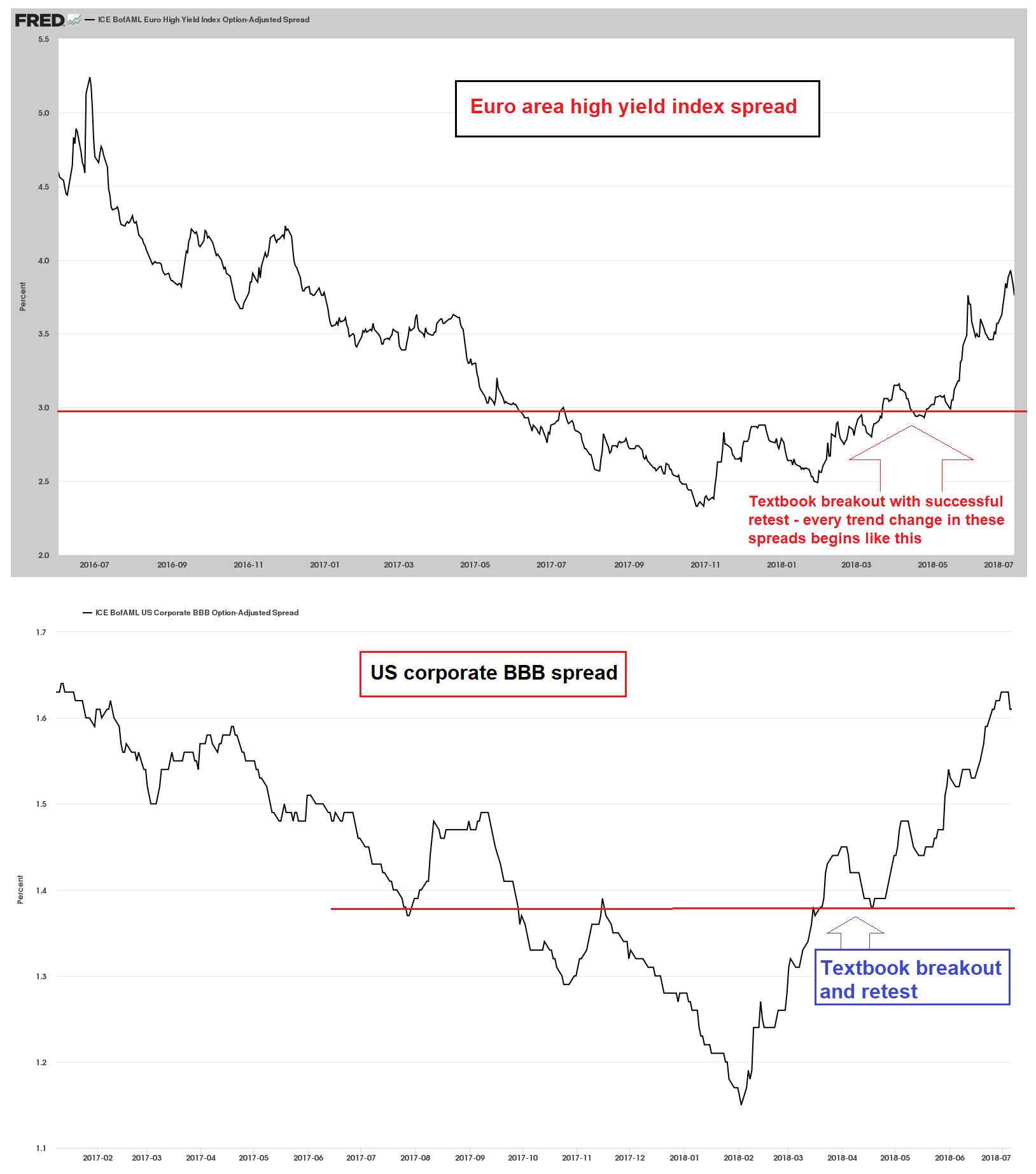

- credit spreads: European high yield spreads have broken out to the upside. In the US, high yield spreads are better behaved (we suppose mainly on account of the fortunes of the energy sector), but spreads on the the lowest rated investment grade category (BBB) have also seen a textbook breakout to the upside.

- emerging market currencies, stocks and bonds have come under pressure on a broad front (this is not just confined to Argentina and Turkey anymore).

- stock market volatility has increased globally.

- bank stocks have entered a downtrend relative to the broad market

- commodity indexes remain in an uptrend (mainly driven by energy prices).

- US federal debt is expanding surprisingly fast. This is happening amid a decline in federal tax receipts, which is astonishing in view of reported economic growth rates. Note that the most recent y/y decline in tax receipts happened in Q1, i.e., before the tax cuts came into force.

- the proprietary Incrementum Inflation Indicator has recently switched to a “full inflation signal” (on June 28). This indicator is based exclusively on market price signals.

