Gold, Nikkei, Yen: Challenging Our Assumptions

Erik Swarts | Nov 03, 2014 12:55AM ET

As the contemporary chapters of quantitative easing mature into their second decade (est. 2001 Japan) of trials and tribulations, it's important to recognize that the policy influences have been applied in varying economic conditions - along different points of the market cycle. In the old growth valley of the long-term yield cycle, where monetary policy has run out of road, quantitative easing has just become an extension along the policy continuum - beyond the mystical plane of ZIRP.

While anxieties have inevitably risen over the sheer size of these relatively unfamiliar policies, we expect as more economies come face to face with QE, a greater and more discriminative understanding will be made on the part of market participants, as QE is enacted - expanded or wound down. A fascinating example of these distinctions can be found today, between monetary policies in Japan, Europe and the US.

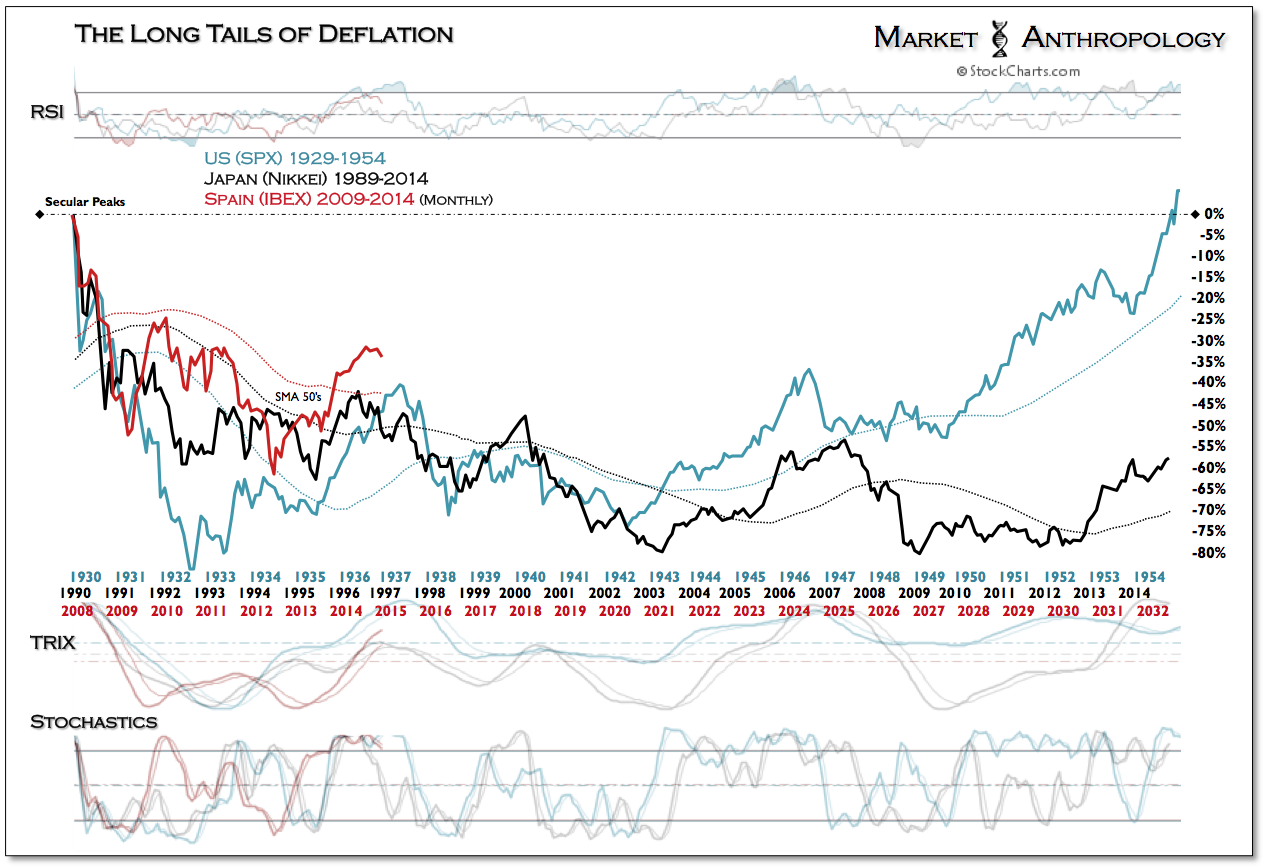

Throughout the year, we have followed the market developments in Japan and expected as the year drew to a close, the Nikkei would break free of the nearly 25 year old range - that has defined its long battle with deflation. Back in April we summed up our thoughts in The Long Tail of Deflation:

Our general outlook for the Nikkei this year has been that the rally that began with the commencement of Abenomics at the end of 2012 became stretched to a relative extreme and that the breakout leg for Japan and perhaps its perennial battle with deflation would occur at a lower level (technically) and after another subsequent correction. That correction has materialized this year with the Nikkei underperforming almost every major market in 2014. - The Long Tail of Deflation

With the Nikkei breaking through overhead resistance in September, a slingshot reflex materialized last week after the Bank of Japan expanded their scope of accommodative policy. From our perspective, it's important to recognize that unlike Europe - which is just beginning to belly up to QE as economic conditions have worsened over the past year, Japan is expanding policy while underlying fundamental conditions have mainly improved. While it's certainly not a panacea, Jeremy Schwartz over at Wisdom Tree has repeatedly and clearly outlined Japan's case, most recently in September (see

