Global Reserve Currency: A Changing Of The Guard?

Fx Empire | Jul 29, 2014 03:20AM ET

Before you read this article, I would like to thank my colleague and associate Scott Carter from Lear Capital who authored this article with me and provided the in-depth analysis and research. Scott is the CEO of Lear Capital; Carter has further advanced Lear’s reputation as a world class seller of gold, silver, platinum and palladium offering consumers credible options to paper-backed investments. Scott Carter is uniquely qualified to address the benefits of holding physical financial assets. Carter is a leading advocate for acquiring gold and silver as a hedge against collapsing currencies, soaring global debt, and political and economic tensions around the world.

The Global Reserve Currency: A “Changing of the Guard”?

The phrase “changing of the guard” was originally coined to describe the custom by which select guards commissioned to protect government buildings, residents, or monuments are either replaced or relieved by a troop of new guards. The most famous example of this is perhaps the changing of the Queen’s Guard at Buckingham Palace which is an elaborate exercise in British pageantry. Over the years the phrase has also come to represent any shift in power or influence that is characterized by an old way of doing things being replaced by a new way.

There was little pomp or circumstance when the US dollar officially replaced the British pound in an effective “changing of the guard” of the world’s reserve currency back in 1945. The “pound sterling” was used for most commercial transactions throughout the 19th and early part of the 20th century when Great Britain was the principal importer/exporter, innovation leader, and shipping power in the world. The pound was pegged to gold and Britain enjoyed the financial stability, sustained growth, and economic strength of sound money. But starting in the 1920’s a taxing world war, heavy borrowing, high inflation, a suspension of the gold standard, and the rise of the United States as an economic super power started to close the curtain on British sterling’s enduring reign after an over a hundred year tenure. Most experts put the dollar’s unofficial arrival at the reserve currency helm at about 1921.

The Bretton Woods accord further inked US economic supremacy as representatives from 44 Allied Nations met in the Northern New Hampshire resort town that would carry the name of the agreement back in the summer of 1944. Their goal was to establish new rules of financial engagement to help resuscitate the world’s war-ravaged banking and economic system. The new procedures for monetary management effectively ended the gold standard, launched the International Monetary Fund, created The World Bank, and established the United States as the world’s foremost global power and the US dollar as the dominant reserve currency.

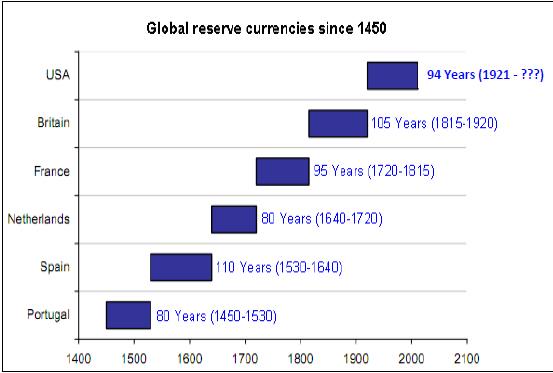

An examination of reserve currencies throughout history reveals a similar pattern of ascendancy followed by a subsequent descent triggered by war, debt, excess, devaluation and an ultimate falling out of monetary favor. Like the guards at Buckingham Palace, world currencies tend to change shifts every 94 years (on average) dating back to the 15th century. The dominance of the Portuguese escudo from about 1450-1530 was toppled by waste, the Spanish peso from 1530-1640 was dethroned by debasement, the Dutch guilder from 1640-1720 was undermined by political upheaval, the French franc from 1720-1815 fell victim to budget deficits, the British pound from 1815-1920 suffered from the massive debt following World War I.

This brings us to the question of the US dollar which has effectively been the world’s reserve currency for the past 93 years but since its departure from the gold standard in 1971, it has been under increasing pressure for displaying those same traits that brought down the dominant monies of the past … debt, waste, war, quantitative easing policies, deficit spending, and political divide.

While the dollar is still the currency most commonly held as a foreign exchange reserve, its numbers have declined steadily since the beginning of the new Millennium dropping from 71% in 1999, to 60.9% in the first quarter of this year. The dollar is experiencing competition from the Euro which gained 6.6% in the same time period and from the Chinese yuan, which while not recognized as a global currency reserve, recently passed the Euro as the second most used currency in global trade finance.

The Chinese have made no secret of their desire to move global transactions away from the dollar. They have been actively calling for a new reserve, stockpiling massive amounts of gold, and carefully positioning the yuan as a global cash alternative. Other nations are listening. China has penned deals with Russia, Germany, Brazil, Australia, Japan, Chile and the United Arab Emirates to conduct trade in their local currencies. Iran and Russia have signed an agreement to replace the dollar in their oil trade dealings. Iraq has signed a non-dollar deal with India and has also been actively backing the dinar with gold in a proposed effort to move further away from the greenback.

The BRICS nations (Brazil, Russia, India, China and South Africa) have gone a step further by not only signing agreements to conduct business in their own currencies but by crafting and capitalizing a New Development Bank to rival the Bretton Woods era IMF which would be less restrictive and less US dominated.

It’s important to remember that the role of a reserve currency is to provide universal stability, a global store of value, fast liquidity, and easy, low-cost transactions. In this capacity, the US dollar has been increasingly compromised by America’s massive debt, meagre economic growth, pronounced deficit spending, and diminished capacity in the world.

Since its divorce from gold, the dollar’s reserve designation has permitted the United States to borrow, spend, and finance its deficits by printing staggering amounts of unbacked money which in the eyes of the world has not only made global exchange unstable but has afforded America undue economic power and influence. There now appears to be a clear shuffling of the geopolitical order and an emerging multipolar world marked by a new cooperation among nations, a new basket of viable currencies, multiple gold superpowers, and a well-timed and coordinated changing of the guard.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.