Global Macro Update: Money Continues To Flow To The U.S.

Tiho Brkan | Oct 19, 2014 01:17AM ET

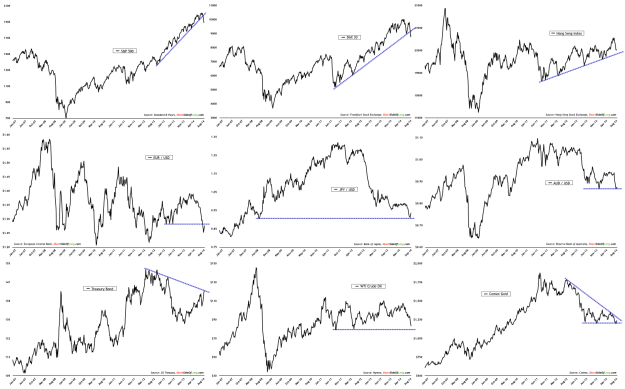

Chart 1: The most volatile week since the Eurozone Crisis during 2011!

Very volatile week last , so let us look at a basic grid of the most important Global Macro asset classes. Here are some interesting developments to note:

- For the most part, Developed Markets stocks have under-performed Emerging Market stocks in the last few weeks. The MSCI World Index together with the S&P 500 and DAX, have all broken below their recent multi-year uptrends. Broad Chinese stocks have outperformed recently, as I correctly predicted almost three months ago.

- Money continues to flow from the rest of the world towards the United States – a reversal of the carry trade. All currencies have been under pressure as of late. The euro has failed to hold its support, while the yen and the Aussie are trying to get a bounce of their respective support levels. If the Fed backs away from rate hikes, the US dollar could be in correction mode for a while.

- We are going through a bit of a deflation scare once again. Crude oil has been under major pressure, while Treasury Bonds have gone through an amazing rally in 2014, and recently rising almost vertically. To me, this looks like a major shakeout of market participants that were betting on inflation and interest rate rises.

Chart 2: Global stock and commodity markets were under pressure this past week

While the ever-popular US large caps and the more neglected Emerging Market stocks looked like they were going to gift investors some decent returns this year (20% plus on annualised basis), it seems that 2014 is all about Treasury Bonds. Starting the year as one of the most hated asset classes, Treasuries have outperformed just about everything this year. Furthermore, on the total return basis, the Treasury Long Bond is currently making record highs.

The other hated asset was Gold. However, I believe the yellow metal continues to look weak despite still holding on to its major support around $1185 per ounce. A breakdown is most likely coming before a major bottom occurs, as Silver continues to lead the whole sector lower.

A lot of readers have asked me: what will it take for the US Dollar to finally top out?

As long as the US dollar remains strong, commodities and emerging market stocks might continue to under-perform. A crescendo would occur as a major deflation shock runs through global financial markets, making the US dollar go vertical at which point the Federal Reserve would most likely reverse its current view of monetary policy by 180 degrees.

Chart 3: Annualised returns show Treasuries outperforming other assets

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.