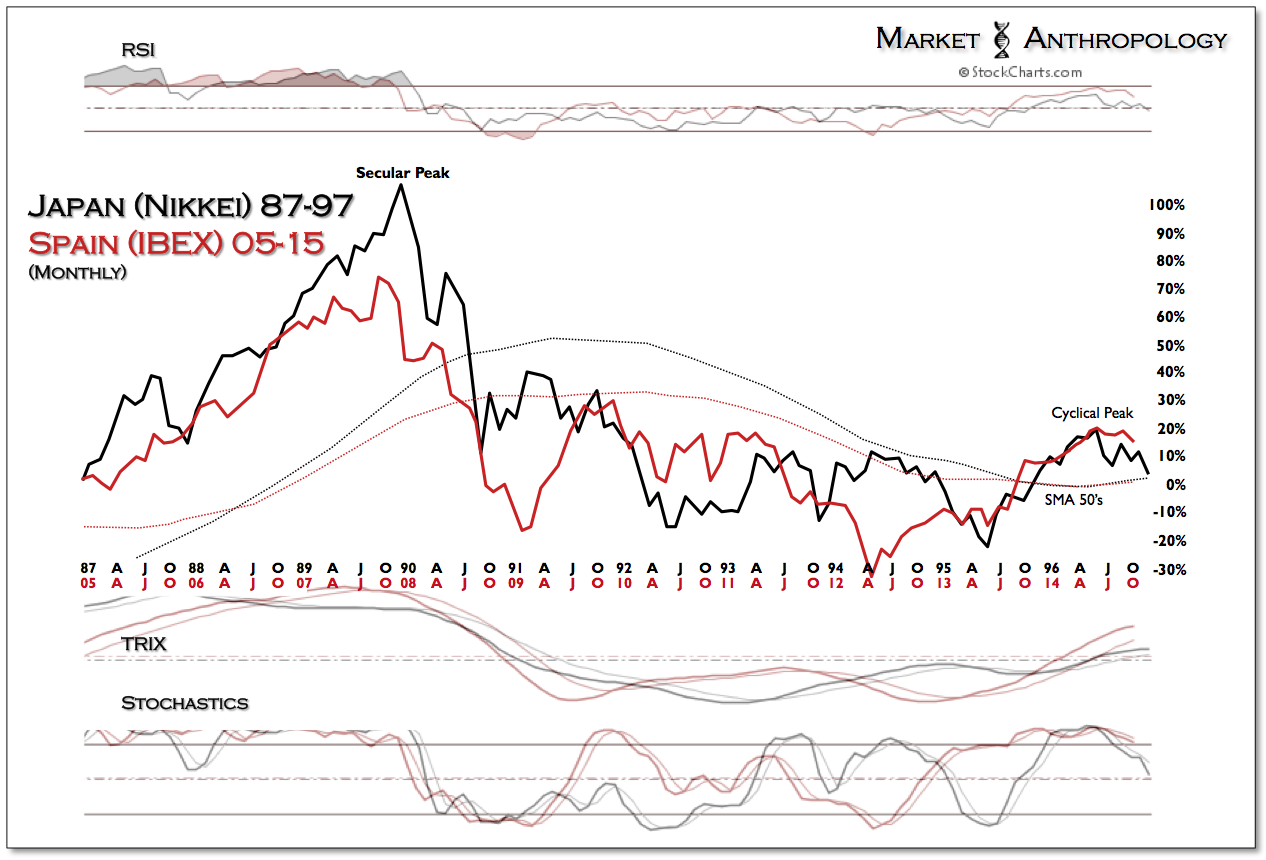

Contrary to contemporary policy in Japan - but similar to where the Nikkei stood in 1996, southern markets in Europe - such as Spain's IBEX, are the leading fronts of where deflation is currently pushing up against the Old World. While Draghi appears to be making a college try at breaking where the deflationary cycle has typically turned down, the realities confronted in the political and structural arenas in Europe may prove too difficult to overcome at the current juncture. As mentioned in previous notes, we're not sure where the German's will find religion, but expect it will only be after pronounced pain in their coffers and weakness in their equity markets shows up at their front door.

As a postscript tie-in between our more bullish leanings in precious metals (gasp) and our continued favorable outlook in Japan, we believe the two market postures can be reconciled, when appraising the long-term correlation trends between the yen and the Nikkei.

While the Nikkei has provided an upside hedge to the continued slide in precious metals, we haven't been able to eat much cake - as the yen has remained tightly correlated with gold and silver and negatively correlated to the Nikkei. So much in fact, that the last time the Nikkei and yen were coming off a comparable correlation extreme, was in the fall of 2008 - as the Nikkei caught fire during the financial crisis and the yen was bid sharply higher in a safe haven scramble.

Today, while the correlation trends are quite similar - the market reflexes are inverse to that time. Should the nuances of the comparisons prove prescient, we expect the yen will find a bottom shortly and start moving higher with the Nikkei and precious metals, challenging more recent assumptions this time around the block. All things considered, we still like the respective positions, especially from an absolute return perspective.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.