Credit spreads strike us as the most important of these factors as proxies for the trend in economic confidence. Here is what the situation in European junk bond spreads and US corporate BBB spreads looks like at the moment:

Examples of historical trend changes in credit spreads and how they played out can be reviewed here: “Credit Spreads: the Coming Resurrection of Polly ”. The last three charts in this article show credit spreads turning up after having been stuck at extremely low levels for extended time periods. These charts explain why we are referring to the moves shown above as “textbook” upside breakouts.

The growth rate of the US federal debtberg strikes us as fairly important for the gold price as well. Empirically it often appears to be a major driver, although it could of course be argued that rapid surges in budget deficits and the federal debt are simply symptoms of the type of fundamental backdrop that is traditionally favorable for gold.

What makes the recent trend particularly interesting is actually the fact that the prevailing economic environment is normally not associated with declining tax receipts and sharp increases in federal debt – on the contrary. And yet, federal tax receipts were down 4.5% y/y in Q1, continuing the weakness in evidence since Q4 2015.

Federal debt and federal tax receipts – the former has resumed growing by leaps and bounds, while growth in the latter has turned negative again in Q1 2018 to the tune of -4.5% y/y – and that was before the tax cuts came into force.

Real Interest Rates and the “Inflation” Question

As our readers are no doubt aware, actual inflation – i.e., the growth rate of the money supply – has slowed rather noticeably. This is normally considered gold bearish, but just as gold bottomed and turned up with the beginning of the rate hike cycle (normally also held to be bearish) it started to firm shortly after the downtrend in the true money supply growth rate got underway.

There is no need to rehash in detail why this happened – the short version is: the gold market appears to be leading future changes in economic conditions and monetary policy by uncommonly long time periods in recent years (this has been the case since 2005). It seems to be more sensitive and forward-looking than any other market in this respect.

It seems that market participants are anticipating the lagged effect of slowing money supply growth on risk assets and the economy and the eventual (inevitable) response of monetary authorities. Along similar lines, when “QE3” was announced in 2012, the gold price started to decline in anticipation of the eventual end of debt monetization by the Fed and the beginning of a new tightening cycle – and yet, it still took more than three years before the first rate hike was actually implemented.

Regardless of the length of this lead time, gold prices definitely respond strongly to real interest rates, or let us rather say, to market perceptions about real interest rates.

Investors express their views on future changes in CPI through the prices they are prepared to pay for TIPS (inflation-protected treasuries). Since they are market-driven, TIPS yields are the best real interest rate measure at our disposal. Not surprisingly, there is normally a strong negative correlation between the gold price and 5-year TIPS yields.

In the chart below we have inverted the TIPS yield in order to make it easier to see what has recently happened:

After maintaining a near perfect negative correlation for quite a long time (depicted as a positive correlation above via inverting TIPS yields – note that the TIPS scale to the left has to be multiplied by [-1] to make sense), gold prices and real interest rates part ways in early 2017. Recently the gap has narrowed a bit, as both TIPS yields and the gold price have declined. Still, this particular indicator actually remains bearish at this point.

There is another, less future-oriented way of looking at real interest rates, which consists of simply comparing the level of short term rates administered by the Fed to the most recent y/y rate of change in CPI. While this approach has many flaws, it shows how “far behind the curve” Fed policy is in the here and now relative to CPI. Moreover, it allows for comparisons with data of the more distant past, when TIPS didn’t exist yet.

A Tale of Two Eras

The chart below compares two eras – in particular the time period from 2010 until today (which obviously includes the 2011 – 2015 cyclical bear market in gold) and the 1970s gold bull market. Both are juxtaposed with the “real” federal funds rate (defined as the nominal FF rate minus CPI).

Two eras compared: gold price vs. the “real” federal funds rate 2010-2018 and 1970- 1980.

The charts reveal an interesting parallel: both during the 2011-2015 bear market and the 1974 to 1976 mid-cycle bear market, the “real” FF rate first reached deeply negative levels close to the peak, and then rose until it briefly eclipsed or touched the zero line. Both bear market periods incidentally generated almost identical losses (-45.5% in 2011-2018, -46% in 1974-1976).

It is worth noting that the fundamental backdrop for gold became progressively less supportive for gold between 1976 and 1980, especially compared to the first bull market phase. And yet, the run-up in gold prices only became “parabolic” in 1979-80, with gold stocks ultimately projecting even bigger gains. Their peak lagged the top in the gold price by almost 8 months: the Barron’s Gold Mining Index only topped out in September 1980, while gold concurrently made a lower high (at $720 vs. the $850 peak of January 1980).

The enthusiasm that characterized the secular gold price peak of 1980 was far more pronounced than that seen at the 2011 top, which looks more like a cousin of the 1974 mid-cycle peak to us. The divergence with gold stocks is particularly telling: in 1980 the more speculative part of the gold universe only topped after the more conservative one.

This is precisely the behavior we tend to see around major stock market peaks as well. These are usually marked by the more speculative Nasdaq stocks topping well after the DJIA and/or the broad market. While we would caution that things don’t always have to play out the same way, all of this suggests to us that the probability that the secular bull market in gold still has further to go remains relatively high.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.